What Does a Bookkeeper Do for a Business?

What does a bookkeeper do for a business? They are the unsung heroes of financial health, meticulously managing the day-to-day transactions that underpin a company’s success. From recording income and expenses to ensuring compliance with financial regulations, their role is crucial for accurate financial reporting and informed business decisions. Understanding the intricacies of bookkeeping is key to a business’s prosperity, and this exploration will delve into the essential tasks, responsibilities, and impact of this vital role.

A bookkeeper’s responsibilities extend far beyond simply recording numbers. They are the guardians of a business’s financial integrity, ensuring accurate record-keeping, meticulous reconciliation of accounts, and compliance with relevant regulations. This role is critical for maintaining a healthy financial standing, facilitating informed decision-making, and ultimately, contributing to the growth and success of the business.

Bookkeeper’s Role in Business Operations

A bookkeeper plays a critical role in the smooth functioning of any small business. They are the backbone of the financial record-keeping system, ensuring accurate and timely financial information for informed decision-making. Their meticulous attention to detail is essential for the business’s overall health and stability.

Day-to-Day Tasks

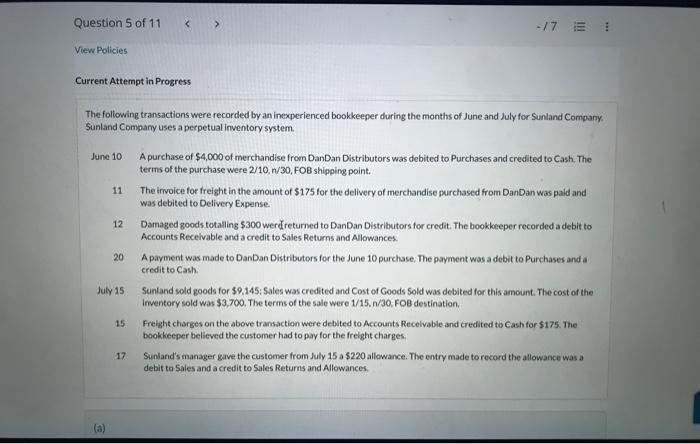

Bookkeepers handle a variety of tasks daily, ranging from recording transactions to preparing financial reports. This involves processing invoices, recording payments, and managing accounts payable and receivable. They also handle bank reconciliations, ensuring the accuracy of financial records.

Importance of Accurate Record-Keeping

Accurate record-keeping is paramount for financial reporting. Inaccurate records can lead to incorrect financial statements, impacting the business’s ability to make informed decisions about pricing, budgeting, and investment strategies. Moreover, accurate records are crucial for tax compliance and potential audits.

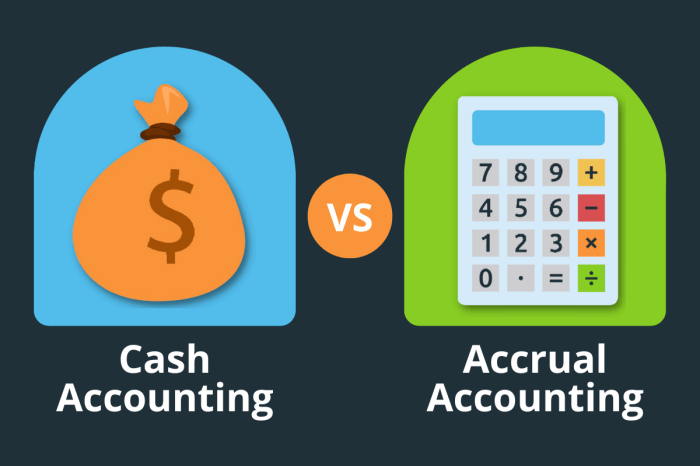

Accounting Methods

Bookkeepers may use various accounting methods, such as cash basis or accrual basis accounting. Cash basis accounting recognizes transactions when cash is received or paid, while accrual accounting records transactions when they occur, regardless of when cash changes hands. The choice of method depends on the specific needs and structure of the business.

Ensuring Compliance with Regulations

Bookkeepers must ensure compliance with relevant financial regulations, such as generally accepted accounting principles (GAAP) and tax laws. This involves adhering to specific procedures and standards to maintain accurate and compliant financial records. Understanding and following these regulations is critical to avoid penalties and maintain a healthy business relationship with regulatory bodies.

Bank Reconciliation Procedures

Reconciling bank statements is a crucial task for a bookkeeper. This involves comparing the company’s records with the bank’s records, identifying any discrepancies, and resolving any issues. The process typically involves reviewing bank statements, comparing them to the company’s records, and investigating any differences. Discrepancies could include outstanding checks, deposits in transit, or errors in either record.

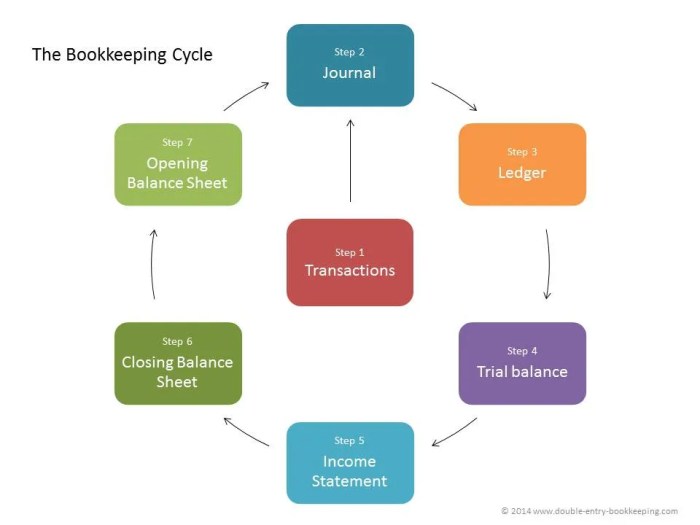

Recording Transactions

A simple step-by-step guide for recording transactions in a business’s accounting system:

- Identify the transaction: Determine the type of transaction (e.g., purchase, sale, payment).

- Record the date: Note the exact date the transaction occurred.

- Record the accounts affected: Identify the accounts impacted by the transaction (e.g., cash, accounts receivable, inventory).

- Determine the debit and credit amounts: Calculate the debit and credit amounts for each account, ensuring the debit and credit sides balance.

- Enter the information into the accounting system: Input the transaction details into the designated accounting software or system.

- Review and verify the entry: Double-check the accuracy of the entry before finalizing it.

Common Business Transactions and Accounting Entries

| Transaction | Account Affected | Debit | Credit |

|---|---|---|---|

| Sale of goods for cash | Cash | Debit | Sales Revenue |

| Purchase of supplies on credit | Supplies | Debit | Accounts Payable |

| Payment of salaries | Salaries Expense | Debit | Cash |

| Receipt of utility bill | Utilities Expense | Debit | Accounts Payable |

Specific Responsibilities and Skills

Source: ansi.ph

A bookkeeper plays a crucial role in the smooth operation of any business. Beyond simply recording transactions, a skilled bookkeeper is a vital part of the financial infrastructure, ensuring accuracy and efficiency in financial reporting. Their responsibilities often extend beyond basic data entry, encompassing tasks that directly impact a company’s financial health and decision-making processes.

A successful bookkeeper possesses a blend of technical skills and soft skills. Attention to detail and accuracy are paramount, as errors in bookkeeping can lead to significant financial discrepancies and costly problems. Furthermore, strong communication and organizational skills are necessary to interact effectively with other departments and maintain accurate records.

Key Skills and Abilities

A bookkeeper needs a strong understanding of accounting principles and practices. This includes knowledge of various financial transactions, debits, and credits, as well as different chart of accounts structures. Proficiency in using bookkeeping software and other relevant tools is essential for efficient data management and reporting. Strong analytical skills are important for identifying patterns and trends in financial data, which can help businesses make informed decisions.

Importance of Attention to Detail and Accuracy

Maintaining meticulous attention to detail is critical in bookkeeping. A single error in recording a transaction can have a cascading effect, leading to incorrect financial statements and potentially impacting tax filings and loan applications. Accurate data is the foundation of all financial reporting, and a bookkeeper’s commitment to accuracy is vital for the entire organization.

Bookkeeper’s Interactions with Other Departments

Bookkeepers frequently interact with various departments within a company. For example, they collaborate with sales teams to ensure accurate recording of sales transactions. They also work with purchasing departments to track expenses and ensure that payments are made on time. A strong working relationship with these departments is essential for maintaining a comprehensive and accurate view of the company’s financial position.

Bookkeeper vs. Financial Accountant, What does a bookkeeper do for a business

While both bookkeepers and financial accountants work with financial data, their responsibilities differ significantly. Bookkeepers primarily handle the day-to-day recording of financial transactions, while financial accountants analyze and interpret the data to provide insights and prepare more complex financial statements. Bookkeepers focus on ensuring accuracy and completeness of data, while financial accountants focus on interpreting data to make strategic decisions.

Common Bookkeeping and Accounting Software

Various software programs facilitate bookkeeping and accounting tasks. Some popular choices include QuickBooks, Xero, and Sage. These platforms offer features for recording transactions, generating reports, and managing accounts payable and receivable. Selection of software depends on specific business needs and size.

Reporting Formats for Business Owners

Bookkeepers produce various reports to provide insights to business owners. These reports include income statements, balance sheets, cash flow statements, and various customized reports based on business needs. Different reporting formats offer varying levels of detail and analysis, allowing business owners to understand their financial performance effectively.

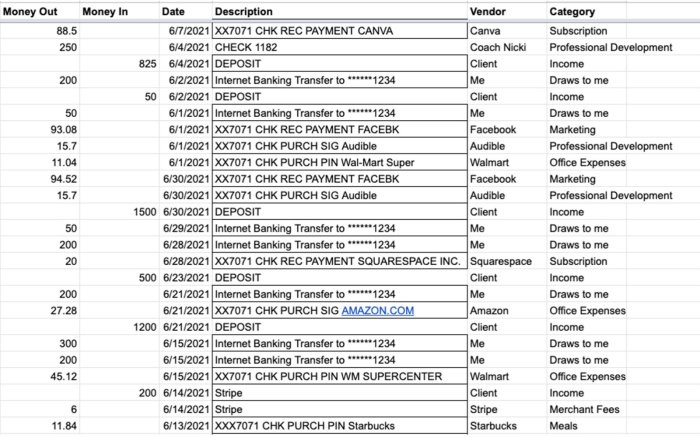

Spreadsheet Use for Tracking Expenses and Income

Spreadsheets are commonly used tools for tracking expenses and income. A well-structured spreadsheet can organize transaction data, categorize expenses, and provide a clear picture of the financial health of the business. Using formulas in spreadsheets, such as SUM, AVERAGE, and COUNT, can automate calculations and enhance the analysis of financial data. For example, a spreadsheet can easily track sales figures for different product categories and identify the most profitable lines.

Impact on Business Growth and Success: What Does A Bookkeeper Do For A Business

Accurate bookkeeping is the bedrock of a thriving business. It provides the crucial financial insights necessary for informed decision-making, sustainable growth, and ultimately, success. A well-maintained bookkeeping system is not just a record-keeping function; it’s a dynamic tool that empowers businesses to navigate financial challenges and capitalize on opportunities.

Accurate Bookkeeping and Financial Health

Precise bookkeeping directly impacts a business’s financial health. Accurate records ensure that financial statements, including the balance sheet, income statement, and cash flow statement, reflect the true financial position of the company. This transparency allows for a clear understanding of revenue, expenses, and profitability, enabling proactive measures to address potential issues and capitalize on favorable trends. When transactions are meticulously recorded, the business can identify areas for cost reduction and efficiency improvements.

Bookkeeping Data and Informed Decisions

Bookkeeping data serves as a critical source of information for strategic decision-making. For instance, tracking sales trends over time allows businesses to anticipate seasonal fluctuations and adjust inventory management strategies accordingly. Detailed expense reports can pinpoint areas where costs are excessive, prompting potential process improvements or outsourcing options. Profitability analysis, gleaned from bookkeeping records, facilitates the identification of high-performing products or services and areas requiring enhancement.

Meeting Financial Obligations

A robust bookkeeping system enables businesses to meet their financial obligations promptly. By meticulously tracking accounts payable and receivable, businesses can maintain a clear understanding of outstanding payments and ensure timely settlements. This proactive approach not only strengthens relationships with creditors but also helps to avoid late payment penalties and maintain a positive credit rating. This, in turn, fosters trust and confidence in the business’s financial stability.

Tracking Cash Flow and Profitability

Accurate bookkeeping is essential for effective cash flow management. The ability to monitor cash inflows and outflows provides insights into the company’s liquidity position, allowing for informed decisions regarding investments, expansions, or debt repayment strategies. A comprehensive bookkeeping system facilitates the calculation of key profitability metrics, including gross profit margin and net profit margin, providing a clear picture of the business’s overall financial performance.

“Consistent monitoring of cash flow and profitability trends helps businesses to anticipate potential financial challenges and adjust strategies accordingly.”

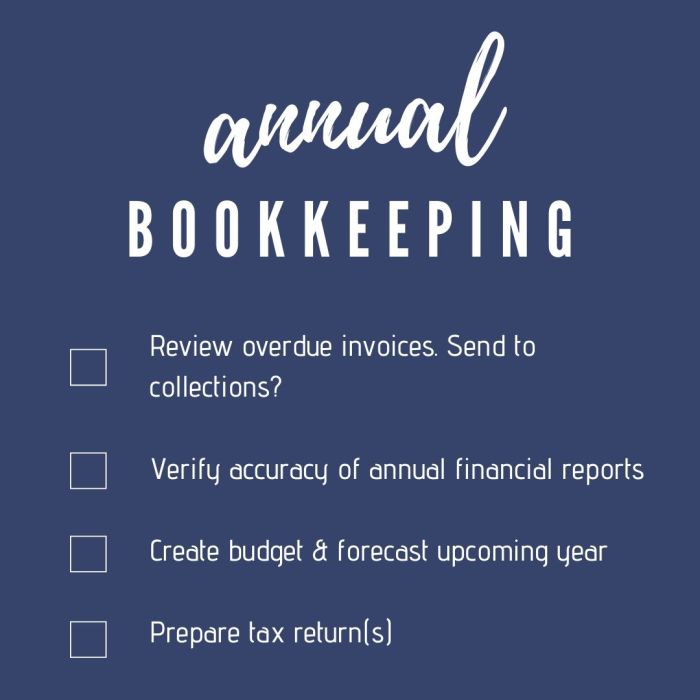

Preparing for Tax Season

Thorough bookkeeping is fundamental to a smooth tax season. Well-maintained records provide a readily available source of information for tax preparation, eliminating the stress and potential errors associated with scrambling for receipts and documents at the last minute. This organized approach minimizes the likelihood of penalties and ensures accurate tax filings, which is crucial for maintaining a positive relationship with tax authorities.

Consequences of Inaccurate Bookkeeping

| Potential Issue | Description | Impact |

|—|—|—|

| Incorrect Financial Statements | Misrepresentation of financial position | Loss of credibility, difficulty in securing loans, inaccurate decision-making |

| Late Payments/Missed Deadlines | Failure to track and meet payment obligations | Damage to credit rating, potential penalties, strained relationships with vendors |

| Tax Errors | Inaccurate reporting of income and expenses | Penalties, audits, potential legal issues |

| Difficulty in Identifying Profitability Issues | Inability to pinpoint areas of loss or inefficiency | Decreased profitability, missed opportunities for improvement |

| Poor Cash Flow Management | Lack of visibility into cash inflows and outflows | Difficulty in meeting financial obligations, increased risk of insolvency |

Preventing Financial Errors

A well-maintained bookkeeping system, with appropriate controls and procedures, minimizes the risk of financial errors. Implementing a system of checks and balances, such as regular reconciliations and independent verification of transactions, enhances the accuracy of financial records. Regular training and updates on accounting software and best practices further strengthen the reliability of the system. By consistently adhering to proper procedures, businesses can safeguard against potential financial discrepancies.

Final Thoughts

Source: cheggcdn.com

In summary, a bookkeeper plays a pivotal role in a business’s financial success. Their meticulous work, encompassing record-keeping, reconciliation, and compliance, ensures accurate financial reporting and facilitates informed decision-making. Understanding a bookkeeper’s responsibilities and the impact of their work is vital for any business owner. A well-managed bookkeeping system is a cornerstone of a financially sound and thriving enterprise.