Virtual Bookkeeping vs. In-House A Business Decision

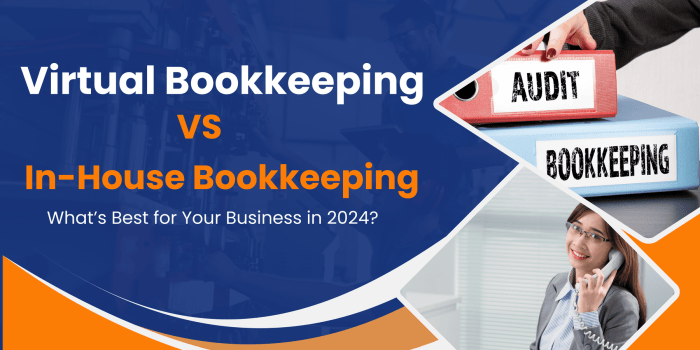

Virtual bookkeeping vs in-house bookkeeping presents a crucial decision for any small business. Choosing the right approach significantly impacts operational efficiency, cost management, and long-term growth. This comparison explores the key aspects of each method, from staffing and pricing to security and scalability, to help you make an informed choice.

This analysis will delve into the core differences between virtual and in-house bookkeeping, exploring the pros and cons of each. Factors like cost, time management, and expertise requirements will be critically examined to illuminate the optimal path for your business.

Introduction to Virtual Bookkeeping vs. In-House Bookkeeping

Source: qbdatarecoveryservice.com

Choosing between virtual and in-house bookkeeping depends heavily on a business’s specific needs and resources. Each option presents distinct advantages and disadvantages, impacting everything from operational costs to the level of control a business maintains over its financial records. Understanding these differences is crucial for making an informed decision.

Virtual bookkeeping services, handled by external accountants, and in-house bookkeeping, performed by employees, differ significantly in their staffing, location, and operational structures. Virtual bookkeeping offers flexibility and cost-effectiveness, while in-house bookkeeping allows for tighter control and potentially deeper integration into the company’s culture. Pricing models also vary substantially, impacting the overall financial implications of each approach.

Virtual Bookkeeping Services

Virtual bookkeeping is handled by external accounting firms or independent bookkeepers. This often involves remote work arrangements, enabling companies to access expertise without the overhead of hiring and managing in-house staff. Virtual bookkeepers use specialized software and tools to manage financial records, ensuring accuracy and efficiency.

In-House Bookkeeping

In-house bookkeeping is performed by employees designated to handle accounting tasks. This model often necessitates hiring and training dedicated staff, which can be a substantial investment in terms of salaries, benefits, and training costs. However, it offers a direct link to financial operations, allowing for a high degree of control and potential integration with other business functions.

Core Differences in Staffing, Location, and Operational Structure

- Staffing: Virtual bookkeeping relies on external specialists, while in-house bookkeeping employs dedicated internal staff. This difference directly impacts hiring, training, and management responsibilities.

- Location: Virtual bookkeepers operate remotely, often from different locations, while in-house bookkeepers are physically present within the company’s premises.

- Operational Structure: Virtual bookkeeping often uses cloud-based accounting software and remote communication tools, while in-house bookkeeping may use a mix of software and internal systems tailored to the company’s specific needs.

Pricing Models

The pricing models for virtual and in-house bookkeeping vary considerably. Virtual bookkeeping often employs a subscription-based pricing model, typically charging a monthly or annual fee based on the scope of work. In-house bookkeeping costs include salaries, benefits, and potential software licensing fees, which can vary significantly depending on the role’s complexity and the size of the company. The total cost of an in-house solution will generally be higher, considering the various fixed costs.

Key Feature Comparison

| Feature | Virtual Bookkeeping | In-House Bookkeeping |

|---|---|---|

| Cost | Generally lower upfront, with predictable monthly fees. | Higher initial investment in salaries, benefits, and software. |

| Flexibility | High, allowing for scaling up or down based on needs. | Lower, often tied to the staffing structure. |

| Control | Lower, with limited direct oversight of daily operations. | Higher, providing direct control over financial processes. |

| Expertise | Often specialized in specific industries or software. | Depends on the expertise of the hired personnel. |

Cost Analysis and Budgeting

Understanding the financial implications of choosing between virtual and in-house bookkeeping is crucial for small business owners. Careful budgeting and cost analysis can help determine the most cost-effective solution. This section will detail the fixed and variable costs associated with each method, providing a framework for comparing total projected costs over a 12-month period.

Fixed Costs for Virtual Bookkeeping

Virtual bookkeeping typically involves lower upfront costs compared to hiring an in-house bookkeeper. These costs are often predictable and include software subscriptions, internet access, and potentially, some administrative expenses like stationery. It’s important to note that while upfront costs are generally lower, ongoing subscription fees and potentially other variable costs can still impact the total cost over a longer period.

Fixed Costs for In-House Bookkeeping

In-house bookkeeping entails higher upfront costs. These may include the salary or wage of the bookkeeper, office space, and potentially equipment such as computers and accounting software. It’s crucial to consider the full range of necessary supplies and expenses to accurately assess the overall investment. These costs are generally fixed but can fluctuate depending on the specifics of the employment agreement.

Variable Costs for Virtual Bookkeeping

Variable costs associated with virtual bookkeeping can fluctuate. These may include expenses for client onboarding, data entry, and other services provided as needed. The cost of these services is often dependent on the complexity of the business’ financial transactions and the level of support required.

Variable Costs for In-House Bookkeeping

Variable costs for in-house bookkeeping can include additional staff support, training, and professional development for the in-house bookkeeper. There may also be additional expenses related to office supplies or equipment maintenance. These costs are often less predictable and can vary based on the business’s needs.

Typical Expenses for a Small Business (Virtual Bookkeeping)

- Software Subscription: $50-$200 per month for accounting software (e.g., QuickBooks Online, Xero). This cost varies depending on the features and functionalities required.

- Internet Access: $20-$100 per month, depending on the plan chosen.

- Client Onboarding: $50-$100 per client, depending on the complexity of the onboarding process.

- Data Entry: $0.10-$0.50 per transaction, depending on the volume of transactions.

- Administrative Expenses: $20-$50 per month for stationery, printing, and postage.

Typical Expenses for a Small Business (In-House Bookkeeping)

- Bookkeeper Salary: $3,000-$6,000 per month depending on experience and qualifications.

- Office Space: $500-$2,000 per month, depending on location and size.

- Equipment: $50-$200 per month for computer maintenance, software, and other necessary equipment.

- Insurance: $50-$200 per month, depending on the type of insurance required.

- Training & Development: $100-$500 per month for professional development for the in-house bookkeeper.

Budgeting Template for Bookkeeping Expenses

| Expense Category | Virtual Bookkeeping | In-House Bookkeeping |

|—|—|—|

| Software Subscription | $150 | $0 |

| Internet Access | $50 | $0 |

| Client Onboarding | $75 per client | $0 |

| Data Entry | $0.25 per transaction | $0 |

| Administrative Expenses | $30 | $100 |

| Bookkeeper Salary | $0 | $3,500 |

| Office Space | $0 | $1,000 |

| Equipment | $0 | $75 |

| Insurance | $0 | $150 |

| Training/Development | $0 | $200 |

| Total Monthly Costs | $255 | $4,995 |

12-Month Projected Costs Comparison

| Expense Category | Virtual Bookkeeping (Annual) | In-House Bookkeeping (Annual) |

|---|---|---|

| Software Subscription | $1,800 | $0 |

| Internet Access | $600 | $0 |

| Client Onboarding | $900 | $0 |

| Data Entry | $3,000 | $0 |

| Administrative Expenses | $360 | $1,200 |

| Bookkeeper Salary | $0 | $42,000 |

| Office Space | $0 | $12,000 |

| Equipment | $0 | $900 |

| Insurance | $0 | $1,800 |

| Training/Development | $0 | $2,400 |

| Total 12-Month Costs | $7,660 | $60,300 |

Skillset and Expertise Requirements

Choosing between in-house bookkeeping and outsourcing to a virtual bookkeeper hinges on understanding the necessary skills and expertise in each scenario. This section delves into the specific requirements for effective in-house management and the qualifications to consider when selecting a virtual bookkeeping service. It also contrasts the responsibilities of a bookkeeper in each setup.

Effective bookkeeping, whether in-house or outsourced, necessitates a strong foundation in accounting principles and meticulous attention to detail. The depth of expertise required varies depending on the complexity of the business operations.

In-House Bookkeeping Skills

Understanding the in-house bookkeeping skillset is crucial for businesses seeking to manage their financial records internally. A dedicated bookkeeper needs a comprehensive understanding of accounting principles, including debits, credits, and various accounting methods (e.g., accrual, cash). They must also possess proficiency in using accounting software, like QuickBooks or Xero, to accurately record transactions and generate reports. Moreover, a strong working knowledge of tax regulations, relevant to the business’s industry and location, is essential.

Virtual Bookkeeping Service Qualifications

Selecting a reliable virtual bookkeeping service demands careful consideration of the service provider’s qualifications and experience. Crucially, potential clients need to ascertain the bookkeeper’s proficiency in accounting software, their understanding of tax regulations, and their capacity to handle various financial transactions securely. Prior experience with similar businesses or industries, demonstrated through case studies or testimonials, is highly valuable.

Bookkeeper Responsibilities Comparison

The responsibilities of a bookkeeper vary depending on whether they are in-house or virtual. In-house bookkeepers are often part of the company’s administrative team, and their responsibilities might extend beyond standard bookkeeping tasks to include financial reporting, reconciliation, and assisting with financial analysis. Virtual bookkeepers, on the other hand, are primarily focused on the day-to-day bookkeeping functions, leaving strategic financial analysis to the client. This distinction is key when evaluating which setup aligns with a company’s needs.

Technical and Soft Skills Comparison

| Feature | In-House Bookkeeper | Virtual Bookkeeper |

|—|—|—|

| Technical Skills | Proficiency in accounting software (QuickBooks, Xero), financial reporting tools, general ledger accounting | Strong proficiency in accounting software, excellent understanding of bookkeeping practices, secure data management, cloud-based accounting software, data entry, and reconciliation |

| Soft Skills | Communication, organization, time management, problem-solving, attention to detail, ability to work independently and as part of a team | Excellent communication (written and verbal), organizational skills, time management, strong attention to detail, problem-solving, ability to work independently, client relationship management, and confidentiality |

| Other Considerations | Physical presence within the company’s office, availability for in-person meetings and training | Remote work, regular communication via email or phone, access to a reliable internet connection, and a dedicated workspace |

Security and Data Privacy Considerations

Protecting sensitive financial data is paramount in both in-house and virtual bookkeeping. Robust security measures are crucial to prevent breaches and maintain client trust. This section details the importance of these measures for both models, focusing on the security protocols employed by reputable virtual bookkeeping services and the necessary precautions for in-house setups. Legal and regulatory aspects of data protection in bookkeeping are also addressed.

Implementing robust security protocols is essential for safeguarding financial data, regardless of the bookkeeping method. Data breaches can lead to significant financial losses, reputational damage, and legal ramifications. A proactive approach to security is vital to mitigate these risks.

Security Protocols of Reputable Virtual Bookkeeping Services

Virtual bookkeeping firms prioritize security to build trust and maintain client confidentiality. They often employ a multi-layered approach to data protection. This includes:

- Secure Data Transmission: Reputable virtual bookkeeping services utilize encrypted communication channels (like HTTPS) for all data transmission. This ensures that sensitive information is protected during transit.

- Data Encryption: Both in transit and at rest, data is encrypted to prevent unauthorized access. This protects data from breaches even if a device or system is compromised.

- Access Control and Authentication: Strict access controls and multi-factor authentication (MFA) measures limit access to sensitive information. This restricts access to authorized personnel only.

- Regular Security Audits: Security protocols are regularly reviewed and updated by professionals to address emerging threats. This includes vulnerability assessments and penetration testing.

- Compliance with Data Protection Regulations: These services adhere to industry standards and regulations like GDPR, CCPA, or others, depending on the location and client base. This is crucial for maintaining compliance and avoiding legal penalties.

Importance of Strong Data Security Measures in In-House Bookkeeping

Establishing strong data security measures is equally crucial when hiring an in-house bookkeeper. Security must be a fundamental aspect of the in-house bookkeeping system. This includes:

- Strong Passwords and Access Controls: Implement strong password policies and limit access to sensitive financial data to authorized personnel only. Use strong password managers and regularly update passwords. This is a crucial first step in protecting your data.

- Physical Security Measures: Secure physical access to servers and financial documents. This involves using locked cabinets, restricted access areas, and other physical security measures to deter theft or unauthorized access.

- Regular Security Training: Provide regular security awareness training to in-house bookkeepers to educate them about phishing scams, malware, and other threats. This proactive approach helps prevent human error.

- Regular Backups: Establish a robust backup and disaster recovery plan to protect data from loss due to hardware failure, natural disasters, or other unforeseen circumstances. This is critical for business continuity.

Legal and Regulatory Requirements for Data Protection in Bookkeeping

Data protection regulations vary by jurisdiction. Understanding and adhering to these regulations is critical to avoid legal issues. These regulations encompass:

- GDPR (General Data Protection Regulation): Applicable in the European Union, this regulation mandates stringent data protection measures for organizations handling personal data. Companies must be compliant with data minimization, data security, and other measures.

- CCPA (California Consumer Privacy Act): In California, the CCPA grants consumers greater control over their personal data. Businesses must be prepared to handle requests for access, deletion, and correction of data.

- Other Regional Regulations: Other regions and countries have specific data protection regulations that organizations must adhere to. This can include similar regulations to GDPR and CCPA.

- Internal Policies: Organizations should establish internal policies that clearly define data handling procedures and responsibilities. This provides clarity on how data is handled and who is responsible.

Scalability and Future Growth: Virtual Bookkeeping Vs In-house

Choosing between virtual and in-house bookkeeping hinges significantly on anticipated business growth. The flexibility and adaptability of each method play crucial roles in supporting future expansion. Understanding these nuances is vital for long-term financial health and operational efficiency.

Adaptability is key when navigating the unpredictable landscape of business growth. The right approach must seamlessly scale with evolving needs, ensuring financial records are meticulously maintained regardless of workload fluctuations. Both virtual and in-house solutions have their strengths and weaknesses in this area.

Virtual Bookkeeping’s Adaptability

Virtual bookkeeping demonstrates remarkable adaptability to fluctuating workload demands. As a business expands, a virtual bookkeeper can easily handle increased transaction volumes and complexities without significant upfront investment in additional personnel. This agility allows for a proportional increase in service provision as required. For example, a small startup might initially require basic bookkeeping services, but as it scales, the virtual bookkeeper can easily manage more complex accounting procedures. Furthermore, virtual bookkeeping allows for a more cost-effective approach to growth compared to hiring and training additional in-house staff.

Challenges of In-House Bookkeeping Scaling

Scaling in-house bookkeeping as the business grows presents substantial challenges. Hiring, training, and managing additional in-house staff requires significant upfront investment and ongoing operational costs. Increased workload demands often lead to bottlenecks and inefficiencies. Moreover, specialized accounting expertise may not be readily available in-house, requiring costly recruitment or training programs. Maintaining the same level of accuracy and efficiency as the business expands can become a major hurdle.

Implications for Long-Term Business Operations

The chosen bookkeeping method significantly impacts long-term business operations. Virtual bookkeeping offers a more agile and cost-effective approach to scaling, allowing for quick adjustments to changing needs. In contrast, in-house bookkeeping can become a constraint on growth if not carefully managed. Long-term strategic planning needs to consider the scalability of each method to avoid operational bottlenecks and ensure financial stability as the business evolves. This includes considering the potential need for specialized accounting expertise, such as in tax law, as the business matures and expands its operations. In-house bookkeeping may require additional infrastructure investment, such as specialized software or hardware, to maintain performance levels as the business grows. The ability to scale seamlessly and cost-effectively will ultimately determine the success and longevity of the chosen bookkeeping strategy.

Client Relationships and Communication

Client relationships are paramount in both virtual and in-house bookkeeping. Effective communication and a strong rapport foster trust, ensuring accurate financial data and timely reporting. This section explores the nuances of communication in each setup.

Communication Channels and Relationship Management

Effective communication is critical for both virtual and in-house bookkeepers. In virtual bookkeeping, communication channels are primarily digital. This often includes email, video conferencing, and project management software. In-house bookkeepers, on the other hand, typically interact face-to-face, with meetings, phone calls, and informal chats also being part of the process. The choice of channel should align with the client’s preference and the specific task at hand.

Communication and Feedback Processes with Virtual Bookkeepers

Virtual bookkeeping necessitates a well-defined communication protocol. Regular updates via email or project management software, outlining tasks completed and upcoming steps, are crucial. Schedule regular video calls or phone calls for progress reviews and feedback. Implementing a feedback system, like surveys or feedback forms, can help identify areas for improvement in communication and service delivery.

Direct Communication and Interaction with an In-House Bookkeeper, Virtual bookkeeping vs in-house

In-house bookkeepers typically have more direct interaction with clients. This allows for quick clarification of queries and immediate resolution of issues. Face-to-face meetings, while valuable, may not always be feasible. Clear and concise communication through emails and documentation is equally important to maintain records and avoid misunderstandings.

Examples of Successful Communication Strategies

Successful communication strategies depend on the specific client and their needs. For virtual bookkeepers, clear project Artikels, regularly scheduled check-ins, and easily accessible documentation are key. For in-house bookkeepers, consistent meetings and prompt responses to inquiries are crucial.

- Virtual Bookkeeping Example: A virtual bookkeeper sends a weekly email summarizing tasks completed, providing updates on the project’s progress, and requesting any necessary clarification. This email is complemented by a project management tool where clients can track progress and upload relevant documents.

- In-House Bookkeeping Example: An in-house bookkeeper schedules monthly meetings with the client to review financial statements, address concerns, and answer any questions. These meetings are complemented by regularly updated reports and clear communication channels, such as shared folders for documentation.

Specific Examples and Use Cases

Choosing between virtual and in-house bookkeeping depends heavily on a business’s unique needs and circumstances. Factors like business size, industry, budget, and internal resources all play a significant role in the optimal approach. Understanding the strengths of each method allows for a well-informed decision that supports long-term growth and efficiency.

Businesses Benefitting from Virtual Bookkeeping

Small to medium-sized enterprises (SMEs) often find virtual bookkeeping advantageous. These businesses frequently lack the internal resources or budget to hire a full-time bookkeeper. Virtual bookkeepers provide a cost-effective solution, allowing SMEs to focus on core business operations. Businesses with fluctuating workloads, seasonal peaks, or project-based revenue streams can also benefit significantly from the flexibility of virtual bookkeeping services. A freelancer or a solopreneur who wants to outsource the bookkeeping task would also find this a good option.

- E-commerce stores with fluctuating sales: Virtual bookkeepers can easily adjust to handling increased transaction volumes during peak seasons. This approach ensures accurate financial records are maintained, minimizing potential errors during these periods.

- Startups with limited resources: Virtual bookkeeping services are affordable for startups with limited budgets. They can focus on other essential aspects of growth, knowing their financial records are managed effectively.

- Service-based businesses: For businesses with variable project timelines and client payments, a virtual bookkeeper can provide accurate tracking and reporting, crucial for project management and client billing.

- Businesses with a geographically dispersed team: Virtual bookkeeping offers a convenient solution when team members are located in different time zones. The virtual bookkeeper can access and manage financial records remotely, ensuring smooth operation.

Businesses Suited for In-House Bookkeeping

In some cases, in-house bookkeeping is the more suitable option. Businesses with complex accounting needs or a high volume of transactions might require the specialized attention of an in-house bookkeeper. Businesses with very specific internal processes that require a close and direct monitoring of financial records would find in-house bookkeeping a good fit.

- Large corporations with complex financial structures: In-house bookkeepers are crucial for large companies with sophisticated accounting procedures, intricate financial reporting requirements, and complex regulatory compliance needs. Their expertise is vital for maintaining compliance with complex regulations.

- Businesses with highly specialized industries: Industries with unique accounting rules, such as healthcare or finance, often require in-house expertise to ensure compliance and accuracy.

- Companies with a large and consistent transaction volume: A significant volume of transactions might require the dedicated attention of an in-house bookkeeper for optimal processing and reconciliation.

Hybrid Approaches

Many businesses find that a hybrid approach combining in-house and virtual bookkeeping is the most effective strategy. This approach can be beneficial when a business needs a dedicated in-house bookkeeper to manage core financial tasks, while outsourcing more routine or less demanding work to a virtual bookkeeper.

- Medium-sized companies with some specialized needs: A company might have a dedicated in-house bookkeeper who manages complex accounting functions, while using a virtual bookkeeper to handle tasks such as accounts payable and receivable.

- Growing businesses anticipating future growth: A hybrid model allows a company to scale its accounting resources as needed. As the business grows, they can increase the scope of responsibilities for the in-house bookkeeper or expand the virtual bookkeeping services.

Optimal Bookkeeping Approach Table

| Business Type | Optimal Bookkeeping Approach |

|---|---|

| Small startups | Virtual Bookkeeping |

| Medium-sized companies with specialized needs | Hybrid Approach |

| Large corporations | In-house Bookkeeping |

| E-commerce businesses with high transaction volumes | Virtual Bookkeeping |

Final Review

Ultimately, the choice between virtual and in-house bookkeeping hinges on your specific business needs and circumstances. Consider your current budget, workload, and growth projections. A careful assessment of these factors, combined with a thorough understanding of the intricacies of each approach, will pave the way for a sound decision. Remember, the best solution may even involve a hybrid model that leverages the strengths of both options.

This exploration of virtual bookkeeping vs in-house options underscores the importance of a strategic approach to bookkeeping. By carefully evaluating your resources and future goals, you can ensure a system that supports your business’s growth and success.