Top Accounting Tools for Freelancers A Guide

Top accounting tools for freelancers are essential for success in today’s gig economy. Whether you’re a graphic designer, writer, or consultant, managing your finances efficiently is key. This guide explores the best invoicing, expense tracking, time tracking, and project management tools available, catering to various freelance needs and budgets. We’ll also discuss crucial elements like security and automation, making the process streamlined and stress-free.

From basic invoicing to sophisticated project management, this comprehensive overview will equip you with the knowledge to choose the right tools for your freelance business. We’ll examine the advantages and disadvantages of each, helping you make informed decisions based on your specific needs and circumstances.

Introduction to Accounting Tools for Freelancers

Managing finances effectively is crucial for freelancers to thrive. Accurate record-keeping, timely invoicing, and efficient expense tracking are essential for profitability and financial health. Without proper accounting tools, freelancers risk losing track of income and expenses, potentially leading to inaccurate tax filings and missed opportunities for growth.

Freelancers face a diverse array of accounting needs. From invoicing clients for services rendered to meticulously tracking business expenses, each freelancer requires a tailored approach to accounting. Different freelancers operate in diverse industries and have varying client bases, so their needs may differ. Some might primarily handle individual clients, while others manage a large number of smaller projects. This diversity in accounting needs underscores the necessity of flexible and adaptable accounting tools.

Accounting Software vs. Spreadsheets

Spreadsheets, while seemingly simple, can quickly become unwieldy and error-prone as a freelancer’s business grows. Dedicated accounting software, on the other hand, offers streamlined solutions for managing invoices, expenses, and income. Software often includes features such as automated invoicing, recurring billing options, and integrated payment processing, which save time and reduce the risk of errors. The automation and integration capabilities of dedicated software significantly enhance efficiency, allowing freelancers to focus on core business activities rather than manual data entry and reconciliation.

Types of Accounting Needs for Freelancers

Freelancers have various accounting needs, encompassing diverse functionalities. These needs include invoicing clients, tracking income and expenses, managing payments, generating reports, and ultimately preparing accurate tax filings. Different software solutions cater to specific needs, offering features tailored to individual situations. This allows freelancers to choose tools best suited to their specific operations and workflow.

Categories of Accounting Software for Freelancers

Effective accounting software for freelancers typically encompasses several crucial functions. A well-rounded solution will often integrate invoicing, expense tracking, and time tracking capabilities.

| Category | Description | Example Features |

|---|---|---|

| Invoicing | Facilitates creating and sending invoices to clients, managing payments, and tracking outstanding balances. | Automated invoice generation, customizable templates, recurring billing, integrated payment processing. |

| Expense Tracking | Allows for the recording and categorization of business expenses, aiding in expense reports and tax deductions. | Expense categorization, automatic import of receipts, expense reports, and budgeting tools. |

| Time Tracking | Helps freelancers accurately record time spent on projects, enabling accurate billing and project management. | Detailed time logs, project-specific time tracking, billable hour calculation, and automatic generation of time-based invoices. |

Top Invoicing Tools for Freelancers

Invoicing is a crucial aspect of freelancing, ensuring timely payment and maintaining a professional image. Effective invoicing tools streamline this process, automating tasks and reducing errors. This section explores popular invoicing platforms, comparing their features, benefits, and drawbacks to help freelancers choose the best fit for their needs.

Invoicing software can significantly improve efficiency for freelancers. By automating the creation, sending, and tracking of invoices, these tools save time and reduce the risk of errors, which can lead to delays in payment and financial stress. The right platform can significantly impact a freelancer’s bottom line and workflow.

Comparison of Three Popular Invoicing Tools

These tools represent a spectrum of features and pricing, catering to different needs and budgets. The key features of each platform influence their applicability for specific freelancer scenarios.

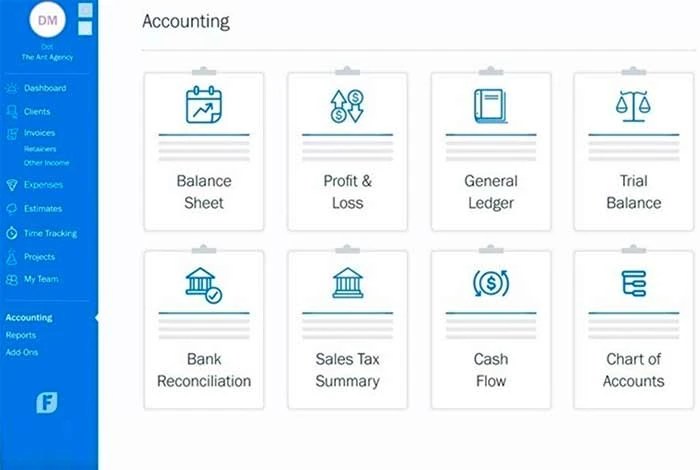

- FreshBooks: Known for its user-friendly interface, FreshBooks offers robust invoicing capabilities, including automated reminders and payment tracking. Its integrated expense tracking and time-tracking features are valuable for freelancers managing multiple projects. It’s suitable for freelancers who need a well-rounded accounting suite, but its features might be overkill for those with simpler needs.

- Invoicely: Invoicely emphasizes simplicity and ease of use. It excels at creating professional-looking invoices quickly, with a focus on straightforward invoicing. Its basic features are accessible, but it might lack the advanced features for more complex freelance operations. It is a suitable choice for freelancers with simpler invoicing requirements.

- Wave: Wave is a free invoicing tool, making it a popular choice for freelancers on a budget. It offers essential invoicing features, such as creating invoices, sending them, and tracking payments. Its free tier is attractive, but the limited features may not suffice for freelancers with extensive needs. Its simplicity and affordability make it an excellent option for new or micro-freelancers.

Benefits and Drawbacks for Different Freelance Scenarios

The suitability of each platform varies based on the freelancer’s specific circumstances.

- For project-based freelancers: FreshBooks, with its time tracking and expense management, would be a good choice, enabling accurate project costing.

- For freelancers with simple invoicing needs: Invoicely, with its user-friendly interface and focus on efficiency, would be a great fit.

- For budget-conscious freelancers: Wave’s free plan, coupled with its core invoicing features, makes it an attractive option.

Pricing Models

The cost of these invoicing tools varies considerably. A clear understanding of the pricing structures is essential for budgeting.

| Tool | Free Tier | Paid Options |

|---|---|---|

| FreshBooks | Limited features, trial period | Various plans based on features and users |

| Invoicely | Limited features, trial period | Various plans based on features and users |

| Wave | Essential invoicing features, completely free | Advanced features for a monthly fee |

Integration Capabilities

Integration with other accounting software is a key factor.

- FreshBooks integrates seamlessly with other accounting software, facilitating a unified workflow.

- Invoicely’s integration capabilities are robust, allowing for smooth data transfer.

- Wave offers integration with other accounting tools, enabling streamlined financial management.

Setting Up an Invoice (Example: FreshBooks)

Setting up an invoice in FreshBooks involves these steps:

- Access the FreshBooks platform and navigate to the invoice creation section.

- Input the client details, including contact information and project name.

- Detail the services rendered, including descriptions and pricing.

- Review the invoice for accuracy and add any necessary notes.

- Choose the desired payment method and schedule.

- Click “Send” to transmit the invoice to the client.

Expense Tracking Tools for Freelancers: Top Accounting Tools For Freelancers

Managing expenses effectively is crucial for freelancers to maintain profitability and avoid costly mistakes. Accurate tracking allows for better budgeting, simplifies tax preparation, and provides a clear picture of financial health. This is essential for those working independently, as the responsibility for financial management rests solely on their shoulders.

Robust Expense Tracking Tools

Several excellent tools cater specifically to the needs of freelancers, simplifying expense management. These tools are designed to streamline the process, from receipt capture to automated reporting. They empower freelancers to focus on their core work while maintaining meticulous financial records.

Detailed Features of Key Tools

- Expensify: Expensify is a comprehensive expense tracking platform known for its ease of use and powerful features. It allows for the capture of receipts via image upload, enabling automated categorization and expense reporting. Expensify seamlessly integrates with accounting software and enables efficient mileage tracking, providing a clear breakdown of business expenses. It facilitates the import of receipts from various sources, including email attachments, and automatically extracts critical data, including dates, locations, and descriptions.

- Coupler: Coupler provides a user-friendly interface for managing expenses. Its intuitive design makes it simple for freelancers to input receipts, track mileage, and categorize expenses effectively. Coupler also offers features to streamline the expense reporting process, ensuring compliance with tax regulations. It supports the import of receipts in multiple formats, enabling seamless integration with various systems and workflows. The platform offers an automatic categorization feature that can accurately categorize expenses according to pre-defined criteria.

- FreshBooks: FreshBooks, primarily known for its invoicing capabilities, also includes robust expense tracking features. This integrated approach simplifies the entire financial workflow for freelancers. FreshBooks enables the import of receipts and mileage tracking, assisting in generating expense reports tailored for tax purposes. It’s especially beneficial for those who already utilize FreshBooks for invoicing and client management. The tool offers a degree of automation, assisting in the classification of expenses and generating reports for better financial oversight.

Importing Receipts and Automating Reporting

Importing receipts into expense tracking tools like Expensify typically involves uploading images of receipts. The software then automatically extracts relevant data, such as dates, descriptions, and amounts. This process can be further streamlined by enabling automatic categorization based on predefined expense categories. Furthermore, most tools allow for the connection to accounting software, facilitating the seamless transfer of expense data for generating reports. Manual data entry can be minimized by utilizing OCR (Optical Character Recognition) technology, enabling the tool to recognize and extract information from scanned documents or digital images of receipts.

Key Features and Pricing Summary

| Tool | Key Features | Pricing |

|---|---|---|

| Expensify | Automated receipt capture, categorization, mileage tracking, integration with accounting software | Various plans, starting from free with limited features; paid plans offer increased storage, user capacity, and advanced features |

| Coupler | Intuitive interface, receipt import, mileage tracking, automated expense reporting, categorization | Various tiers, ranging from free to paid, with different levels of functionality and user capacity |

| FreshBooks | Integrated expense tracking within invoicing platform, receipt import, mileage tracking, automated reporting | Subscription-based pricing, varying based on features and user needs |

Time Tracking Tools for Freelancers

Time management is crucial for freelancers, as it directly impacts their profitability and project success. Effective time tracking tools allow freelancers to accurately record their work hours, categorize tasks, and ultimately, generate precise invoices. This detailed look at time tracking tools will provide insights into how these tools can optimize billing and project management.

Three Time Tracking Tools for Freelancers

Several robust time tracking tools cater to the needs of freelancers. Here are three popular choices, highlighting their user interfaces.

- Toggl Track: Toggl Track boasts a simple, intuitive interface. Users can easily log work hours, set project-specific time entries, and categorize tasks. The interface is designed to be straightforward, enabling quick entry of time spent on various activities. Its intuitive nature makes it suitable for both new and experienced freelancers.

- Clockify: Clockify offers a comprehensive time tracking platform with a clean and organized interface. It allows for detailed project tracking, time categorization, and even task breakdowns. This platform supports multiple users and projects, making it ideal for teams or freelancers managing multiple client projects. Its visual dashboard provides a clear overview of tracked time and progress.

- Harvest: Harvest’s interface is designed for seamless integration with other tools, particularly invoicing platforms. Its user-friendly interface is focused on efficient time entry, allowing for rapid recording of hours worked. Harvest’s interface is highly customizable, enabling freelancers to tailor the platform to their specific needs. This often includes the ability to add custom fields or categories for tracking expenses and activities.

Improving Billing Accuracy and Project Management

Time tracking tools directly improve billing accuracy by providing precise records of billable hours. This eliminates guesswork and ensures accurate invoices, preventing under- or over-billing. Moreover, these tools help manage projects more effectively by providing visibility into time spent on each task. This allows for better estimations of project timelines and resource allocation.

Integrating Time Tracking with Invoicing Software

Integrating time tracking with invoicing software streamlines the entire process. Automated invoicing, based on tracked time entries, eliminates manual data entry, reducing errors and saving time. This integration ensures that invoices are accurate, generated efficiently, and sent out promptly. This automated process often includes automatic updates to project timelines and client communication.

Comparison of Time Tracking Tools

| Feature | Toggl Track | Clockify | Harvest |

|---|---|---|---|

| Accuracy | High; simple interface minimizes errors | High; detailed categorization options reduce mistakes | High; integrates well with other tools, reducing human error |

| Flexibility | Good; suitable for individual freelancers | Excellent; supports teams and multiple projects | Excellent; customizable and highly adaptable |

Tracking Billable Hours using Toggl Track

To track billable hours using Toggl Track, first, create a new project for the client. Then, initiate a timer when you start working on a billable task. After completing the task, stop the timer. Toggl Track automatically records the time spent. For billable hours, ensure the project associated with the time entry is correctly identified. This ensures that billable hours are accurately categorized and available for invoicing.

Accurate time tracking is crucial for maintaining a healthy financial standing and successfully managing projects as a freelancer.

Project Management Tools with Accounting Integration

For freelancers, managing projects and finances can be a juggling act. Efficient tools that seamlessly integrate project management with accounting streamline operations, enabling better time management, accurate invoicing, and improved profitability. This section explores project management platforms that offer accounting features, highlighting their benefits and potential drawbacks for freelancers of various project sizes.

Project Management Tools with Integrated Accounting, Top accounting tools for freelancers

Several project management tools now offer accounting features, allowing freelancers to track project costs, manage expenses, and generate invoices directly within the platform. This integration simplifies the workflow, reduces manual data entry, and minimizes the risk of errors. Three prominent examples are Asana, Monday.com, and Trello.

Asana

Asana, a popular project management tool, provides basic accounting functionalities within its platform. It allows users to track project costs, assign expenses to specific tasks, and generate invoices. Asana integrates with other accounting software via Zapier or similar integrations. This capability facilitates seamless data flow between Asana and accounting systems.

Monday.com

Monday.com, a versatile platform, offers robust accounting features through its customizable workflows and integrations. Users can create custom fields for tracking project expenses, manage budgets, and automate invoicing processes. Monday.com’s extensive integrations with accounting software provide a seamless flow of financial data.

Trello

Trello, known for its visual approach to project management, offers basic accounting capabilities. While not as comprehensive as Asana or Monday.com, Trello allows users to track project expenses by attaching receipts and estimates to cards. Limited invoicing and reporting are also available, although further integration with accounting software might be required for complete financial management.

Accounting Features within Each Tool

- Asana: Asana offers basic expense tracking and invoicing features. Users can link expenses to specific tasks and create invoices directly within the platform. Integration with external accounting software via Zapier or similar tools is crucial for complete financial management.

- Monday.com: Monday.com’s customizable workflows empower users to create custom fields for project expenses, track budgets, and automate invoicing. Its robust integration capabilities connect with various accounting software for seamless financial data transfer.

- Trello: Trello’s basic accounting capabilities include expense tracking through receipts and estimates. Users can link financial data to project cards, facilitating rudimentary invoicing and expense management. However, it requires additional integrations for more comprehensive accounting processes.

Benefits and Drawbacks for Different Project Sizes

| Project Management Tool | Small Projects | Medium Projects | Large Projects |

|---|---|---|---|

| Asana | Good for basic needs; potential limitations for complex financial management | Adequate for managing expenses and invoices, but may lack advanced features for large teams | Limited support for large teams and complex project structures; integration with external tools is necessary |

| Monday.com | Excellent for simple projects; strong flexibility for scaling | Excellent choice for managing complex projects and expenses, with strong scalability | Strong choice, providing robust support for large teams and projects |

| Trello | Suitable for small projects; limited features for comprehensive financial management | Can be used, but advanced features may be needed; integration might be complex | Not recommended for large projects due to limited accounting features; external integrations are essential |

Streamlining Project Workflow

These integrated tools streamline the entire project workflow by automating tasks such as expense tracking, invoicing, and reporting. This automation reduces manual effort, minimizes errors, and provides freelancers with more time to focus on core project activities. For example, automatic expense categorization within Monday.com saves significant time and effort compared to manual tracking. Moreover, generating invoices directly within Asana eliminates the need for separate invoicing software, ensuring accurate and timely billing.

Tools for Specific Freelance Industries

Freelance work encompasses a wide array of specializations, from graphic design and writing to consulting and web development. Each industry presents unique accounting challenges, requiring tools tailored to specific needs. General-purpose accounting software, while versatile, may not always perfectly address the nuanced requirements of these specialized sectors. Specialized tools often offer features designed to streamline workflows and ensure accurate financial reporting within a particular industry’s context.

Specialized accounting tools for freelance industries offer advantages over general-purpose solutions by focusing on industry-specific functionalities. These tools can streamline tasks, reduce errors, and improve overall financial management for freelancers in niche sectors. They can integrate with existing industry-standard software or platforms, providing a unified workflow experience. For example, a graphic designer might find tools specifically designed to manage client contracts and track design assets. This level of customization ensures the accounting process is seamlessly integrated with the freelancer’s core work.

Graphic Design Freelance Accounting

Graphic design freelancers often face unique challenges in managing projects, invoicing, and tracking expenses. Specialized tools for graphic designers frequently incorporate features for managing design assets, tracking time spent on specific projects, and automatically generating invoices based on project specifications. This streamlines the process of creating and sending invoices, often with templates and options for recurring billing. Furthermore, these tools typically provide detailed project cost breakdowns, making it easier to track revenue and expenses associated with each design project. These tools also allow for seamless integration with project management platforms, further enhancing efficiency.

Writing Freelance Accounting

Freelance writers often face challenges in accurately tracking hours worked, managing various client contracts, and invoicing for different project types. Specialized writing tools often include features for time tracking, contract management, and automated invoice generation based on agreed-upon rates and deliverables. These tools can also track milestones, ensuring that payments are properly allocated based on completion. These tools can handle complex projects and different billing structures, such as fixed fees or hourly rates, accommodating the diverse needs of writing freelancers.

Consulting Freelance Accounting

Consulting freelancers need tools that can handle multiple clients, different project types, and diverse billing structures. Specialized tools for consultants often include features for project management, client relationship management (CRM), and advanced reporting. These tools allow consultants to track time spent on each client and project, create detailed invoices, and manage expenses associated with client engagements. Furthermore, these tools can handle multiple billing methods (e.g., retainer fees, hourly rates, project-based fees) and offer advanced reporting capabilities for financial analysis and forecasting.

Comparison of Specialized and General-Purpose Tools

| Feature | Specialized Tools | General-Purpose Tools |

|---|---|---|

| Project Tracking | Often integrated with project management, offering specific features for design assets, writing milestones, or consulting engagements. | May require additional integrations or manual input for project tracking. |

| Industry-Specific Templates | Pre-built templates for invoices, contracts, and other documents tailored to the industry. | Requires manual creation or modification of templates. |

| Expense Tracking | May include features for specific expense categories relevant to the industry. | May not have industry-specific expense categorization options. |

| Pricing Models | Often support various pricing models common to the industry. | May not support specific pricing models or require extensive customization. |

Integration and Automation

Streamlining your freelance accounting process is crucial for efficiency and accuracy. Effective integration between different accounting tools empowers freelancers to manage their finances seamlessly. Automation further enhances this by automating repetitive tasks, freeing up valuable time and minimizing the risk of human error. This section will delve into the importance of integration, showcase automation examples, provide a practical integration guide, and highlight the benefits of automation for freelancers.

Integrating different accounting tools allows for a unified financial overview. This interconnectedness facilitates the flow of data between tools, eliminating manual data entry and reducing the potential for errors. Furthermore, seamless integration often provides real-time updates, ensuring that all your financial information is always current and readily available.

Importance of Tool Integration

Integrating various accounting tools provides a consolidated view of your finances. This unified platform streamlines workflows, enabling quick access to crucial financial data, from invoices to expenses. This holistic view significantly reduces the risk of missing crucial information, allowing for more informed financial decisions.

Automation Examples

Numerous tasks can be automated to boost efficiency. For example, automatic invoice generation from project management software is a common use case. Similarly, automatic expense categorization based on predefined rules is possible with some expense tracking tools. Time tracking software can automatically populate your accounting software with time entries, removing the need for manual data entry. These examples illustrate how automation simplifies accounting for freelancers.

Step-by-Step Integration Guide (Example: Invoicing and Time Tracking)

This guide details integrating invoicing software (e.g., FreshBooks) with time tracking software (e.g., Toggl Track).

- Setup in Toggl Track: Configure Toggl Track to export time entries in a specific format (e.g., CSV). Specify the fields to be included (e.g., project, task, duration).

- Setup in FreshBooks: Configure FreshBooks to import data from a specific external source. Choose the data format (e.g., CSV) and map the fields from Toggl Track to FreshBooks (e.g., project name in Toggl Track corresponds to the client name in FreshBooks). This step often involves uploading a template or mapping file.

- Test and Refine: Import a small batch of time entries to test the integration. Verify the data is correctly transferred. Adjust mappings or configurations as needed.

- Schedule Automation: Configure automatic import schedules in FreshBooks to ensure data synchronization (e.g., daily or weekly).

- Verify: Check the imported data in FreshBooks to ensure accuracy. Confirm the data from both systems matches. If there are any discrepancies, identify and resolve the issue in the respective systems.

Benefits of Automating Recurring Tasks

Automating recurring tasks like invoice generation, expense reports, and payroll significantly reduces manual work. This automation boosts efficiency by eliminating repetitive actions, saving time, and preventing errors in data entry. By freeing up time, freelancers can focus on higher-level tasks like client management and business development.

Impact of Automation on Efficiency and Error Reduction

Automation streamlines the accounting process by reducing the manual effort required for routine tasks. This significantly boosts efficiency, as time saved can be dedicated to more strategic activities. Furthermore, the automation process minimizes human error, ensuring accuracy in financial reporting. Consequently, freelancers gain greater control over their finances, leading to more informed decision-making.

Free and Affordable Options

For freelancers on a budget, free or low-cost accounting tools can be a valuable asset. These tools often provide essential features, but may have limitations compared to premium options. Understanding these trade-offs is crucial for selecting the right solution.

Free Invoicing Tools

Many free invoicing tools cater to basic needs. These tools typically support creating invoices, sending them electronically, and tracking payments. However, advanced features like recurring billing, custom branding, or detailed reporting are often absent.

- FreshBooks Free: This tool offers a free plan for basic invoicing, expense tracking, and time tracking. However, it has limitations on the number of clients and features compared to its paid plans. It’s ideal for freelancers with a small client base who prioritize simplicity.

- Wave Accounting: Wave offers a free plan that covers invoicing, expense tracking, and basic accounting features. It’s user-friendly and integrates with other services like PayPal and Stripe. The free version often has transaction limits or restrictions on advanced features.

- Zoho Invoice: Zoho Invoice’s free plan allows you to create and send invoices, manage clients, and track payments. While it’s a solid option for free invoicing, it may lack the depth of customization and reporting capabilities of paid versions.

Comparing Free and Paid Tools

The table below summarizes the comparison between free and paid accounting tools.

| Feature | Free Tools | Paid Tools |

|---|---|---|

| Invoicing | Generally available, limited features | Extensive features, customizable templates |

| Expense Tracking | Basic or limited features | Detailed expense categorization, reporting |

| Client Management | Limited client profiles | Advanced client management, communication tools |

| Reporting | Basic reporting, often limited data | Comprehensive reports, customizable dashboards |

| Price | Free | Subscription-based |

Ease of Use and Learning Curve

The learning curve for free tools varies depending on the specific tool. While many free tools prioritize simplicity, they may lack the extensive tutorials and support found in paid versions. Free tools are often designed for users with limited accounting experience, while paid versions may have more features requiring a deeper understanding. Ease of use depends on the individual’s familiarity with accounting software and willingness to explore the tool’s features.

Security and Data Management

Protecting your financial data is paramount for freelancers. Robust security measures ensure the safety of your client information, invoices, and financial records, preventing potential breaches and associated losses. Choosing accounting tools with strong security protocols safeguards your business and builds trust with clients.

Importance of Security for Freelancers

Freelancers often handle sensitive financial information, making security a critical concern. Compromised data can lead to significant financial losses, reputational damage, and legal issues. Secure accounting tools minimize these risks, protecting your financial well-being and maintaining client trust. Implementing strong security practices is essential for freelancers in all industries.

Best Practices for Data Backup and Recovery

Regular data backups are crucial for freelancers. Automated backups minimize the risk of data loss due to technical issues or human errors. Maintaining multiple copies of your data in different locations provides redundancy and safeguards against total data loss. Testing backup and recovery procedures is essential to ensure they function correctly when needed.

Different Security Features Offered by Accounting Tools

Various accounting tools offer different security features to protect user data. These features can include two-factor authentication, encryption, access controls, and regular security audits. Strong encryption methods protect data from unauthorized access, while access controls limit who can view and modify sensitive information.

Security Protocols of Different Accounting Tools

| Accounting Tool | Security Protocols |

|---|---|

| FreshBooks | Two-factor authentication, data encryption, role-based access controls, regular security audits. |

| Xero | Two-factor authentication, data encryption, multi-layered security protocols, regular security updates. |

| Zoho Books | Two-factor authentication, data encryption, access controls based on user roles, regular security audits. |

| Wave Accounting | Two-factor authentication, data encryption, role-based access controls, regular security updates. |

Note: Security features can vary between different plans and versions of the accounting software. Always refer to the specific tool’s documentation for detailed information.

Maintaining Data Privacy and Compliance for Freelancers

Adhering to data privacy regulations and industry standards is crucial for freelancers. Understanding and implementing compliance measures protects both your business and your clients’ data. Data privacy regulations, like GDPR (General Data Protection Regulation), require adherence to specific security measures and data handling practices. Consult with legal professionals to ensure compliance with applicable regulations.

Conclusion

![[Latest] 10+ Best Tools for Freelancers to Keep Your Business Growing Top accounting tools for freelancers](https://bookkeeping.wibuh.com/wp-content/uploads/2025/04/Accounting-Software-for-Freelancers.png)

Source: epicwinapp.com

In conclusion, navigating the world of freelance accounting doesn’t have to be daunting. By leveraging the right tools, freelancers can streamline their operations, improve accuracy, and ultimately achieve greater financial success. This guide has provided a comprehensive overview of various accounting software options, from simple invoicing platforms to integrated project management tools. Remember to consider your specific needs, budget, and industry when making your choices. Ultimately, the right tools empower you to focus on what you do best – your craft.