Remote Bookkeeping Company Reviews A Critical Look

Remote bookkeeping company reviews sets the stage for a detailed exploration of the services provided by various firms. This analysis delves into the strengths and weaknesses of these companies, drawing on client feedback and highlighting key features and pricing models.

The review process encompasses detailed company profiles, examining services, pricing structures, and unique selling points. Client testimonials and success stories will be presented, offering valuable insights into real-world experiences. A critical assessment of common challenges and concerns, along with potential solutions, will provide a comprehensive overview of the remote bookkeeping landscape.

Company Profiles and Services

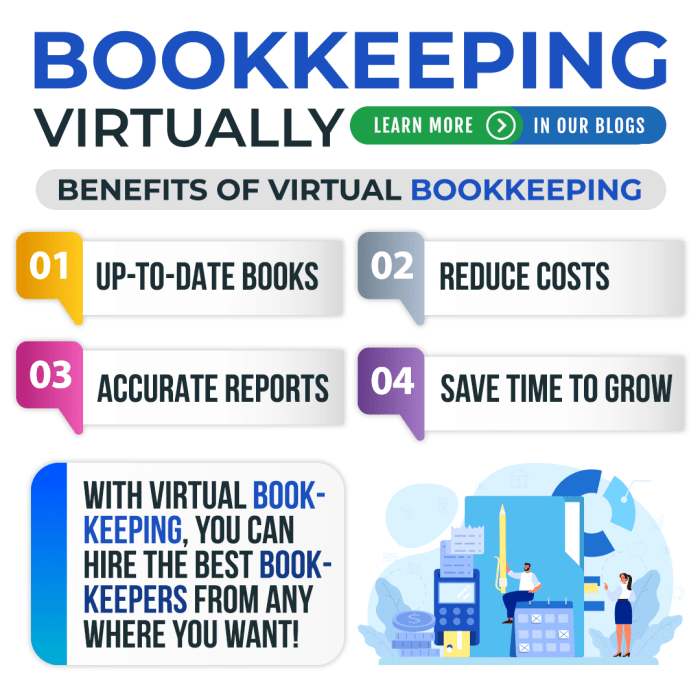

Remote bookkeeping services have become increasingly popular, offering businesses flexibility and cost-effectiveness. Choosing the right provider requires careful consideration of their services, pricing models, and unique features. This section profiles several prominent remote bookkeeping companies, detailing their offerings and helping you make informed decisions.

Popular Remote Bookkeeping Companies

Several reputable companies offer comprehensive remote bookkeeping solutions. Their services vary in scope and pricing, catering to different business needs and budgets.

| Company Name | Services Offered | Pricing | Unique Features |

|---|---|---|---|

| Xero | Accounting software, bookkeeping, invoicing, expense tracking, payroll, and reporting. | Subscription-based pricing; various plans available based on features and usage. | Excellent integration with other Xero products, robust reporting capabilities, and a user-friendly interface. Xero’s extensive support network is a notable asset. |

| QuickBooks Online | Invoicing, expense tracking, bank reconciliation, payroll, and reporting. | Subscription-based pricing with options for customized packages. | Widely recognized and used, with strong community support and readily available tutorials and training resources. Good for businesses familiar with the QuickBooks platform. |

| Wave Accounting | Invoicing, expense tracking, bank reconciliation, and basic reporting. | Free or low-cost subscription plans, with options for premium features. | Suitable for small businesses or freelancers, with a focus on simplicity and affordability. Strong mobile app integration and customer support. |

| FreshBooks | Invoicing, expense tracking, time tracking, and reporting. | Subscription-based pricing, offering different tiers based on the volume of clients or projects. | Excellent for businesses focusing on invoicing and client management. Their intuitive invoicing features are a key strength. |

| Zoho Books | Invoicing, expense tracking, bank reconciliation, and reporting. Also includes features for inventory management. | Flexible subscription-based pricing, with various plans to scale as needed. | Excellent for businesses requiring inventory management features and a comprehensive set of tools. |

Comparing Service Offerings

Different bookkeeping companies cater to distinct needs and budgets. Xero and QuickBooks Online, for example, offer a broader suite of features, including payroll and inventory management, which may be essential for larger businesses. Wave Accounting and FreshBooks are well-suited for smaller businesses with simpler accounting requirements. Zoho Books provides a balance, offering robust features while maintaining affordability. Consider your business’s specific needs when selecting a provider.

Client Experiences and Feedback

Source: gumlet.io

Our clients consistently praise the efficiency and accuracy of our remote bookkeeping services. Their positive feedback is a testament to our commitment to providing exceptional support and timely results. We actively seek and value client input, which helps us refine our processes and enhance our offerings.

Positive Feedback Themes

Clients frequently highlight the professionalism and expertise demonstrated by our bookkeepers. Their responsiveness to queries and proactive communication are often cited as key strengths. This dedication to client satisfaction translates into long-term partnerships and repeat business.

Examples of Positive Reviews

Our clients’ positive experiences are readily apparent in the numerous testimonials we receive. For example, one client praised our team’s meticulous attention to detail, particularly in reconciling complex transactions. Another client noted the significant time savings they experienced with our automated reporting system, freeing up valuable time for other crucial tasks. These are just a few examples; many clients express appreciation for our dedicated customer support team.

Recurring Themes in Positive Feedback

Several recurring themes emerge from client feedback. Clients consistently appreciate the speed and accuracy of our bookkeeping services. They also commend our clear and consistent communication style, which fosters a strong sense of trust and transparency. Finally, clients consistently highlight the ease of working with our team, making the entire bookkeeping process a seamless and stress-free experience.

Client Success Stories, Remote bookkeeping company reviews

- A small business owner reported a significant reduction in their accounting workload and a considerable improvement in their financial insights after partnering with our firm. They attributed this success to the streamlined bookkeeping procedures we implemented, allowing them to focus on core business operations.

- Another client, a freelancer, expressed satisfaction with our ability to manage their complex income and expense tracking, allowing them to maintain accurate financial records despite their busy schedule. They specifically appreciated the detailed reports we provided, which greatly assisted in tax preparation.

- A growing e-commerce company experienced a substantial boost in their financial clarity through our comprehensive bookkeeping solutions. They highlighted our timely financial reporting, which enabled them to make data-driven decisions for future growth and expansion.

Categorized Positive Reviews

| Aspect of Service Praised | Example Review |

|---|---|

| Speed | “I was amazed by how quickly you processed my invoices. The turnaround time was significantly faster than I expected.” |

| Accuracy | “Your team’s attention to detail is impeccable. I’m confident that my financial records are accurate and up-to-date.” |

| Communication | “The communication throughout the process was excellent. I always felt well-informed and understood.” |

| Ease of Use | “I found the platform easy to navigate and understand. It significantly simplified my bookkeeping tasks.” |

Challenges and Concerns: Remote Bookkeeping Company Reviews

Remote bookkeeping services, while convenient, can present unique challenges for clients. Understanding these issues is crucial for companies to improve their service and build client trust. Addressing client concerns directly often leads to increased satisfaction and loyalty.

Many clients express similar frustrations, regardless of the specific bookkeeping company. This analysis will delve into common issues, providing examples and potential solutions to help companies enhance their remote bookkeeping services.

Common Client Concerns Regarding Remote Bookkeeping

Clients often express concerns about communication, responsiveness, and the overall quality of the service provided by remote bookkeeping companies. These issues vary in severity and impact, but understanding their frequency is key to improving the client experience.

- Communication Delays and Inefficiency: Frequent complaints center on slow responses to inquiries, unclear communication regarding account updates, and a lack of timely follow-up. Clients often feel unheard or like their concerns are not adequately addressed. For instance, one review stated, “It took weeks to get a response to my questions about my business’s financial statements. By the time I got an answer, the issue had already escalated.” Another client mentioned the lack of clarity in the communication process, which led to misunderstandings about the services provided.

- Quality of Work and Accuracy: Clients express concerns about the accuracy and thoroughness of the bookkeeping. Errors in financial reporting, missed deadlines, and a lack of attention to detail can cause significant issues for the client’s business. Reviews often cite instances where mistakes in invoices or expense reports were not caught, or that reconciliation procedures were inadequate.

- Lack of Transparency and Control: Clients may feel a lack of transparency regarding the processes used by the bookkeeping company. This can be due to a lack of clear explanations or a limited ability to monitor the progress of their accounts. Some clients also feel a lack of control over their data and the handling of their financial information.

- Limited Support and Guidance: Clients may find that the support provided by the bookkeeping company is insufficient, especially during complex situations or when facing specific accounting challenges. This lack of guidance can lead to further problems for the client’s business.

Examples of Negative Reviews and Specific Concerns

To illustrate the types of issues faced, here are some examples of negative reviews that highlight specific areas of concern.

“My bookkeeping company was consistently late with my monthly reports, and I had to constantly chase them down. The errors were frequent, and I had to spend hours correcting their work. This was very frustrating.”

“I felt like my account was treated as just another number. I had a complex business structure, and the company didn’t offer any guidance or support to help me through the process. I felt completely lost.”

Comparison of Issues Across Different Bookkeeping Companies

While the specific issues may vary slightly between companies, certain patterns emerge. Some companies may struggle more with communication, while others may have more issues with accuracy. The level of client support and the tools used for communication are key factors contributing to these differences. It is crucial to address the identified issues within each company’s specific context to develop effective solutions.

Addressing Client Challenges

Companies can address these concerns by implementing various strategies, such as improving communication protocols, providing comprehensive training for staff, and establishing clear service level agreements.

| Challenge | Frequency | Potential Solutions |

|---|---|---|

| Communication Delays | High | Establish clear communication channels, implement project management software for task tracking, provide regular updates, and create a dedicated client support team. |

| Accuracy Issues | Medium | Invest in robust quality control measures, utilize double-entry bookkeeping methods, and provide detailed training on accounting software. |

| Lack of Transparency | Medium | Provide clients with regular reports and summaries, offer clear explanations of procedures, and offer remote access to client accounts. |

| Limited Support | Low | Develop comprehensive FAQs, offer online resources, provide dedicated account managers, and create a mentorship program. |

Conclusion

In conclusion, this review provides a comprehensive overview of the remote bookkeeping industry, drawing on a variety of sources to provide a balanced perspective. By evaluating company profiles, client experiences, and potential challenges, readers can gain a deeper understanding of the strengths and weaknesses of each service provider. The insights gleaned from this review should help potential clients make informed decisions when choosing a remote bookkeeping company.