Outsourcing Bookkeeping for Startups A Guide

Outsourced bookkeeping for startups – Outsourcing bookkeeping for startups is a smart move, streamlining finances and freeing up valuable time. Startups often juggle many tasks, and bookkeeping can quickly become a major administrative burden. This guide explores the benefits, types of services, and critical factors for choosing the right outsourced bookkeeping provider, ensuring financial accuracy and enabling scalability for your growing business.

This guide delves into the intricacies of outsourcing bookkeeping for startups, providing a comprehensive overview of the process, from initial setup to ongoing management. We will explore the diverse range of services available, highlighting the advantages and disadvantages of various options. Understanding the nuances of different providers, their pricing models, and the importance of strong communication are key to a successful partnership. Ultimately, this guide aims to equip startup founders with the knowledge to confidently navigate the complexities of outsourced bookkeeping.

Introduction to Outsourced Bookkeeping for Startups

Outsourcing bookkeeping is a critical aspect of successful startup management. It frees up valuable time and resources that entrepreneurs can dedicate to core business functions, like product development, marketing, and sales. This allows founders to focus on scaling their operations and driving growth, without the burden of managing accounting tasks.

Effective bookkeeping is crucial for startups to track income, expenses, and financial performance accurately. This precise record-keeping enables informed decision-making, accurate financial reporting, and facilitates compliance with tax regulations. A well-maintained bookkeeping system is essential for securing funding, attracting investors, and navigating the complex financial landscape of the early stages of a business.

Bookkeeping Needs of Startups

Startups often face unique bookkeeping challenges due to their rapid growth and evolving operational structures. These challenges typically involve managing multiple accounts, tracking various expenses, and reconciling transactions promptly. They may use various payment methods, potentially from various countries, and have diverse financial instruments and investments. Accurate tracking of these activities is essential for compliance and future financial planning. Maintaining consistent and accurate financial records is a top priority to ensure the business’s health and growth.

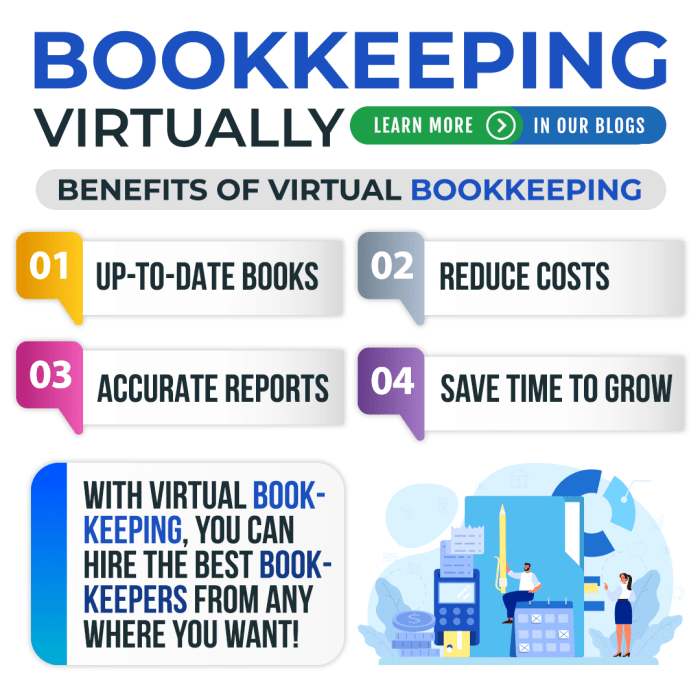

Benefits of Outsourcing Bookkeeping

Outsourcing bookkeeping offers several key advantages for startups. It alleviates the burden of managing financial tasks, allowing founders to focus on core business functions. This frees up valuable time, resources, and mental capacity to concentrate on strategic initiatives. The expertise of outsourced bookkeepers often includes industry-specific knowledge, allowing for tailored solutions to address the unique financial needs of startups. Outsourcing can also reduce operational costs, especially in the early stages of a startup.

Common Challenges Startups Face Regarding Bookkeeping

Startups frequently face challenges related to bookkeeping. These difficulties often stem from a lack of in-house accounting expertise or the limited resources available in the early stages of business development. Startups often struggle with the complexity of bookkeeping procedures and the potential for errors. A lack of financial knowledge and expertise within the founding team can be a significant obstacle. Moreover, the rapid growth and evolution of the business can create complexities that require specialized accounting skills to manage.

In-House vs. Outsourced Bookkeeping

This table compares the tasks involved in in-house and outsourced bookkeeping for startups, highlighting the costs associated with each approach.

| Task | In-House | Outsourced | Cost |

|---|---|---|---|

| Record keeping | Requires dedicated employee with accounting knowledge; time-consuming | Professional bookkeeper handles data entry; efficient process | Salary, benefits, training costs; higher initial cost |

| Reconciliation | Requires expertise and time; prone to errors | Expertise in reconciliation; reduced risk of errors | Potential errors in in-house reconciliation; outsourcing reduces error rate |

| Tax preparation | Requires specialized knowledge; potential for errors | Professionals with tax expertise; accurate returns | Time spent on tax preparation and potential penalties; outsourced tax preparation is more cost-effective |

| Financial reporting | Requires time and effort; potentially inaccurate reporting | Professionals provide accurate reports; readily available | Potential delays and inaccuracies in in-house reporting; outsourcing provides timely and accurate reports |

| Compliance | Requires up-to-date knowledge of regulations; compliance issues can arise | Professionals maintain current knowledge; proactive compliance | Time spent on compliance; compliance failures lead to penalties |

Types of Outsourced Bookkeeping Services

Outsourcing bookkeeping for startups can be a smart move, freeing up valuable time and resources. Different service providers offer varying levels of support and features, allowing startups to tailor their bookkeeping needs to their budget and scale. This section explores the different types of outsourced bookkeeping services, highlighting their distinctions and helping you choose the right fit for your business.

Different Service Provider Types

Various approaches to bookkeeping outsourcing exist, each with unique characteristics. Cloud-based services, for example, leverage online platforms and software, while traditional bookkeeping often involves a more hands-on approach with physical records. The differences in these methods impact service delivery, communication, and the overall experience. Choosing the right service provider type is crucial to ensuring efficiency and accuracy in your financial records.

Comparison of Service Packages

Bookkeeping services often come in different packages to suit various needs and budgets. Basic packages might offer essential tasks such as bank reconciliation and invoice processing, while premium packages can include more advanced features like financial reporting and budgeting assistance. These packages are designed to cater to the evolving needs of a startup, and a suitable package ensures your financial records are properly managed at every stage.

Essential Features of a Reliable Bookkeeping Service

A reliable bookkeeping service for startups should possess specific features that contribute to accurate and timely financial reporting. These include robust data security measures, clear communication channels, and a dedicated point of contact. Furthermore, a dependable service provider should be capable of adapting to the unique needs of the startup, from managing complex transactions to providing timely reports. These features ensure transparency and accountability in your financial management.

Table of Bookkeeping Service Types

| Service Type | Pros | Cons | Cost |

|---|---|---|---|

| Cloud-Based | Accessibility (anywhere, anytime), efficiency (automated processes), data security (often enhanced), scalability (easily adaptable to growth). | Potential for technical issues, dependence on internet connection, potential for data breaches if not secured properly, may require additional training for users. | Generally mid-range, but can vary based on features and complexity. |

| Traditional (In-House/Onsite) | Direct control over the process, better understanding of specific needs, potentially lower costs for simple setups. | Limited accessibility, potentially slower processing, less scalability, often higher initial investment. | Lower costs for basic setups, but could increase substantially with complex needs. |

| Hybrid | Combines the benefits of both cloud-based and traditional methods, providing a customized approach. | Can be more complex to manage, potential for communication issues between different parts of the system, can be more costly than a simple service. | Variable costs depending on the extent of customization and complexity. |

The table above provides a comparative overview of different bookkeeping service types. Careful consideration of the pros, cons, and associated costs is crucial for selecting the most suitable option for your startup’s specific circumstances.

Benefits of Outsourcing Bookkeeping for Startups

Outsourcing bookkeeping offers significant advantages for startups, allowing them to focus on core business functions rather than administrative tasks. This frees up valuable time and resources, ultimately boosting efficiency and growth potential. By entrusting financial record-keeping to experts, startups can streamline their operations and achieve better financial management.

Time Savings Associated with Outsourced Bookkeeping

Outsourcing bookkeeping significantly reduces the time commitment founders dedicate to financial tasks. Manual bookkeeping procedures, such as entering transactions, reconciling accounts, and preparing reports, can be time-consuming and distract from essential strategic activities. Outsourcing this work allows founders to dedicate their time to product development, marketing, sales, and other crucial aspects of scaling the business. A dedicated bookkeeping service can process transactions quickly and accurately, freeing up considerable time for core business operations.

Reduced Administrative Burden for Startup Founders

Outsourcing bookkeeping lightens the administrative burden on startup founders. Managing accounts payable, accounts receivable, and payroll can be complex and overwhelming. Bookkeeping professionals handle these responsibilities efficiently, allowing founders to concentrate on strategic growth initiatives. This reduced administrative workload enables them to focus on long-term goals and strategic decisions, which are essential for startup success.

Improved Financial Accuracy and Reduced Errors

Outsourcing bookkeeping can significantly enhance financial accuracy and minimize errors. Bookkeeping professionals possess specialized knowledge and experience in handling financial transactions and maintaining records. Their expertise ensures that financial data is recorded accurately, reducing the risk of errors that can occur with in-house bookkeeping. This meticulous attention to detail is crucial for maintaining financial integrity and making informed decisions.

Advantages of Better Financial Reporting and Analysis

Outsourcing bookkeeping improves financial reporting and analysis capabilities. Bookkeeping services provide comprehensive financial reports, including income statements, balance sheets, and cash flow statements. These reports offer insights into the financial health of the startup and help identify trends and areas for improvement. By having access to accurate and timely financial reports, startups can make data-driven decisions that enhance profitability and growth.

How Outsourcing Can Help Startups Scale

Outsourcing bookkeeping is instrumental in supporting the scaling of startups. As a business grows, financial transactions increase in volume and complexity. A dedicated bookkeeping service can handle the increased workload effectively, ensuring accurate record-keeping and timely reporting. This scalability is vital for startups navigating rapid growth, as accurate financial management becomes increasingly critical.

Top 5 Advantages of Outsourcing Bookkeeping for Startups

- Reduced operational costs: Outsourcing bookkeeping eliminates the need for in-house staff, reducing payroll and overhead costs.

- Improved financial accuracy: Bookkeeping professionals ensure data accuracy, minimizing errors and improving financial reporting.

- Increased efficiency: Outsourcing frees up valuable time for founders to focus on core business activities.

- Enhanced financial insights: Detailed financial reports and analysis empower informed decision-making.

- Scalability support: Outsourcing adapts easily to growing transaction volumes, supporting rapid startup growth.

Choosing the Right Outsourced Bookkeeping Provider

Selecting a reliable outsourced bookkeeping service is crucial for the success of any startup. The right provider can streamline financial operations, allowing you to focus on growth and strategic initiatives. A poor choice, however, can lead to errors, delays, and increased costs in the long run. Thorough research and careful evaluation are essential to avoid these pitfalls.

Choosing the right bookkeeping provider involves more than just the lowest price. A comprehensive evaluation process should consider the provider’s experience, expertise, reputation, and reliability. Key factors like communication channels, software compatibility, and data security practices must also be carefully examined. A strong partnership with a competent provider can significantly impact a startup’s financial health and future prospects.

Factors to Consider When Selecting a Bookkeeping Service

A successful partnership relies on aligning the provider’s capabilities with your startup’s specific needs. This includes considering their experience in handling various accounting procedures and industry-specific knowledge, if applicable. Thorough understanding of accounting standards and regulations is also vital. Consider the provider’s technical proficiency, their capacity to adapt to evolving business needs, and their overall understanding of your business’s goals and objectives.

Importance of Experience and Expertise

A provider with extensive experience in handling similar startups or businesses operating in your industry is likely to have a better understanding of your specific financial challenges and needs. They can offer more tailored solutions and anticipate potential issues more effectively. A strong understanding of industry-specific accounting practices can also prevent costly mistakes. Expertise in using various accounting software and handling diverse financial transactions is also essential. This translates to greater efficiency and accuracy in your financial reporting.

Evaluating Provider Reputation and Reliability

A provider’s reputation and reliability are key indicators of their trustworthiness. Check online reviews and testimonials from other clients to assess their service quality and client satisfaction. Seek references from satisfied clients, verifying the authenticity of their feedback. Look for providers who are actively involved in the industry, perhaps participating in relevant professional organizations or maintaining certifications. A strong reputation is built on consistent quality service and client satisfaction.

Checklist for Evaluating Outsourced Bookkeeping Providers, Outsourced bookkeeping for startups

- Experience: Assess the provider’s years of experience and their expertise in handling similar startups.

- Software Proficiency: Confirm compatibility with your chosen accounting software (or willingness to integrate with it). Verify their familiarity with the specific software you utilize or are planning to use.

- Communication: Evaluate their communication channels and responsiveness to queries.

- Data Security: Inquire about their data security protocols and procedures to ensure the protection of your financial data.

- Pricing and Transparency: Understand the pricing structure, fees, and any hidden costs. Ensure clear and transparent pricing models.

- Client Testimonials and Reviews: Research online reviews and testimonials to gauge client satisfaction and service quality.

- Industry Recognition: Consider whether the provider holds relevant certifications or memberships in professional organizations.

- References: Request references from previous clients to assess their experiences firsthand.

Researching and Comparing Different Providers

Thorough research is critical in selecting the right provider. Start by identifying potential providers in your area or online. Compare their pricing, features, and services offered. Consider their level of expertise, experience, and reputation. A comprehensive comparison table will help in making an informed decision. Pay attention to their client testimonials and reviews, as they often offer valuable insights into the provider’s service quality.

Provider Comparison Table

| Provider | Key Features | Pricing | Reviews |

|---|---|---|---|

| Bookkeeping Solutions Inc. | Extensive experience in startup accounting, excellent software proficiency, transparent pricing, secure data handling | $1500/month for basic services, $2500/month for premium packages | High ratings on Clutch, Good Reviews on Google |

| QuickBooks Pro | Integration with QuickBooks software, automated reporting, dedicated support team, well-regarded for small business accounting | $1200/month for basic services, $1800/month for premium packages | Positive reviews emphasizing speed and efficiency |

| Accountant.com | Wide range of services, flexible subscription options, comprehensive reporting tools, industry-specific expertise for startups | $1000/month for basic services, $2000/month for advanced packages | Generally positive reviews, with some clients mentioning initial learning curve |

Managing the Outsourced Bookkeeping Relationship: Outsourced Bookkeeping For Startups

Source: innovatureinc.com

A strong relationship with your outsourced bookkeeping provider is crucial for the smooth operation of your startup’s finances. This involves more than just handing over your records; it’s about fostering a partnership that ensures accuracy, efficiency, and ultimately, financial success. Effective communication, clear expectations, and proactive issue resolution are key elements in maintaining this partnership.

Effective management of the outsourced bookkeeping relationship is essential for startups. It builds trust, minimizes errors, and ensures financial data is accurately and timely processed, which is vital for informed decision-making. A well-managed relationship also reduces stress and allows business owners to focus on other critical aspects of the company’s growth.

Importance of Clear Communication

Clear and consistent communication with your bookkeeping provider is paramount. This includes regular updates on company changes, new policies, or any financial updates that may affect the bookkeeping process. Open lines of communication allow for prompt clarification of any doubts or questions. This proactive approach prevents misunderstandings and ensures everyone is on the same page.

Establishing Clear Expectations and Procedures

Defining clear expectations and procedures right from the start is vital for a successful partnership. This involves outlining the scope of work, expected turnaround times for tasks, and the frequency of communication. A well-defined process ensures that both parties are aware of their roles and responsibilities. For example, establishing a clear protocol for submitting invoices and expense reports minimizes potential delays and ensures smooth data flow.

Ensuring Accurate and Timely Data Exchange

Accurate and timely data exchange is critical for the accuracy of financial records. This includes defining the frequency and method of data transfer, and establishing clear guidelines for data formatting and security. Using a secure file-sharing system and adhering to strict data security protocols will ensure the safety and integrity of sensitive financial information. Examples include regularly scheduled data uploads, standardized file formats, and encryption protocols.

Addressing Issues that May Arise

Disagreements and problems will inevitably arise. A well-defined process for addressing issues promptly and effectively is essential. This involves establishing a clear escalation path, outlining the steps involved in reporting issues, and having a mechanism for resolving conflicts. Having a pre-defined communication channel (e.g., email thread, project management software) and a process for escalating concerns will help to mitigate potential conflicts.

Monitoring the Outsourced Bookkeeping Service

Monitoring the outsourced bookkeeping service is vital for ensuring its effectiveness and quality. Regular reviews of the service’s performance, including an assessment of accuracy, timeliness, and compliance with relevant regulations, are important for identifying areas needing improvement. Monitoring should involve checking for errors, reviewing reports, and comparing results against previous periods. Metrics such as the number of errors per month, the time taken to process transactions, and the accuracy of financial statements are useful indicators.

Process for Reporting Issues or Making Changes

A structured process for reporting issues or making changes is necessary for efficient problem-solving and smooth service adjustments. This process should include a defined method for submitting requests, a clear timeline for resolution, and regular updates to ensure transparency.

| Issue/Change Request | Reporting Method | Resolution Timeline | Communication Channel |

|---|---|---|---|

| Data Entry Error | Email with detailed description and affected documents | Within 24-48 hours | Designated project manager email |

| Process Improvement Suggestion | Meeting or formal email | Within 1 week | Designated project manager or team lead |

| System Change Request | Formal request form | Within 2 weeks | Designated project manager or team lead |

This structured approach minimizes confusion, ensures prompt action, and helps to maintain a smooth working relationship.

Technology and Tools Used in Outsourced Bookkeeping

Outsourcing bookkeeping for startups often relies heavily on technology to streamline processes and ensure accuracy. This section delves into the critical tools and platforms used in this context. Efficient use of these tools is essential for the success of both the bookkeeping service provider and the startup client.

Outsourcing bookkeeping services are inherently intertwined with modern accounting software. These systems provide the infrastructure for efficient data management, processing, and reporting. The use of cloud-based platforms is paramount for accessibility and collaboration, further enhancing the efficiency of the entire process.

Accounting Software in Outsourced Bookkeeping

Accounting software plays a central role in outsourced bookkeeping. These programs automate various tasks, from recording transactions to generating reports, significantly improving efficiency and reducing errors. This automation translates into cost savings for the startup and increased accuracy for the bookkeeping service. Comprehensive accounting software solutions typically encompass functionalities for invoicing, expense tracking, accounts payable and receivable, and general ledger management. This comprehensive approach ensures a holistic view of the startup’s financial performance.

Cloud-Based Accounting Platforms

Cloud-based accounting platforms have become increasingly important in outsourced bookkeeping. These platforms offer remote access, collaboration features, and real-time data updates, enabling seamless communication and data sharing between the bookkeeping provider and the startup. Cloud-based solutions are particularly valuable for startups operating in multiple locations or with distributed teams. The accessibility of real-time data fosters better financial oversight and allows for more agile decision-making.

Secure Data Storage and Transmission

Security is paramount in outsourced bookkeeping. Data breaches can have severe consequences for both the bookkeeping provider and the startup client. Robust security measures, including encryption and access controls, are essential for protecting sensitive financial information. Regular security audits and compliance with relevant regulations are critical for maintaining a secure environment. The importance of data encryption and secure transmission protocols cannot be overstated in this context.

Examples of Specific Software Solutions

Several software solutions are commonly used in outsourced bookkeeping. Popular choices include Xero, QuickBooks Online, and FreshBooks. These platforms provide comprehensive features, from invoicing and expense tracking to reporting and analysis. The choice of software depends on the specific needs and requirements of the startup. Xero, for example, offers a range of plans tailored to different business sizes, while QuickBooks Online is known for its robust features for managing complex accounting needs.

Common Bookkeeping Software Solutions

| Software | Features | Cost | Customer Reviews |

|---|---|---|---|

| Xero | Invoicing, expense tracking, bank reconciliation, reporting, inventory management | Variable, tiered pricing | Generally positive, highlighting ease of use and features |

| QuickBooks Online | Comprehensive accounting software, including invoicing, expense tracking, and reporting, plus payroll and inventory management | Variable, tiered pricing | Positive reviews for robust features, but some users mention a steeper learning curve |

| FreshBooks | Invoicing, billing, expense tracking, and client management | Variable, tiered pricing | Positive feedback on ease of use and features specifically for invoicing and billing |

| Zoho Books | Invoicing, expense tracking, bank reconciliation, reporting, inventory management | Variable, tiered pricing | Positive feedback, especially for its integration capabilities and customer support |

Legal and Compliance Considerations

Outsourcing bookkeeping involves entrusting sensitive financial data to a third-party provider. Therefore, understanding and adhering to legal and compliance requirements is crucial for startups to maintain financial integrity and avoid potential legal issues. Proper due diligence and ongoing oversight are vital to ensuring compliance.

Relevant Regulations and Compliance Requirements

Startups operating in various jurisdictions must comply with specific tax laws, accounting standards, and data privacy regulations. This includes adhering to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the country or region. Furthermore, specific industry regulations may apply. For example, businesses handling consumer data must comply with regulations like GDPR (General Data Protection Regulation) in the EU or CCPA (California Consumer Privacy Act) in California. Understanding these regulations is essential for avoiding costly penalties and maintaining trust with stakeholders.

Data Privacy and Security

Data privacy and security are paramount when outsourcing bookkeeping. Startups must ensure that their financial data is protected from unauthorized access, breaches, and misuse. The chosen bookkeeping provider must have robust security measures in place, including data encryption, access controls, and regular security audits. Implementing strong security protocols is not just a best practice, it’s a legal necessity. Breaches can lead to significant financial penalties and reputational damage.

Essential Legal Documents to Review

Reviewing the service agreement is crucial to understanding the provider’s responsibilities, limitations, and liability. The agreement should clearly Artikel data handling practices, security measures, and dispute resolution procedures. Key aspects to examine include the scope of services, payment terms, termination clauses, and confidentiality agreements. Additionally, review the provider’s certifications and licenses to ensure they are compliant with relevant regulations. Thorough review and understanding of these documents are essential to minimizing potential risks.

Ensuring Compliance with Laws and Regulations

Regularly review and update the service agreement to reflect changes in regulations or best practices. Establish clear communication channels with the bookkeeping provider to ensure consistent compliance with all relevant laws and regulations. Conduct periodic audits of the bookkeeping processes to identify and address any potential compliance gaps. This proactive approach to compliance reduces the likelihood of penalties and maintains a positive reputation.

Examples of Legal Issues to Avoid When Outsourcing Bookkeeping

Failing to comply with data privacy regulations, such as GDPR or CCPA, can result in hefty fines and legal action. Another potential issue is not properly safeguarding sensitive financial data, which could lead to data breaches and significant financial losses. Using an unqualified or non-compliant bookkeeping provider can also lead to accounting errors, tax issues, and reputational damage. By proactively addressing these issues, startups can avoid costly legal and financial repercussions.

Legal and Compliance Considerations Summary

Outsourcing bookkeeping presents both opportunities and potential risks. Careful consideration of legal and compliance factors is essential to mitigate these risks. This includes reviewing contracts, understanding relevant regulations, ensuring data security, and establishing clear communication channels with the bookkeeping provider. Startups should prioritize compliance to maintain financial integrity, avoid penalties, and build trust with stakeholders. By taking a proactive and informed approach, startups can harness the benefits of outsourcing while minimizing potential legal issues.

Cost and ROI of Outsourced Bookkeeping

Outsourcing bookkeeping for startups offers a compelling proposition, not just for efficiency but also for cost-effectiveness. Understanding the associated costs and the potential return on investment (ROI) is crucial for making an informed decision. This section delves into the specifics, from pricing models to budgeting strategies.

Outsourcing bookkeeping can significantly reduce administrative burdens and financial risks, freeing up valuable time and resources for startup founders to focus on core business functions. The right bookkeeping provider can optimize financial processes, minimizing errors and ensuring compliance with relevant regulations.

Typical Costs Associated with Outsourced Bookkeeping

The costs of outsourced bookkeeping vary significantly based on the scope of services, the provider’s expertise, and the volume of work involved. Factors such as the number of transactions, complexity of financial records, and required reporting frequency all influence the pricing. Generally, startups can expect to pay a monthly retainer fee, which typically covers tasks such as bank reconciliation, invoice processing, and general ledger maintenance.

Different Pricing Models and Service Packages

Outsourcing providers typically offer different pricing models, each tailored to specific needs. Some common models include:

- Per-transaction pricing: This model charges a fixed fee for each transaction processed, such as invoice entry or bank statement reconciliation. This model is often less predictable and more suitable for businesses with a fluctuating volume of transactions.

- Hourly rate: This pricing model allows for more flexibility and is ideal for projects with specific tasks or time-sensitive requirements.

- Monthly retainer: This model offers a fixed monthly fee for a pre-defined scope of services. This is often the most popular option for startups because of its predictability.

- Value-based pricing: This model focuses on the value the bookkeeping service delivers rather than the number of hours spent. This is a common model for firms that are providing more comprehensive financial management services.

Different service packages also exist, from basic bookkeeping services like data entry and bank reconciliation to more comprehensive packages encompassing financial reporting, budgeting, and forecasting.

Calculating the Return on Investment (ROI) of Outsourcing

Calculating the ROI of outsourcing bookkeeping involves assessing the cost savings against the value generated. A key element is identifying the costs associated with in-house bookkeeping, such as salary, benefits, training, and equipment.

ROI = (Benefits – Costs) / Costs

Budgeting for Outsourced Bookkeeping Services

Developing a budget for outsourced bookkeeping requires careful consideration of the startup’s financial situation and projected growth. Startups should consider the anticipated volume of transactions, the level of support required, and the complexity of their financial processes.

Illustrative Examples of How Outsourcing Bookkeeping Can Save Costs

Imagine a startup with 100 transactions per month. An in-house bookkeeper might cost $4,000 per month, including salary and benefits. An outsourced bookkeeping service might charge $1,500 per month for similar services. This represents a potential savings of $2,500 per month. Over a year, this translates to significant cost savings, allowing the startup to reinvest in core business activities.

Comparison of In-House vs. Outsourced Bookkeeping Costs

| Startup Size | In-House Cost | Outsourced Cost | Savings |

|---|---|---|---|

| Small (0-5 employees) | $4,000-$8,000 per month | $1,000-$2,000 per month | $2,000-$6,000 per month |

| Medium (5-20 employees) | $8,000-$15,000 per month | $2,000-$4,000 per month | $6,000-$11,000 per month |

| Large (20+ employees) | $15,000+ per month | $4,000+ per month | $11,000+ per month |

Note: These figures are estimates and may vary based on specific circumstances. The table demonstrates the potential cost savings associated with outsourcing bookkeeping for different startup sizes. These figures are illustrative and are not exhaustive.

Closing Summary

In conclusion, outsourcing bookkeeping for startups offers a wealth of benefits, from freeing up valuable time to improving financial accuracy and enabling scalability. Choosing the right provider, understanding the nuances of different services, and establishing a clear communication channel are crucial for a smooth transition and lasting success. By carefully considering the factors discussed in this guide, startups can confidently leverage outsourced bookkeeping to optimize their financial processes and focus on driving growth.