Online Invoicing and Bookkeeping Tools Your Guide

Online invoicing and bookkeeping tools are revolutionizing how businesses manage their finances. These powerful platforms streamline the entire process, from creating invoices to tracking payments, and offer a wealth of features to suit various business needs and sizes. From small startups to large enterprises, these tools can significantly improve efficiency and accuracy in accounting.

This guide explores the intricacies of online invoicing and bookkeeping tools, examining their functionalities, benefits, and essential features. We’ll delve into everything from user experience and security to pricing models and the latest trends in the industry. This comprehensive overview will help you navigate the world of online accounting tools and choose the best solution for your business.

Introduction to Online Invoicing and Bookkeeping Tools

Online invoicing and bookkeeping tools have revolutionized how businesses manage their financial transactions. These digital solutions offer a streamlined and efficient alternative to traditional methods, enabling companies of all sizes to handle their financial tasks more effectively. From simple invoicing to comprehensive accounting, these tools provide a wide array of functionalities to suit diverse needs.

Online invoicing and bookkeeping tools are designed to automate and simplify the entire financial workflow. They encompass a range of features, from generating professional invoices and managing customer payments to tracking expenses and generating financial reports. This streamlined approach saves businesses valuable time and resources, allowing them to focus on core operations.

Core Functionalities of Online Tools

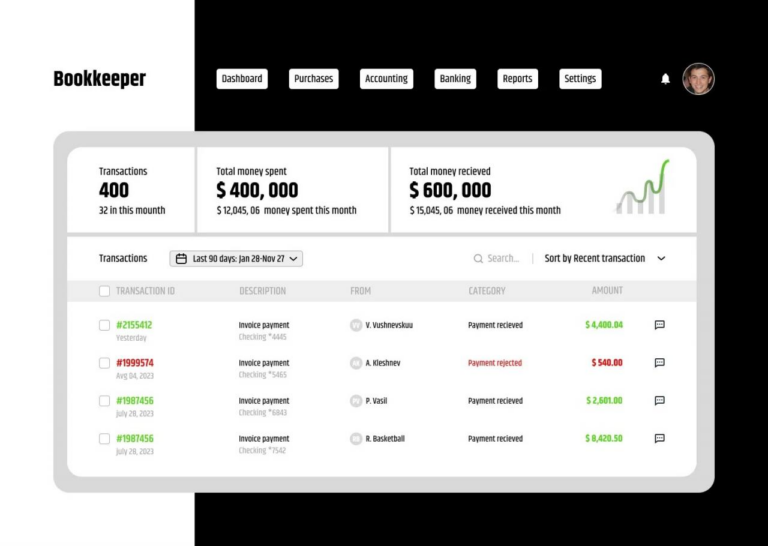

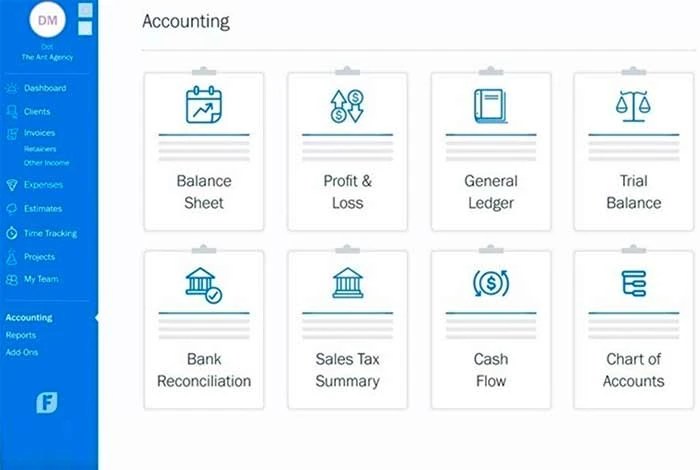

These tools excel in streamlining various financial processes. They provide an integrated platform for handling invoices, payments, expenses, and financial reporting. The key functionalities include:

- Automated Invoice Generation: Templates and customizable layouts facilitate the creation of professional-looking invoices quickly and efficiently. This eliminates manual data entry, reducing errors and saving time.

- Secure Payment Processing: Integrated payment gateways allow businesses to accept payments securely through various methods, such as credit cards, debit cards, and online banking transfers. This ensures efficient and secure handling of transactions.

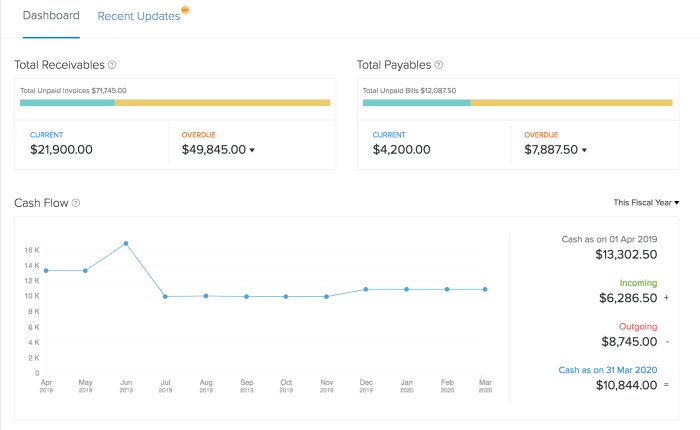

- Expense Tracking and Reporting: Features like expense categorization and automatic recording streamline expense management, providing comprehensive insights into spending patterns. This facilitates accurate financial reporting and budgeting.

- Financial Reporting and Analysis: Generated reports offer valuable insights into financial performance, helping businesses track key metrics like revenue, expenses, and profitability. These reports enable data-driven decision-making.

- Customer Management: Tools often integrate customer databases, facilitating communication, tracking outstanding invoices, and managing customer relationships more effectively.

Benefits of Online Tools Over Traditional Methods

The shift towards online invoicing and bookkeeping tools brings several advantages compared to traditional methods.

- Increased Efficiency: Automation reduces manual effort, enabling faster processing of invoices and payments. This saves time and reduces the risk of errors.

- Enhanced Accuracy: Digital data entry minimizes human error, leading to more accurate financial records. Automated calculations ensure greater precision.

- Improved Security: Secure online platforms protect financial data from unauthorized access. Data encryption and secure payment gateways provide added layers of security.

- Accessibility and Scalability: Access financial data and manage transactions from anywhere with an internet connection. The scalability of these platforms adapts to business growth.

- Cost-Effectiveness: Often more affordable than traditional methods, especially for small businesses. Reduced labor costs and error rates contribute to overall cost savings.

Comparison of Online Invoicing and Bookkeeping Tools

This table compares different types of online invoicing and bookkeeping tools.

| Tool Name | Key Features | Pricing | User Reviews |

|---|---|---|---|

| FreshBooks | Invoicing, expense tracking, time tracking, client portal | Various plans, ranging from free to paid tiers | Generally positive, praised for ease of use and customer support |

| Xero | Invoicing, accounting, expense management, inventory management, rand eporting | Various subscription tiers based on features and usage | High user ratings, praised for its robust features and adaptability |

| Zoho Books | Invoicing, accounting, inventory management, CRM, payment processing | Various subscription tiers | Positive feedback on its comprehensive features and customer support |

| Wave | Invoicing, expense tracking, invoicing accounting | Free plan with limited features, paid plans for advanced features | Positive feedback for its free plan and user-friendly interface |

Features and Functionality

Source: firmbee.com

Online invoicing and bookkeeping tools offer a comprehensive suite of features designed to streamline financial processes for businesses of all sizes. These tools automate tasks, improve accuracy, and provide valuable insights into financial performance. They are particularly beneficial for small businesses, which often lack dedicated accounting staff, but are also highly useful for large enterprises.

These tools are powerful instruments that can dramatically enhance a business’s financial management. By automating key processes, they free up valuable time and resources that can be invested elsewhere. Moreover, the detailed reporting and analysis capabilities allow for a better understanding of financial health and performance, leading to more informed decisions.

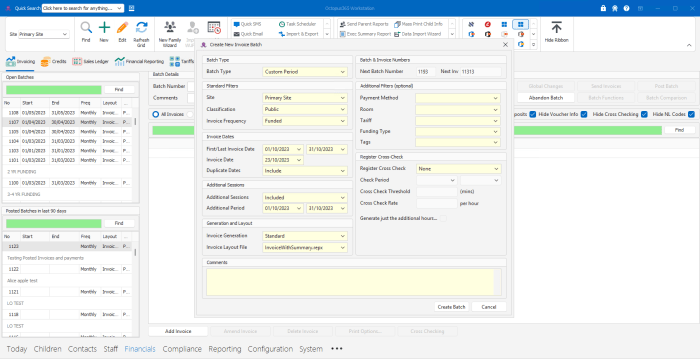

Invoicing Options

Various invoicing options cater to different business needs. Recurring invoices are ideal for subscriptions, memberships, or services rendered on a regular schedule. Project-based invoicing is suited for projects with defined deliverables and payment milestones. These options allow businesses to customize invoicing procedures to match their specific requirements. Additionally, many tools support custom invoice templates, enabling businesses to maintain a consistent brand image and presentation.

Automation of Tasks

Automated invoice sending and payment tracking are key features of online invoicing and bookkeeping tools. Automated sending ensures invoices are sent promptly, minimizing delays and improving cash flow. Automated payment tracking enables real-time monitoring of payment status, allowing for timely follow-ups on overdue invoices. These automation capabilities significantly reduce manual effort and human error.

Key Functionalities for Different Business Sizes

The functionality of online invoicing and bookkeeping tools varies based on the size of the business. Small businesses typically require simpler tools with basic features. Large enterprises, on the other hand, need more comprehensive tools with advanced functionalities.

| Business Size | Feature 1 | Feature 2 | Feature 3 |

|---|---|---|---|

| Small Business | Basic invoicing and expense tracking | Simplified reporting and analysis | Easy-to-use interface |

| Medium Business | Advanced invoicing options (recurring, project-based) | Integration with other business apps | Customizable dashboards and reports |

| Large Enterprise | Multi-user access and security | Detailed financial reporting and analysis | Advanced data analytics and forecasting tools |

Integration and Compatibility

Modern businesses rely heavily on interconnected systems to streamline operations and improve efficiency. Online invoicing and bookkeeping tools, therefore, need to seamlessly integrate with other business applications to avoid data silos and redundant tasks. This integration allows for a unified view of financial data, reducing manual data entry and enhancing overall accuracy.

Integrating various applications, such as customer relationship management (CRM) systems and inventory management software, offers significant advantages. By connecting these tools, businesses can automate workflows, enhance data accuracy, and gain valuable insights into their operations. This leads to more informed decision-making and improved overall performance.

Importance of Integration with Other Business Applications, Online invoicing, and bookkeeping tools

Integrating invoicing and bookkeeping tools with other business applications, like CRM systems or inventory management software, streamlines workflows and reduces manual data entry. This interconnectedness allows for real-time data updates, preventing errors and improving the accuracy of financial reports. It also fosters a unified view of business operations, empowering better decision-making.

Different Integrations Offered by Online Invoicing and Bookkeeping Tools

These tools frequently offer integrations with popular business applications. Common integrations include: customer relationship management (CRM) systems (e.g., Salesforce, HubSpot), inventory management software (e.g., QuickBooks Inventory), e-commerce platforms (e.g., Shopify, WooCommerce), and accounting software (e.g., Xero, Sage). These connections allow for automated data transfer between systems, minimizing manual effort and improving accuracy. This interconnectedness helps in automating tasks like generating invoices from CRM data or updating inventory levels based on sales.

Common Issues with Integration and Solutions

Integration challenges can arise due to differing data formats or incompatible APIs. One common issue is mismatched data structures, leading to errors in data transfer. A solution involves utilizing data mapping tools or custom scripting to transform data into a compatible format. Another issue is the complexity of configuring integrations, often requiring technical expertise. Tools with user-friendly setup wizards and comprehensive documentation mitigate this issue. Troubleshooting integration problems typically involves checking logs for errors, reviewing documentation, and consulting with support teams. Tools with robust support systems are crucial for resolving these issues quickly and efficiently.

Comparison of Integration Methods

Different integration methods exist, each with its advantages and disadvantages. The choice often depends on the complexity of the integration and the technical expertise available.

| Tool 1 | Tool 2 | Common Integrations | Compatibility Issues |

|---|---|---|---|

| FreshBooks | Salesforce | Invoice generation from Salesforce contacts, and automatic updates of customer information in FreshBooks | Potential data mapping issues if Salesforce data fields don’t align with FreshBooks’ structure. Requires careful setup and configuration. |

| Zoho Books | Shopify | Automated invoice creation from Shopify orders, and real-time inventory updates | Variations in data formats between the two systems may require custom scripts or third-party tools for seamless integration. |

| QuickBooks Online | QuickBooks Inventory | Inventory tracking and sales data syncing, automatic cost calculations in QuickBooks Online | Potential compatibility issues if data structures aren’t perfectly aligned; requires careful configuration of both systems. |

API integrations, utilizing Application Programming Interfaces, are common for more complex integrations, offering flexibility and customization. Direct connections, often pre-built within the software, are simpler and more user-friendly for basic integrations, but might lack the flexibility of API approaches. Both methods, however, require careful planning and testing to ensure smooth data flow.

User Experience and Interface

A user-friendly interface is paramount for online invoicing and bookkeeping tools. A well-designed platform empowers users to efficiently manage their financial processes, reducing errors and maximizing productivity. A seamless experience minimizes frustration and encourages adoption of these valuable tools.

Interface Design Principles

The design principles of these tools prioritize intuitive navigation, clear visual cues, and a consistent layout. Color schemes and typography are chosen to enhance readability and visual appeal. The layout should be adaptable to different screen sizes and devices, ensuring a consistent experience across platforms. The design should support users with varying technical proficiency, providing both a beginner-friendly and advanced experience.

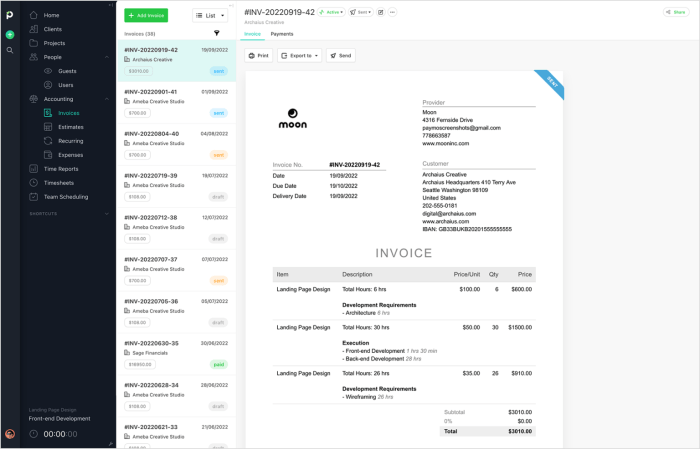

Intuitive and User-Friendly Interfaces

Numerous examples demonstrate the effectiveness of intuitive design. For instance, tools employing drag-and-drop functionality for tasks like adding items to invoices or categorizing expenses are highly praised. Another approach, utilizing visual calendars and charts for financial overview, enhances understanding and aids in forecasting. Clear labeling of fields and prompts, and a logical flow of information, are key components of a good user interface. For instance, a clear visual representation of invoice status (e.g., draft, sent, paid) simplifies tracking.

Adaptability to User Needs

The optimal design adapts to different user needs. Small businesses might require simpler invoicing templates, while larger enterprises may need more sophisticated features and reporting capabilities. Tools with customizable templates and fields, alongside adjustable reporting options, are essential for diverse user bases. Moreover, the ability to personalize dashboards and preferences further caters to unique needs.

Mobile Access and Accessibility

Mobile access is crucial for modern users. Responsive design, ensuring optimal display on various mobile devices, is vital. The tools should also consider accessibility needs, providing options for screen readers, keyboard navigation, and adjustable font sizes. Features like offline access or syncing across devices enhance mobile functionality.

User Flow Diagram for Creating an Invoice and Tracking Payments

Step Action Description 1 Create Invoice User selects “Create Invoice” and enters invoice details (client information, due date, description of services). 2 Add Items/Services User adds items or services to the invoice with their respective descriptions and quantities. 3 Review Invoice User reviews the invoice details for accuracy and completeness before sending it to the client. 4 Send Invoice User sends the invoice electronically via email or other methods. Tools should integrate with popular email clients. 5 Track Payment User monitors the invoice status and tracks payments received using the tool’s dashboard. Notifications of payment status changes (e.g., pending, received) are critical. 6 Manage Payments User manages received payments, records them, and reconciles them with the invoice.

Security and Data Protection

Online invoicing and bookkeeping tools handle sensitive financial data, making robust security measures paramount. Protecting user data and financial information is crucial for maintaining trust and preventing potential financial losses. A secure platform fosters user confidence and encourages adoption of these valuable tools.

Protecting user data and financial information in online invoicing and bookkeeping tools is essential for building user trust and preventing data breaches. A robust security infrastructure safeguards against unauthorized access and misuse, ensuring the confidentiality and integrity of financial records. This includes employing strong encryption protocols, multi-factor authentication, and regular security audits.

Importance of Security Measures

Security measures are critical in online invoicing and bookkeeping tools to prevent data breaches, protect user financial information, and maintain user trust. Strong security protocols deter unauthorized access and misuse, ensuring the safety and confidentiality of sensitive data. This includes the use of encryption, multi-factor authentication, and regular security audits to prevent potential financial losses.

Data Protection Mechanisms

These tools employ various methods to safeguard user data. Data encryption transforms sensitive information into an unreadable format, making it inaccessible to unauthorized individuals. Strong passwords and multi-factor authentication add another layer of security by requiring multiple verification steps. Regular security audits and vulnerability assessments help identify and address potential weaknesses.

Security Protocols and Encryption Methods

Various security protocols and encryption methods are employed to protect user data. HTTPS (Hypertext Transfer Protocol Secure) ensures encrypted communication between the user’s device and the online platform. Advanced encryption standards, like AES (Advanced Encryption Standard), safeguard sensitive financial data at rest and in transit. These methods convert data into unreadable formats, protecting it from unauthorized access. Data loss prevention (DLP) systems monitor and prevent sensitive data from leaving the platform.

Examples of Data Breaches and Prevention

Notable data breaches in the past highlight the importance of robust security measures. Breaches can result in significant financial losses, reputational damage, and legal repercussions. Preventive measures include regular software updates, strong password policies, and employee training on security best practices. Implementing two-factor authentication, robust firewalls, and intrusion detection systems is crucial in preventing such incidents.

Summary of Security Features

| Tool | Data Encryption | Two-Factor Authentication | Security Protocols |

|---|---|---|---|

| Tool A | AES-256 | Yes | HTTPS, TLS 1.3 |

| Tool B | RSA-4096 | Yes | HTTPS, TLS 1.2 |

| Tool C | AES-128 | No | HTTPS, TLS 1.1 |

| Tool D | AES-256 | Yes | HTTPS, TLS 1.3, DLP |

Note: This table is illustrative and does not represent an exhaustive list of all security features for each tool. Specific features and protocols may vary depending on the particular tool.

Pricing and Subscription Models

Source: co.uk

Online invoicing and bookkeeping tools cater to a diverse range of users, from small businesses to large enterprises. Understanding the pricing models and associated features is crucial for selecting the right tool. Different plans address varying needs and budgets.

Pricing structures often reflect the complexity and scope of functionalities offered. Basic plans typically focus on essential features, while more advanced plans include comprehensive functionalities, customization options, and enhanced support. Understanding these distinctions is essential to selecting a tool that aligns with operational requirements.

Pricing Model Variations

Various pricing models are employed by online invoicing and bookkeeping tools. These models often involve tiered subscription plans, where the level of access to features and functionalities increases with the subscription plan. A common model includes basic, pro, and enterprise plans. Some tools may offer custom pricing or packages tailored to specific industry requirements.

Comparison of Pricing Structures

Different pricing structures reflect the different levels of features and functionalities offered. A basic plan might include core invoicing and bookkeeping capabilities, such as generating invoices, tracking expenses, and basic reporting. A more comprehensive plan may include advanced features like inventory management, multi-currency support, and detailed reporting. Enterprise-level plans typically encompass advanced customization options, robust security features, and dedicated customer support.

Subscription Options and Benefits

Subscription options vary in terms of duration (monthly or annually) and features included. Annual subscriptions often offer a more cost-effective option compared to monthly subscriptions, particularly for sustained usage. Furthermore, various add-ons or premium features may be available for purchase alongside the subscription plan, offering additional functionality. These options allow users to tailor their plan to their specific needs and budget.

Impact on User Groups

The pricing structures of online invoicing and bookkeeping tools impact various user groups differently. Small businesses might benefit most from basic plans, which offer essential features without exceeding their budget. Mid-sized businesses might opt for a pro plan, which encompasses enhanced functionalities for scaling operations. Large enterprises, with significant operational complexities, might benefit from enterprise plans that provide customized features and dedicated support.

Pricing Structure Table

| Tool | Basic Plan | Pro Plan | Enterprise Plan |

|---|---|---|---|

| InvoicingPro | $19/month, 5 invoices/month, basic reporting | $49/month, unlimited invoices, advanced reporting, custom branding | $199/month, unlimited invoices, custom integrations, dedicated account manager |

| BookkeepingBuddy | $25/month, 10 transactions/month, basic accounting | $79/month, unlimited transactions, advanced financial statements, data migration | $299/month, unlimited transactions, custom reporting, data security audit |

| QuickBooks Online | $29/month, 1 user, limited reporting | $79/month, multiple users, advanced reporting, custom integrations | $199/month, unlimited users, advanced reporting, custom integrations, advanced security |

Choosing the Right Tool

Selecting the ideal online invoicing and bookkeeping tool is crucial for streamlining business operations and ensuring financial accuracy. A carefully chosen tool can significantly reduce administrative burden, improve data management, and contribute to informed decision-making. This section delves into the key factors to consider when making this important decision.

Evaluating tools based on specific business needs is paramount. A solution tailored to the unique requirements of a small retail store, for example, will differ significantly from one designed for a large e-commerce platform. Understanding the volume of transactions, complexity of financial processes, and desired level of automation is essential.

Factors to Consider

A comprehensive evaluation process involves considering several key factors. Transaction volume, frequency of invoices, and the number of employees involved in financial tasks directly influence the optimal tool selection. Integration capabilities with existing software systems are also critical to minimize data entry errors and ensure seamless workflow. The specific features offered by each tool, such as expense tracking, inventory management, and reporting capabilities, need to be carefully assessed.

Evaluating Tools Based on Specific Needs

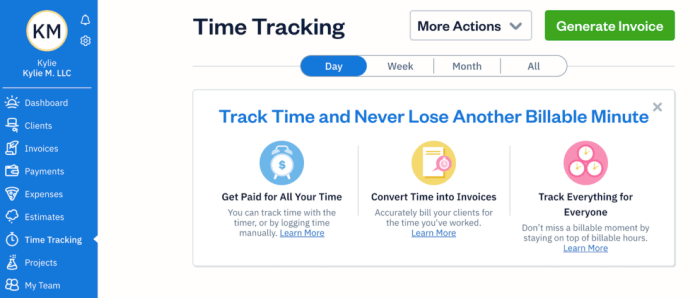

Businesses should meticulously evaluate tools against their specific requirements. A detailed checklist can help ensure that all critical functionalities are considered. For example, a service provider specializing in freelance work might prioritize features for time tracking and client management, while a manufacturing company might focus on inventory management and cost accounting modules. Consider the long-term scalability of the chosen tool to accommodate future growth.

Evaluation Methods and Criteria

Several methods are available to evaluate online invoicing and bookkeeping tools. Detailed reviews from other businesses, available online and in industry publications, provide valuable insights. Free trials and demos allow firsthand experience with the tool’s interface and functionality. Comparative tables outlining features, pricing, and integration capabilities are also beneficial. Prioritize tools that offer comprehensive support documentation and responsive customer service. Furthermore, investigate industry ratings and certifications to gauge the tool’s reliability and security.

Comparing Tools Based on User Reviews and Industry Ratings

User reviews and industry ratings provide valuable perspectives on the performance and usability of different tools. Platforms like Capterra and G2 offer comprehensive reviews, highlighting the strengths and weaknesses of various solutions. Analyze these reviews for common themes and specific concerns raised by users. Look for consistent positive feedback regarding ease of use, efficiency, and customer support.

Case Studies of Tool Benefits

Numerous case studies illustrate how specific tools have improved business operations. For example, a small e-commerce business using a particular invoicing platform experienced a significant reduction in invoice processing time, leading to faster payment cycles and improved cash flow. Similarly, a professional services firm benefited from an integrated accounting solution that automated expense reporting, reducing administrative overhead and improving financial accuracy. These real-world examples underscore the potential advantages of carefully selecting the right tool.

Trends and Future Developments

Source: paymoapp.com

Online invoicing and bookkeeping tools are rapidly evolving, driven by technological advancements and changing business needs. This evolution is reshaping how businesses manage their finances, impacting efficiency and accuracy. The increasing demand for user-friendly, secure, and automated solutions is fostering innovation across the industry.

The future of these tools promises even greater integration, automation, and personalized experiences. This section explores key trends and future developments, emphasizing the growing importance of mobile-first and cloud-based solutions.

Current Trends in Online Invoicing and Bookkeeping Tools

The market is experiencing a shift towards more intuitive interfaces, streamlined workflows, and enhanced reporting capabilities. Businesses are increasingly seeking tools that integrate seamlessly with existing accounting software and CRM systems.

Emerging Technologies and Innovations

Artificial intelligence (AI) is a key driver of innovation. AI-powered features are being incorporated into invoicing and bookkeeping tools to automate tasks such as invoice generation, data entry, and expense tracking. Machine learning algorithms can analyze financial data to identify potential issues and provide proactive insights.

AI and Automation in Online Invoicing and Bookkeeping

AI-powered tools can automate various tasks, reducing manual effort and improving accuracy. Examples include automated invoice processing, intelligent expense categorization, and proactive fraud detection. The use of natural language processing (NLP) allows for more intuitive and conversational interactions with these systems.

- Automated Invoice Processing: AI can automatically extract data from invoices, matching it to purchase orders and customer records, and generating accurate financial entries.

- Intelligent Expense Categorization: AI can analyze expense descriptions and receipts to automatically categorize expenses, eliminating manual effort and ensuring accurate financial reporting.

- Proactive Fraud Detection: AI algorithms can monitor financial transactions for unusual patterns and potential fraudulent activities, providing alerts and preventing financial losses.

Mobile-First and Cloud-Based Solutions

Mobile-first solutions are becoming increasingly important, offering flexibility and accessibility to users. Cloud-based platforms provide scalability, security, and data accessibility from anywhere with an internet connection. The growing trend is toward comprehensive, all-in-one platforms, encompassing invoicing, bookkeeping, and financial reporting.

Future Directions and Potential Advancements

The future of online invoicing and bookkeeping tools will likely involve even more sophisticated AI-driven automation, enhanced security measures, and seamless integrations with other business applications. Expect increased personalization based on user behavior and financial patterns.

Growing Importance of Mobile-First and Cloud-Based Solutions

The mobile-first approach allows for anytime, anywhere access to financial data, empowering users to manage their finances on the go. Cloud-based solutions facilitate collaboration, real-time data sharing, and secure data storage. These platforms are adaptable to varying business needs, offering scalability and flexibility.

Final Review: Online Invoicing And Bookkeeping Tools

In conclusion, online invoicing and bookkeeping tools have become indispensable for businesses of all sizes. By streamlining financial processes, improving accuracy, and offering robust security features, these tools provide significant advantages over traditional methods. This guide has provided a comprehensive overview of the key aspects to consider when selecting the right tool for your specific needs. Choosing the right tool can be a game-changer for your business, leading to more efficient operations and better financial management.