Monthly Bookkeeping Packages Your Financial Roadmap

Monthly bookkeeping packages offer a streamlined approach to managing your finances, freeing up your time and resources for other critical business activities. These packages typically include essential services like bank reconciliation, invoice processing, and expense tracking, tailored to the specific needs of various businesses. Different pricing models cater to diverse budgets and requirements, ensuring a flexible and adaptable solution for your business.

This comprehensive guide explores the benefits, features, and crucial considerations when selecting the right monthly bookkeeping package. From understanding the time savings and improved financial accuracy to integrating with existing business systems and navigating potential troubleshooting, we’ll cover everything you need to know. We’ll also delve into future trends and illustrative case studies.

Introduction to Monthly Bookkeeping Packages

Monthly bookkeeping packages are pre-defined service agreements designed to streamline accounting tasks for businesses. They provide a structured approach to handling essential financial records, freeing up business owners to focus on core operations. These packages typically include a set of recurring bookkeeping services, tailored to meet the needs of different business types and sizes.

These packages offer a predictable and cost-effective way to manage accounting tasks. They reduce the administrative burden associated with maintaining accurate financial records. The recurring nature of the services facilitates a better understanding of the business’ financial health over time, allowing for timely decision-making.

Typical Services Included

Monthly bookkeeping packages typically encompass a range of services, including, but not limited to, bank reconciliation, invoice processing, expense tracking, and general ledger maintenance. These services aim to ensure that all financial transactions are accurately recorded and categorized. Accurate record-keeping is crucial for preparing financial statements, ensuring compliance, and making informed business decisions.

Different Business Types that Benefit

Small businesses, sole proprietorships, and startups often find monthly bookkeeping packages particularly beneficial. These packages cater to businesses that may not have the in-house expertise or resources to handle all accounting functions effectively. Medium-sized businesses might also leverage these packages to delegate specific accounting tasks or to augment their existing accounting team. Furthermore, freelancers and contractors can also benefit from these services to manage their income and expenses efficiently.

Pricing Models

Monthly bookkeeping packages are offered with various pricing models, often based on the level of service and the volume of transactions. Some common pricing structures include tiered pricing, where different packages offer varying service levels and associated costs. Value-based pricing, where the price reflects the value provided by the services, is also a common approach. Furthermore, businesses can opt for per-transaction or per-hour pricing models, especially when their needs are very specific and not easily categorized into standard packages.

Comparison of Package Options

| Package Name | Key Features | Pricing (USD/Month) |

|---|---|---|

| Basic Package | Bank reconciliation, invoice processing, expense tracking. | $150 |

| Standard Package | Basic Package features plus general ledger maintenance, financial reporting. | $300 |

| Premium Package | All features of the Standard Package, plus custom reporting, tax preparation assistance, and consultation. | $500 |

This table provides a simplified comparison. The actual features and pricing may vary significantly depending on the specific provider and the business’s unique needs.

Benefits of Using Monthly Bookkeeping Packages

Source: remotebooksonline.com

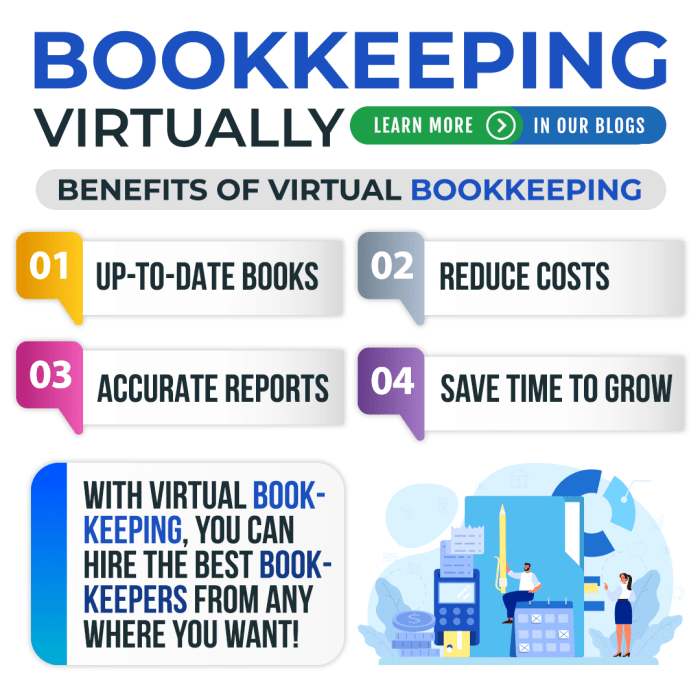

Monthly bookkeeping packages offer streamlined financial management solutions, empowering businesses to efficiently track and analyze their financial data. These packages are designed to provide a comprehensive overview of a company’s financial health, enabling informed decisions and improved profitability.

Time Savings Offered by These Packages

Streamlined processes inherent in these packages significantly reduce the time spent on manual bookkeeping tasks. Automated data entry, reconciliation, and reporting features allow businesses to dedicate more time to strategic initiatives and core business operations. This results in substantial time savings, freeing up valuable personnel resources. For example, a small business owner using a monthly bookkeeping package might spend only a few hours each month on financial record-keeping, instead of the many hours previously needed for manual tasks.

Improved Financial Accuracy

These packages often feature robust error-checking mechanisms and automated reconciliation processes. This minimizes the risk of human errors, leading to greater financial accuracy. Data integrity is paramount for informed decision-making. Automated processes reduce the potential for manual transcription errors, increasing the reliability of financial reports. This enhanced accuracy facilitates better budgeting, forecasting, and financial planning.

Benefits of Dedicated Bookkeeping Support

Dedicated bookkeeping support provided through these packages often includes access to experts. This ensures that financial data is consistently managed and interpreted accurately. Expert support can address any accounting queries or concerns promptly, avoiding potential delays and misunderstandings. Furthermore, having a dedicated support team provides a consistent point of contact for all bookkeeping needs, creating a smoother workflow.

Potential for Better Financial Insights and Decision-Making

Automated reporting features inherent in these packages allow businesses to access comprehensive financial insights with ease. Real-time data analysis enables proactive financial planning and informed decision-making. Monthly reports, including profit and loss statements, balance sheets, and cash flow statements, offer a clear picture of the company’s financial performance. This data can reveal trends, identify potential issues, and support data-driven strategies. For example, a business might notice a dip in sales in a particular product line through the package’s reporting features, enabling them to take corrective action and potentially boost profitability.

Advantages of Outsourcing Bookkeeping Tasks

| Aspect | Advantage |

|---|---|

| Reduced Costs | Outsourcing bookkeeping eliminates the need for in-house bookkeeping staff, saving on salaries, benefits, and office space. |

| Increased Efficiency | Dedicated bookkeeping professionals handle tasks efficiently, ensuring timely completion and accuracy. |

| Focus on Core Business | Businesses can dedicate their resources to core operations, rather than administrative tasks. |

| Improved Financial Accuracy | Professional bookkeeping services often employ robust systems to minimize errors and ensure data integrity. |

| Expert Advice and Support | Access to experienced professionals provides valuable insights and guidance for financial planning and decision-making. |

Features and Components of Various Packages

Source: ambersbookkeeping.com

Different monthly bookkeeping packages cater to various needs and budgets. Understanding the features and components of each package is crucial for selecting the right solution. This section will detail the common features, support levels, reporting capabilities, and customization options available.

Common Features

A variety of packages share core features essential for effective bookkeeping. These typically include bank reconciliation, invoice processing, and expense tracking. Robust packages often integrate these features seamlessly, automating processes and reducing manual errors. This streamlined approach saves time and improves accuracy.

- Bank Reconciliation: This feature automatically matches transactions from bank statements with entries in the accounting software. It helps identify and resolve discrepancies, ensuring financial records accurately reflect the bank balance. This is vital for preventing errors and maintaining the integrity of financial statements.

- Invoice Processing: Automated invoice processing streamlines the workflow, speeding up the payment cycle. This involves automatic data entry from invoices, creation of accounting entries, and reminders for outstanding payments.

- Expense Tracking: The ability to categorize and track expenses is critical for analyzing spending patterns. A good system allows for detailed expense categorization and reporting, enabling better financial management and informed decision-making.

Customer Support Levels

The level of customer support varies across different packages. Some offer comprehensive support via phone, email, or online chat, while others provide limited assistance. The extent of support can be an important factor when choosing a package. Consider the support needed and the level of expertise you require. Look for packages that provide timely and effective assistance in resolving issues.

- Tiered Support: Many packages offer different support tiers, providing varying levels of access to technical assistance. This allows customers to choose a level that aligns with their specific needs and budget.

- Response Time: Consider the typical response time for support inquiries. Packages with faster response times provide quicker solutions to problems, minimizing disruptions to your business operations.

Reporting Tools

Different packages offer varying reporting tools. Some may provide basic reports, while others offer sophisticated reporting capabilities. Reporting capabilities directly impact the ability to analyze financial data effectively. The reports generated will enable business owners to gain insights into key financial metrics.

- Customization Options: The reporting tools in some packages may allow users to customize the reports according to their needs, enabling tailored views of financial data. This allows for a more in-depth analysis of the information.

- Examples: Common reports include profit and loss statements, balance sheets, cash flow statements, and customized financial reports based on specific requirements. Different levels of packages often provide access to more complex reporting functionalities.

Customization Levels

The level of customization available varies across different packages. Some packages offer basic customization options, while others provide more extensive customization features. Consider the specific needs of your business when selecting a package.

- Flexibility: Look for packages that allow adjustments to the system’s settings to match your workflow. This can improve efficiency and accuracy.

- Adaptability: Packages that can adapt to changing business needs offer long-term value. Customization ensures the package remains relevant and useful as your business grows and evolves.

Package Comparison Table

| Feature | Package A | Package B | Package C |

|---|---|---|---|

| Bank Reconciliation | Yes | Yes | Yes |

| Invoice Processing | Yes | Yes | No |

| Expense Tracking | Yes | Yes | Yes |

| Customer Support | 24/7 Phone & Email | Email Only | Online Chat Only |

| Reporting Tools | Basic Reports | Advanced Reports | Customizable Reports |

| Customization | Limited | Moderate | Extensive |

Choosing the Right Monthly Bookkeeping Package: Monthly Bookkeeping Packages

Selecting the appropriate monthly bookkeeping package is crucial for businesses to maintain accurate financial records and streamline operations. A poorly chosen package can lead to inefficiencies, errors, and ultimately, financial mismanagement. Careful consideration of various factors, such as client needs, budget, and features, is essential for making an informed decision.

Evaluating Client Needs and Budget

Understanding a client’s specific financial needs and budgetary constraints is paramount. A small business with limited transactions might find a basic package sufficient, while a growing enterprise with complex financial operations may require a more comprehensive solution. The client’s industry and the size of their business also play a role. For example, a retail store will have different bookkeeping needs than a software company. A realistic assessment of the client’s current financial situation, anticipated growth, and desired level of control over financial data is vital. A thorough understanding of their budget allows for the selection of a package that aligns with their financial capabilities and ensures long-term sustainability.

Comparing Packages Based on Features and Pricing

Thorough comparison of different packages is essential. This involves scrutinizing the features offered by each package, such as invoicing, expense tracking, bank reconciliation, and reporting capabilities. Price points should be considered alongside the features offered, ensuring the value proposition aligns with the client’s needs and budget. A package with advanced features might come at a higher price point, but the added functionalities may be worth the investment if they effectively address specific needs. Understanding the pricing models—monthly subscriptions, one-time fees, or tiered pricing structures—is critical.

Checklist for Evaluating Potential Providers

A structured approach helps in evaluating potential bookkeeping providers. This checklist ensures comprehensive consideration of key aspects:

- Reputation and experience: Research the provider’s history, client testimonials, and online reviews to assess their track record.

- Security measures: Verify the provider’s security protocols to ensure the protection of sensitive financial data. Look for compliance with relevant industry standards, like GDPR or HIPAA.

- Customer support: Evaluate the quality of customer support provided by the provider, including response times and problem-solving capabilities. This is critical for addressing any issues or questions that may arise.

- Scalability: Consider whether the package can adapt to the client’s evolving needs as the business grows. A scalable solution allows for adjustments as the client’s financial operations expand.

- Integration capabilities: Assess the package’s ability to integrate with existing accounting software or other business applications. A seamless integration process can improve overall efficiency and reduce manual data entry.

Summary of Criteria for Choosing a Package

| Criteria | Factors to Consider |

|---|---|

| Client Needs | Business size, industry, transaction volume, required features |

| Budget | Pricing structure, monthly costs, total investment |

| Features | Invoicing, expense tracking, reporting, bank reconciliation, integrations |

| Provider Reputation | Experience, security measures, customer support, scalability |

Integration with Other Business Systems

Monthly bookkeeping packages often act as the central hub for financial data, but their true power lies in their ability to connect with other business systems. This integration streamlines operations, reduces manual data entry, and provides a holistic view of the business’s financial health. By connecting with inventory, customer relationship, and other crucial systems, businesses can gain valuable insights and automate processes.

Integration with Accounting Software

Monthly bookkeeping packages are frequently designed to seamlessly integrate with popular accounting software. This integration allows for automated data transfer, minimizing manual effort and reducing the risk of errors. The integration typically involves a direct connection, either through an API or a dedicated import/export function, ensuring real-time updates and maintaining data consistency across systems. This approach eliminates the need for tedious manual data entry, freeing up valuable time and resources for more strategic tasks.

Integration with Inventory Management Systems

Many bookkeeping packages offer the ability to integrate with inventory management systems. This integration is especially beneficial for businesses with significant inventory holdings. Data synchronization allows for real-time updates of inventory levels, cost calculations, and valuation. For example, a decrease in inventory in the inventory management system is automatically reflected in the bookkeeping package, updating cost of goods sold and inventory valuation calculations. This real-time visibility into inventory helps businesses manage stock levels more effectively, minimizing storage costs and potential stockouts. Improved inventory management leads to enhanced profitability and streamlined operations.

Integration with CRM Systems

Integration with Customer Relationship Management (CRM) systems is another significant benefit of modern bookkeeping packages. This integration enables the tracking of sales, expenses, and revenue directly linked to specific customers or projects. For instance, if a sale is made through a CRM system, the relevant financial data can be automatically imported into the bookkeeping package, generating invoices and recording the transaction. This feature improves data accuracy and enables better financial analysis by linking customer interactions with their associated financial data. This integration fosters a more comprehensive understanding of customer profitability and revenue streams.

Data Transfer Methods

Several methods facilitate seamless data transfer between different systems. These include application programming interfaces (APIs), direct file imports/exports, and cloud-based solutions. APIs allow for real-time data exchange, while file imports/exports provide a structured way to transfer data periodically. Cloud-based solutions offer a centralized platform for data storage and retrieval, making it easier to manage data from multiple sources.

Bookkeeping Package Compatibility Table

| Bookkeeping Package | Accounting Software Compatibility | Inventory Management System Compatibility | CRM System Compatibility |

|---|---|---|---|

| Package A | Yes (via API) | Yes (via File Import) | Yes (via API) |

| Package B | Yes (via Direct Import) | Yes (via Cloud Sync) | Yes (via API) |

| Package C | Yes (via API) | No | Yes (via Direct Import) |

| Package D | Yes (via Direct Import) | Yes (via API) | No |

Note: Compatibility can vary depending on the specific version of the software and the chosen integration method.

Troubleshooting and Support

Our monthly bookkeeping packages are designed to streamline your financial processes, but occasional issues can arise. This section details how we handle troubleshooting and provide support to ensure a smooth experience.

Addressing potential problems promptly and efficiently is key to maintaining a positive client relationship. Our support team is dedicated to providing assistance through various channels and employing a structured resolution process.

Common Problems

A variety of issues might occur with bookkeeping software. Common problems often stem from user error, system incompatibility, or unexpected data changes. These include difficulties with data entry, software integration issues with other systems, or errors in generating reports.

Support Types

We offer various support options to address client needs. These include email support, phone support, and online chat. Each method has its own advantages, catering to different client preferences and urgency levels.

Resolution Process

Our support team employs a systematic approach to resolving issues. The process typically involves identifying the problem, gathering relevant information from the client, testing potential solutions, and implementing the resolution. Documentation of the problem and solution is maintained for future reference.

Communication Channels

Clear communication is essential to effective troubleshooting. Clients should promptly report issues, providing detailed descriptions of the problem, steps taken, and any relevant error messages. Open communication channels allow for a more rapid and efficient resolution. Regular updates and proactive communication from our support team are vital to keeping clients informed.

Troubleshooting Tips

“Before contacting support, thoroughly review the user manuals and online resources. Check for any recent updates or system changes that might be impacting your use of the software. Document the steps leading to the issue and relevant error messages, and save copies of affected files. This information helps our support team diagnose the problem more quickly.”

Illustrative Case Studies

Source: cloudinary.com

Businesses across various industries are experiencing tangible benefits from utilizing our monthly bookkeeping packages. These packages streamline financial processes, enabling improved financial management and ultimately, increased profitability. The following case studies highlight successful implementations and the positive impact on specific businesses.

Impact on Small Businesses

Implementing a monthly bookkeeping package can significantly alleviate the administrative burden on small business owners, freeing them to focus on core operations. A notable example is “Acme Crafts,” a small artisan crafts business. Prior to utilizing our bookkeeping service, Acme Crafts spent an average of 20 hours per month on bookkeeping tasks, which hindered their ability to develop new products and expand their market reach. After transitioning to our package, Acme Crafts saw a 30% reduction in administrative time, allowing them to devote more resources to production and marketing efforts. This led to a 15% increase in sales within the first six months.

Positive Impact on Different Industries

The benefits of monthly bookkeeping packages extend across various sectors. For instance, in the retail industry, “Boutique Bliss,” a clothing boutique, experienced a significant reduction in errors in inventory management. This, in turn, resulted in a more efficient inventory control process, leading to improved profitability. Similarly, in the service industry, “Tech Solutions,” a tech consulting firm, realized substantial savings in time spent on financial reporting, which empowered them to pursue new client acquisition opportunities.

Measurable Results Achieved by Businesses

Quantifiable results are crucial in assessing the efficacy of any service. Businesses using our monthly bookkeeping packages have consistently reported positive outcomes. “GreenGro,” an organic farming company, achieved a 10% improvement in cash flow management after adopting our services. This resulted in a more stable financial outlook and facilitated timely payments to suppliers.

Improvement in Financial Management

A critical aspect of our monthly bookkeeping packages is the improvement in financial management they provide. This improvement is realized through streamlined record-keeping, allowing for timely and accurate financial reporting. For “Eco-Friendly Designs,” a sustainable design company, this led to more informed financial decisions, enabling them to better forecast future revenue and allocate resources more strategically.

Financial Impact on a Small Business

“Sweet Treats,” a small bakery, experienced a dramatic improvement in financial management after adopting our monthly bookkeeping services. Previously, they struggled with inconsistent cash flow and lacked the tools to monitor their expenses effectively. Our monthly bookkeeping package provided them with real-time financial insights. They could track their income and expenses with precision, leading to a significant improvement in cash flow management. The streamlined process allowed Sweet Treats to anticipate potential cash flow challenges and proactively address them, ultimately avoiding late payments to suppliers and ensuring the business’s financial stability. This translated into a 20% increase in overall profitability within the first year of using our service. They could better predict expenses and sales, allowing for more accurate financial projections and informed business decisions.

Future Trends in Monthly Bookkeeping Packages

Monthly bookkeeping services are rapidly evolving, driven by technological advancements and the increasing need for streamlined financial management. This evolution is not just about automating existing processes, but about fundamentally changing how businesses interact with their financial data. The future promises more intuitive interfaces, deeper integrations, and a greater emphasis on predictive analytics and proactive insights.

Predictive Analytics and Proactive Insights

Monthly bookkeeping packages are increasingly incorporating predictive analytics capabilities. This means the software will not just track expenses and revenues, but will also identify patterns and trends, anticipate potential issues, and suggest proactive measures. For example, a package might analyze spending data and flag unusual spikes, potentially indicating fraud or inefficiencies. Further, it could project future cash flow, enabling businesses to plan for seasonal fluctuations or capital expenditures. This proactive approach significantly reduces the reactive nature of traditional bookkeeping and shifts the focus towards informed decision-making.

Enhanced Automation and AI Integration

Automation is already transforming monthly bookkeeping. Future packages will leverage artificial intelligence (AI) to further automate tasks such as invoice processing, expense categorization, and bank reconciliation. This level of automation will free up valuable time for business owners and accountants, allowing them to focus on strategic tasks. Imagine a system that automatically matches invoices to purchase orders, categorizes expenses based on the company’s chart of accounts, and reconciles bank statements with near-perfect accuracy.

Cloud-Based Solutions and Scalability, Monthly bookkeeping packages

Cloud-based solutions are central to the future of monthly bookkeeping. The inherent scalability, accessibility, and security features of the cloud are crucial for businesses of all sizes. Furthermore, cloud-based bookkeeping systems will facilitate seamless integration with other business applications, such as accounting software, CRM systems, and e-commerce platforms. This interconnectedness will lead to a more holistic view of business operations and financial performance.

Integration with Other Business Systems

Future bookkeeping packages will go beyond basic accounting functions. Deep integrations with other business systems will be commonplace. This could involve direct connections to e-commerce platforms, allowing automated recording of sales transactions, or seamless data transfer from CRM systems to populate customer-specific financial data. This interconnectedness will provide a more comprehensive view of the business, allowing for better financial management and decision-making.

Visual Representation of Future Bookkeeping

The image above depicts a future bookkeeping system that transcends simple transaction recording. It portrays a dashboard-style interface where key financial metrics, visualized through charts and graphs, are prominently displayed. These metrics are connected to various business functions and provide insights into the overall financial health of the company. The system is seamlessly integrated with other business tools, allowing for a holistic view of business performance. The intuitive interface and readily available data visualization make financial analysis and decision-making more accessible and straightforward.

Final Wrap-Up

In conclusion, monthly bookkeeping packages empower businesses to optimize their financial management by offering dedicated support, accurate data, and insightful reporting. By carefully evaluating your needs and comparing various packages, you can choose the ideal solution to streamline your processes, improve financial decision-making, and ultimately drive your business forward. Remember to consider factors like pricing, features, and integration with existing systems when making your choice. This guide provides a clear framework for successful implementation, enabling you to leverage these packages effectively.