FreshBooks vs Wave Accounting A Detailed Comparison

FreshBooks vs Wave Accounting: Choosing the right accounting software for your small business can be tricky. This in-depth comparison examines both platforms, considering pricing, features, integrations, support, and user experience. We’ll delve into the specifics, helping you decide which tool best fits your needs and workflow.

Both FreshBooks and Wave Accounting offer robust accounting solutions tailored for freelancers and small businesses. FreshBooks emphasizes a comprehensive suite of tools, while Wave Accounting prioritizes simplicity and affordability. The comparison will cover pricing models, essential features, integrations, and customer support to help you make an informed decision.

Introduction

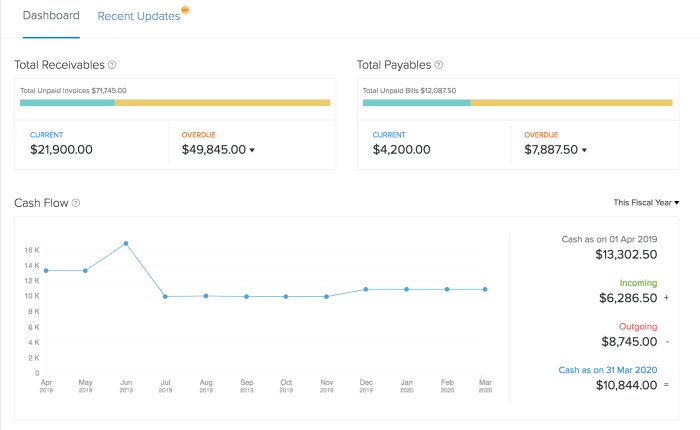

Source: techrepublic.com

FreshBooks and Wave Accounting are popular choices for small businesses and freelancers seeking accounting software solutions. FreshBooks is known for its robust invoicing and client management features, while Wave Accounting offers a streamlined, largely free platform for essential accounting tasks. This comparison will delve into the core functionalities, target audiences, and key features of each platform to help users make informed decisions.

Overview of Platforms

FreshBooks and Wave Accounting cater to different needs within the small business and freelance sector. FreshBooks is a comprehensive solution, ideally suited for businesses requiring advanced invoicing, expense tracking, and project management capabilities. Wave Accounting, on the other hand, focuses on simplifying the fundamental accounting processes, making it particularly attractive to freelancers and small businesses with simpler needs. This differentiation in approach is key to understanding the respective strengths of each platform.

Target Audience

FreshBooks is well-positioned for businesses that value a unified platform for managing clients, invoices, and expenses. Its user-friendly interface and robust features are ideal for entrepreneurs and small business owners who want to streamline their workflow and manage multiple clients effectively. Wave Accounting, with its focus on ease of use and free tier options, resonates particularly with freelancers, sole proprietors, and small businesses seeking a cost-effective solution for their basic accounting needs.

Feature Comparison

This table Artikels the basic features of FreshBooks and Wave Accounting.

| Feature | FreshBooks | Wave Accounting | Key Differentiator |

|---|---|---|---|

| Invoicing | Robust invoicing with customizable templates, recurring billing, and automated reminders. | Basic invoicing functionality, but lacks the extensive customization options of FreshBooks. | FreshBooks offers more robust and customizable invoicing tools. |

| Expense Tracking | Detailed expense tracking, categorization, and reporting. | Simple expense tracking with basic categorization. | FreshBooks provides more comprehensive expense management capabilities. |

| Client Management | Client management features allow for contact organization, communication, and task management. | Basic client management tools for contact organization. | FreshBooks includes robust client relationship management (CRM) features. |

| Reporting | Extensive reporting options, including financial statements and customizable dashboards. | Provides basic reporting features, focusing primarily on income and expenses. | FreshBooks provides detailed reporting and insightful dashboards. |

Pricing Models

Understanding the pricing models for accounting software is crucial for businesses to choose the solution that best fits their needs and budget. Different platforms offer various pricing tiers, each with specific features and functionalities. This section delves into the pricing structures of FreshBooks and Wave Accounting, comparing their billing cycles and payment methods.

Pricing Structure Comparison

The pricing structures of FreshBooks and Wave Accounting differ significantly, reflecting their distinct target markets and functionalities. FreshBooks, often favored by small businesses with complex accounting needs, usually offers tiered pricing plans, whereas Wave Accounting, known for its free tier and simplicity, tends to rely on a subscription model with potential add-on features.

FreshBooks Pricing

FreshBooks employs a tiered pricing model. Each tier typically includes a set of features, and different tiers offer increasing levels of functionality. For example, a basic plan might include invoicing, expense tracking, and basic reporting, while a higher tier might add features such as client portals, inventory management, and more comprehensive reporting.

Wave Accounting Pricing

Wave Accounting presents a unique pricing approach. It offers a completely free tier that provides basic invoicing and expense tracking, making it an attractive option for startups and small businesses with limited budgets. Beyond the free tier, Wave offers a paid subscription model with more features. These paid plans typically unlock additional features and functionalities.

Billing Cycles and Payment Methods

Both platforms use recurring billing cycles. The payment methods accepted generally include credit cards and bank transfers. It’s important to verify the specific payment options and billing schedules with the respective platforms. The billing cycle frequency (monthly or annually) and payment methods may vary based on the chosen plan.

Examples of Pricing Tiers

To illustrate the pricing models, here are examples of pricing tiers for both FreshBooks and Wave Accounting. These examples highlight the differences in features and pricing associated with different tiers. Note that specific pricing and features may vary.

- FreshBooks – Basic Plan: Typically priced around $20-$30 per month, this plan includes basic invoicing, expense tracking, and basic reporting. This is a suitable option for very small businesses with simple accounting needs.

- FreshBooks – Professional Plan: Often priced at $50-$80 per month, this plan provides advanced features like client portals, inventory management, and comprehensive reporting. This option suits businesses with a moderate volume of transactions and more complex requirements.

- Wave Accounting – Free Plan: This plan is completely free and provides essential invoicing and expense tracking. The free plan is ideal for small businesses starting out.

- Wave Accounting – Paid Plan: Wave’s paid plans, typically priced on a per-user or per-month basis, provide more advanced features. The specific features included in each paid plan are available on the Wave Accounting website.

Pricing Model Comparison Table

This table summarizes the key differences in pricing models between FreshBooks and Wave Accounting.

| Feature | FreshBooks | Wave Accounting | Key Differences |

|---|---|---|---|

| Pricing Model | Tiered subscription | Free tier with paid options | FreshBooks offers various tiers, while Wave has a free option. |

| Basic Features | Invoicing, Expense Tracking, Basic Reporting | Invoicing, Expense Tracking, Basic Reporting | Both platforms include essential accounting features in their basic plans. |

| Advanced Features (examples) | Client portals, Inventory Management, Advanced Reporting | Advanced Reporting, CRM Integration, Payroll (add-on) | FreshBooks focuses on accounting tools, while Wave provides additional integrations. |

| Pricing Range (approximate) | $20-$80+/month | Free to $20+/month | Significant difference in price ranges depending on the tier. |

Features and Functionality

FreshBooks and Wave Accounting cater to different accounting needs, from simple invoicing to complex business management. Understanding their respective features is crucial for choosing the right platform. This section details the core functionalities of each software, highlighting their strengths and weaknesses, and comparing their suitability for various business types.

FreshBooks Features

FreshBooks excels in its core invoicing and client management capabilities. Its intuitive interface streamlines the process of creating professional invoices, tracking payments, and managing client communications. Key features include:

- Invoicing: FreshBooks allows for customizable invoices with recurring billing options, streamlining the invoicing process for businesses with regular clients.

- Expense Tracking: FreshBooks provides a simple way to track business expenses, categorizing them for better financial oversight. This is particularly useful for freelancers and consultants.

- Client Management: Client portals allow for secure communication and document sharing, fostering strong client relationships. This is essential for maintaining transparency and building trust.

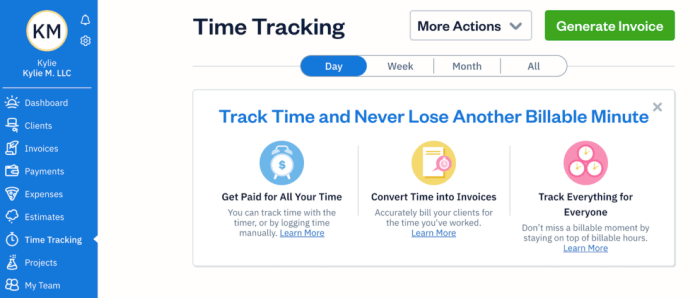

- Project Management: FreshBooks integrates project management tools, enabling businesses to track time spent on projects and invoice accordingly. This feature is beneficial for freelancers and agencies.

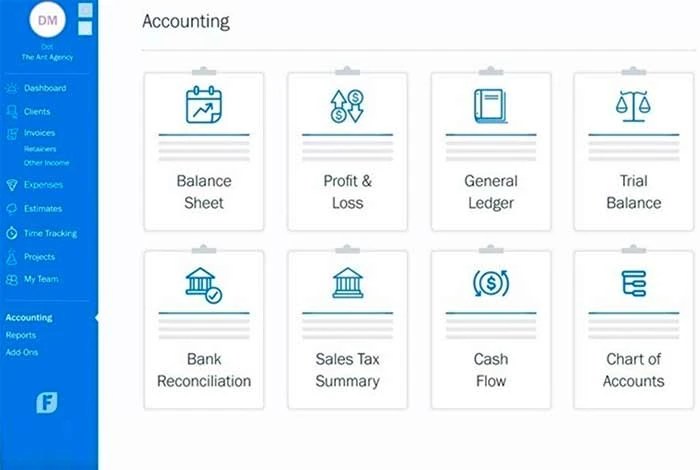

Wave Accounting Features

Wave Accounting offers a free, comprehensive suite of tools, making it an attractive option for small businesses. Its strengths lie in its ease of use and integrated features, designed for simplicity. Key features include:

- Invoicing: Wave Accounting offers a user-friendly invoicing system, including automated reminders and payment processing. It’s particularly well-suited for businesses with simple invoicing needs.

- Expense Tracking: The expense tracking functionality is straightforward and integrates well with the other features. It helps businesses maintain accurate financial records.

- Client Management: While not as robust as FreshBooks, Wave Accounting allows for basic client communication and data management. This is adequate for small businesses with straightforward client relationships.

- Payroll: Wave Accounting integrates with other payroll services, which can help simplify payroll management, although this may not be the primary focus for all businesses.

Industry and Business Type Support

FreshBooks is well-suited for freelancers, consultants, and small businesses needing a robust invoicing and client management solution. Its project management capabilities make it particularly valuable for agencies. Wave Accounting, with its free tier, is ideal for startups, solopreneurs, and small businesses with limited budgets and straightforward needs. Its simplicity makes it attractive for a wider range of businesses.

Ease of Use

FreshBooks boasts a user-friendly interface, particularly for those new to accounting software. Its intuitive design makes it relatively easy to learn and navigate. Wave Accounting is similarly straightforward and intuitive, prioritizing ease of use for a wider user base. However, the extensive feature set of FreshBooks might be more complex for users who are not accustomed to detailed accounting systems.

Feature Comparison

| Feature | FreshBooks | Wave Accounting | Key Differences |

|---|---|---|---|

| Reporting | Comprehensive reporting features, allowing for detailed financial analysis. | Basic reporting tools, sufficient for monitoring key metrics. | FreshBooks offers deeper insights into financial performance. |

| Client Portals | Robust client portals with secure communication and document sharing. | Basic client communication tools, primarily focused on invoice management. | FreshBooks facilitates stronger client relationships through dedicated portals. |

| Pricing | Generally more expensive, tiered pricing options. | Free basic plan, affordable tiered plans for higher needs. | Wave’s free option is a significant draw for budget-conscious businesses. |

| Integrations | Extensive integrations with other business applications. | Integrations with other services, but potentially fewer than FreshBooks. | FreshBooks offers broader integration possibilities. |

Integrations and API

Both FreshBooks and Wave Accounting offer robust integration capabilities, allowing users to connect their accounting software with other business tools. Understanding the depth and breadth of these integrations is crucial for choosing the platform that best complements your existing workflows. This section delves into the integration options available for each platform, highlighting their flexibility and potential for custom development.

Available Integrations

FreshBooks and Wave Accounting boast extensive lists of integrations, enabling seamless data flow between accounting software and other applications. This facilitates automation of tasks, streamlining operations, and improving overall efficiency. These integrations often include direct connections with payment processors, CRM systems, project management tools, and more.

Flexibility and Depth of Integrations

FreshBooks, with its broader range of features, tends to offer a more comprehensive array of integrations. Its integration network typically includes popular project management platforms, calendar applications, and various other tools crucial for project-based businesses. Wave Accounting, while still offering a considerable number of integrations, often focuses more on core accounting and financial tools. This approach may be more suitable for businesses prioritizing streamlined financial management without extensive project-related add-ons.

API Strength and Custom Development Potential

The API strength of both platforms directly influences the potential for custom development. FreshBooks’ API allows for greater customization options, enabling developers to build bespoke solutions. Wave Accounting’s API, while capable, may have slightly fewer capabilities for complex integrations. This difference is particularly important for businesses requiring advanced automation or unique workflows.

Compatibility with Other Business Tools

The compatibility of each platform with other business tools is crucial. FreshBooks integrates well with popular project management tools, making it a strong choice for businesses using such platforms. Wave Accounting excels in its compatibility with various financial tools, enhancing its suitability for firms focused on accounting-centric operations.

Key Integrations Comparison

The table below provides a comparative overview of key integrations available for FreshBooks and Wave Accounting.

| Category | FreshBooks | Wave Accounting | Description |

|---|---|---|---|

| Payment Processors | Stripe, PayPal, Square, and more | Stripe, PayPal, and others | Facilitates seamless payment processing and reconciliation. |

| Project Management | Asana, Trello, Monday.com | Limited direct project management integrations, but often works with other project management tools through third-party integrations. | Allows for the synchronization of project data and billing information. |

| CRM Systems | Salesforce, HubSpot, Zoho CRM | Integrates with CRM systems, though less comprehensive than FreshBooks in this area. | Allows for the seamless exchange of customer data and project details. |

| Email Marketing | Mailchimp, Constant Contact | Mailchimp, Constant Contact | Enables the automation of email campaigns and customer communications. |

Customer Support and Training

Both FreshBooks and Wave Accounting offer vital support to their users, but their approaches and levels of support differ. Understanding these distinctions is crucial for selecting the right platform for your needs. Choosing the right platform hinges significantly on the level of support provided, and how readily available that support is.

Support Types and Availability

FreshBooks and Wave Accounting provide various support options to address user queries and issues. FreshBooks prioritizes a blend of self-service resources and dedicated support staff, whereas Wave Accounting focuses heavily on self-service resources and community forums. The varying levels of support cater to different user preferences and technical expertise.

- FreshBooks offers comprehensive documentation, tutorials, and video guides. Their extensive knowledge base addresses a wide range of common accounting tasks and software features. This allows users to find answers independently, which significantly speeds up the problem-solving process. They also provide phone and email support, and in some cases, live chat.

- Wave Accounting provides a substantial amount of online documentation, FAQs, and video tutorials. Their website and support resources are organized to assist users in navigating the platform and resolving common issues independently. The accessibility of these resources is a core strength of their support strategy.

Online Resources and Documentation

The accessibility and comprehensiveness of online resources play a critical role in user satisfaction. Thorough documentation, tutorials, and FAQs empower users to troubleshoot problems independently. This reduces wait times for support and allows users to manage their tasks efficiently.

- FreshBooks boasts a substantial library of online resources. From detailed user manuals to video tutorials, FreshBooks covers a broad range of topics. This comprehensive support ensures users can navigate the platform effectively and find answers to their questions.

- Wave Accounting offers an equally robust collection of online resources. Their extensive FAQs, step-by-step guides, and video tutorials are readily available, allowing users to resolve issues quickly. The high level of self-service support provided by Wave Accounting is a key factor in their user-friendly approach.

Support Channel Comparison

The support channels offered by each platform significantly influence the user experience. Understanding these channels is crucial to selecting the platform that best fits your needs.

| Feature | FreshBooks | Wave Accounting | Accessibility |

|---|---|---|---|

| Documentation | Extensive, well-organized | Comprehensive, easily searchable | High |

| Video Tutorials | Available, covering various topics | Available, focusing on key functions | High |

| Phone Support | Available | Limited or not available | Moderate |

| Email Support | Available | Available | High |

| Live Chat | Available in some cases | Not available | Moderate |

| Community Forums | Not as prominent | Active, providing user-to-user support | Moderate |

The availability and quality of customer support directly impact user satisfaction and platform adoption. A well-structured support system with various channels and resources contributes to a smoother user experience.

User Interface and Experience: Freshbooks Vs Wave Accounting

Both FreshBooks and Wave Accounting aim to streamline accounting tasks, but their approaches to user interface differ significantly. Understanding these differences is crucial for choosing the right platform for your business needs. A user-friendly interface directly impacts efficiency and user satisfaction.

FreshBooks User Interface

FreshBooks boasts a visually appealing and intuitive interface, generally considered user-friendly for small businesses. Its layout is clean and well-organized, making navigation straightforward. Menus and tools are clearly labeled, minimizing the learning curve. The platform excels at presenting information in a digestible format, particularly regarding invoices, estimates, and client communication. This is important for managing client relationships effectively.

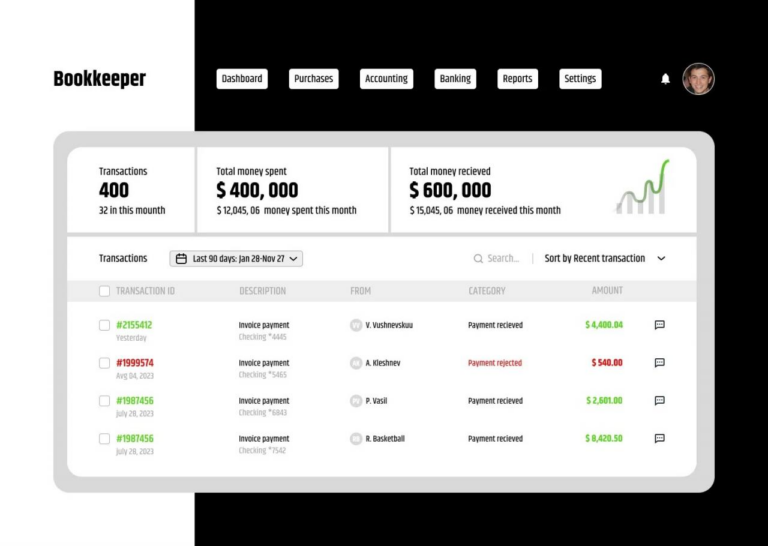

Wave Accounting User Interface

Wave Accounting’s interface is generally simpler and more minimalist than FreshBooks’. While less visually elaborate, it often prioritizes functionality over aesthetics. This approach can be appreciated by users seeking a straightforward, task-oriented experience. Wave’s focus on simplicity may translate to a quicker learning curve for some.

Comparative Analysis of Navigation and Usability

FreshBooks, with its more comprehensive feature set, necessitates a more complex navigation structure. This complexity is offset by clear labeling and logical organization. Wave Accounting, with a more focused set of features, offers a simpler, more direct navigation path. The usability of each platform hinges on the user’s specific needs and familiarity with accounting software. A user accustomed to complex accounting software may find FreshBooks more manageable, while a user with less experience might prefer Wave’s simplicity.

Handling Complex Tasks

FreshBooks, with its extensive features, can handle complex tasks like managing multiple clients and intricate invoicing scenarios. It provides granular control over every aspect of the accounting process, allowing for a high degree of customization. Wave Accounting excels in its ability to manage basic accounting needs. However, for extremely complex tasks, its limitations become apparent. This is particularly true when advanced financial reporting or complex project accounting is required.

Example of Interface Elements

| FreshBooks | Wave Accounting | FreshBooks (Detail) | Wave Accounting (Detail) |

|---|---|---|---|

|

A screenshot of FreshBooks’ dashboard, displaying a summary of invoices, clients, and upcoming tasks. The interface is organized with clearly labeled sections and color-coded elements. |

A screenshot of Wave Accounting’s dashboard, showcasing a streamlined view of key financial metrics. Notice the minimalist design and straightforward presentation. |

A zoomed-in view of a FreshBooks invoice, highlighting the detailed line items, amounts, and payment options. The layout is clear and easy to read. |

A zoomed-in view of a Wave Accounting invoice, featuring a simplified structure with essential details. The layout is minimalist, focusing on the necessary information. |

The table above illustrates the visual differences between the two platforms. FreshBooks presents a more comprehensive view, while Wave offers a streamlined experience.

Security and Compliance

Security and compliance are paramount when choosing accounting software. Both FreshBooks and Wave Accounting prioritize these aspects to protect user data and maintain trust. This section details the security measures, compliance standards, and data protection practices implemented by each platform.

Security Measures

Both FreshBooks and Wave Accounting employ robust security measures to safeguard user data. These include encryption technologies, multi-factor authentication, and regular security audits to identify and mitigate potential vulnerabilities. Access controls and permission settings are crucial to limit data access to authorized personnel.

Compliance Standards

FreshBooks and Wave Accounting adhere to various compliance standards, depending on the specific region and user needs. These standards may include data privacy regulations like GDPR (General Data Protection Regulation) and other industry-specific requirements. The adherence to these standards is vital for maintaining user trust and avoiding potential legal issues.

Data Protection Policies and Practices

Both platforms have comprehensive data protection policies outlining their commitment to protecting user data. These policies typically address data collection, storage, use, and disclosure practices. They emphasize adherence to relevant data protection regulations and provide users with clear insights into how their information is handled. For example, these policies often specify the retention period for data and the procedures for data deletion.

Data Backup and Recovery

Robust backup and recovery procedures are essential for ensuring data availability and minimizing disruption. FreshBooks and Wave Accounting both employ regular data backups to safeguard against data loss. These backups are stored securely, and the platforms have well-defined recovery procedures to restore data in case of system failures or other incidents. They also likely have disaster recovery plans to ensure business continuity.

Comparison Table: Security and Compliance, Freshbooks vs wave accounting

| Feature | FreshBooks | Wave Accounting | Comparison |

|---|---|---|---|

| Security Measures | FreshBooks employs industry-standard encryption and multi-factor authentication. Regular security audits and vulnerability assessments are performed. | Wave Accounting utilizes robust encryption and multi-factor authentication. Regular security assessments are also conducted. | Both platforms prioritize security through encryption and authentication. |

| Compliance Standards | FreshBooks adheres to relevant data privacy regulations, including GDPR where applicable. | Wave Accounting complies with data privacy regulations like GDPR and industry standards. | Both platforms demonstrate commitment to compliance with regulations. |

| Data Protection Policies | Clear data protection policies are in place, outlining data handling procedures. | Detailed data protection policies specify data collection, use, and retention. | Both platforms have well-defined data protection policies. |

| Data Backup and Recovery | FreshBooks has established data backup and recovery procedures. | Wave Accounting utilizes robust backup and recovery systems. | Both offer data backup and recovery capabilities to mitigate data loss. |

Specific Use Cases

Choosing between FreshBooks and Wave Accounting hinges on the specific needs of your small business. Understanding the strengths of each platform for different workflows and business types is crucial for making an informed decision. This section explores how each platform excels in particular situations.

Consulting Firms

FreshBooks is often a better fit for consulting firms due to its robust invoicing and time tracking capabilities. Its detailed time tracking allows consultants to precisely document billable hours, streamlining the invoicing process and generating accurate reports. FreshBooks also excels at managing multiple clients and projects simultaneously. For instance, a consulting firm offering diverse services to multiple clients can efficiently track their time, manage projects, and generate invoices for each client with ease using FreshBooks.

E-commerce Stores

Wave Accounting, with its seamless integration with popular e-commerce platforms like Shopify and WooCommerce, proves advantageous for e-commerce stores. Its ability to automatically sync sales data directly from these platforms streamlines the accounting process. Wave’s straightforward interface makes it easy for non-accounting experts to manage their finances, freeing up valuable time for other aspects of the business. An example of this would be an online clothing retailer using Wave to effortlessly track sales from their Shopify store, manage expenses, and generate reports.

Freelancers

Both platforms cater to freelancers, but FreshBooks stands out with its advanced time tracking features, ideal for accurately recording billable hours and creating detailed invoices. Wave Accounting, on the other hand, is known for its simple setup and user-friendly interface, making it a practical choice for freelancers who prefer a straightforward accounting solution. A freelance web designer, for instance, might choose FreshBooks to meticulously track their time on various projects and generate professional invoices.

Real-World Examples

FreshBooks boasts a strong presence in the professional services sector, with many consulting firms and law practices relying on its features for efficient invoicing and project management. Wave Accounting, with its emphasis on simplicity and integration, has gained traction among small e-commerce businesses and freelancers.

Comparison Table

| Feature | FreshBooks | Wave Accounting |

|---|---|---|

| Invoicing | Robust, detailed invoicing with time tracking | Simple, automated invoicing through e-commerce integrations |

| Time Tracking | Excellent for detailed time tracking, crucial for consulting | Basic time tracking; not as detailed as FreshBooks |

| E-commerce Integration | Limited integration options | Strong integration with popular platforms like Shopify, WooCommerce |

| User Interface | Feature-rich, potentially overwhelming for simpler needs | Intuitive and user-friendly, easy for non-accounting experts |

Conclusion

In conclusion, FreshBooks and Wave Accounting both present viable options for small businesses. FreshBooks provides a more feature-rich platform, but at a higher cost. Wave Accounting, on the other hand, is more affordable and user-friendly, making it ideal for simpler needs. Ultimately, the best choice depends on your specific business requirements, budget, and technical proficiency. Consider your workflow, desired features, and support needs before making a decision. Hopefully, this comparison gives you a clear understanding of both platforms and empowers you to select the perfect accounting solution.