Freelance Virtual Bookkeeper Your Guide

Freelance virtual bookkeeper services are booming. They offer a flexible, cost-effective alternative to in-house bookkeepers, handling everything from basic bookkeeping tasks to complex financial reporting. This guide dives deep into the world of freelance virtual bookkeeping, exploring the role’s responsibilities, market trends, and essential marketing strategies for success.

This guide covers the core responsibilities, common tasks, and critical skills needed to thrive in this dynamic field. It also examines market demand, pricing models, and the best strategies for attracting and retaining clients. Understanding these elements is key to launching a successful freelance bookkeeping business.

Defining the Freelance Virtual Bookkeeper Role

A freelance virtual bookkeeper provides essential financial support to businesses and individuals without the overhead of an in-house employee. They handle a wide range of bookkeeping tasks, from basic record-keeping to complex financial reporting, allowing clients to focus on core business operations.

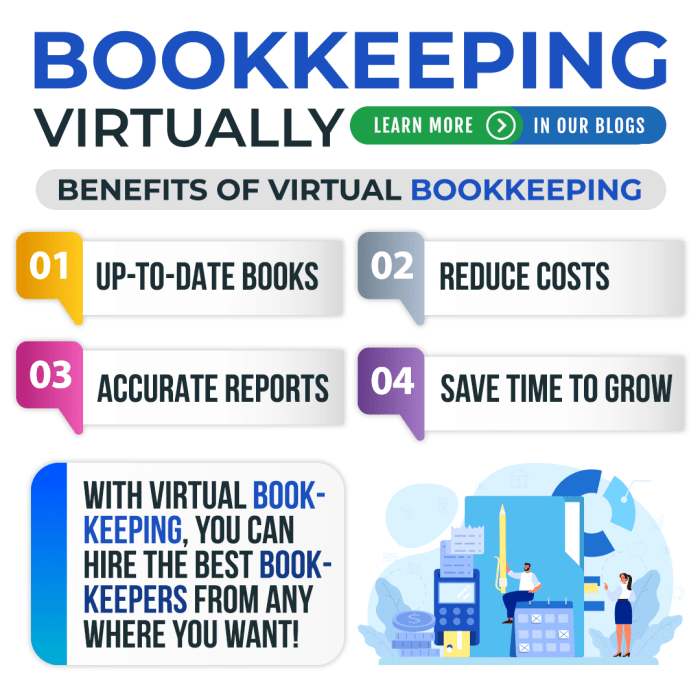

This role is increasingly popular due to its flexibility and cost-effectiveness, particularly for small businesses and startups. The ability to scale services up or down based on client needs makes it an attractive option for businesses with fluctuating workloads.

Core Responsibilities

Freelance virtual bookkeepers are responsible for maintaining accurate and up-to-date financial records. This includes handling various financial transactions, ensuring compliance with accounting standards, and producing financial reports for clients. Their responsibilities often extend to providing expert advice on financial management strategies.

Typical Tasks

A comprehensive list of tasks often handled by a freelance virtual bookkeeper includes:

- Entering invoices and payments.

- Reconciling bank and credit card statements.

- Preparing and processing payroll.

- Managing accounts payable and receivable.

- Generating financial reports, including balance sheets, income statements, and cash flow statements.

- Assisting with tax preparation (often, this involves preparing data for tax professionals).

- Creating and maintaining accounting charts of accounts.

- Reconciling general ledger accounts.

- Performing account analysis to identify trends and areas for improvement.

- Providing support for financial audits.

Difference from In-House Bookkeeper

The primary difference between a freelance virtual bookkeeper and an in-house bookkeeper lies in their employment status and the level of direct interaction with the client. A virtual bookkeeper works remotely and typically has a more limited scope of responsibilities for a particular client, while an in-house bookkeeper is a direct employee of the company. Freelance virtual bookkeepers often offer a higher degree of flexibility, potentially accommodating fluctuating workloads or specialized projects.

Types of Bookkeeping Services

Freelance virtual bookkeepers offer a variety of bookkeeping services, catering to diverse client needs:

- Basic bookkeeping: This encompasses routine tasks like invoice processing, expense tracking, and bank reconciliation.

- Payroll processing: Handling payroll calculations, tax withholdings, and direct deposit payments.

- Accounts payable/receivable management: Managing invoices, payments, and collections.

- Financial reporting: Creating and delivering regular financial reports to clients.

- Tax preparation support: Assisting clients with data gathering and organization for tax professionals.

Key Skills and Qualifications

Essential skills for a successful freelance virtual bookkeeper include:

- Strong accounting knowledge and experience.

- Proficiency in accounting software.

- Excellent organizational and time-management skills.

- Exceptional attention to detail.

- Strong communication and interpersonal skills.

- Familiarity with relevant tax regulations.

- Problem-solving abilities.

- Adaptability and the ability to work independently.

Bookkeeping Software Comparison

The choice of bookkeeping software significantly impacts efficiency and accuracy. Here’s a comparison of popular options:

| Software | Pros | Cons | Typical Client Needs |

|---|---|---|---|

| Xero | Intuitive interface, good for small businesses, robust reporting features. | Can be slightly more expensive than some competitors, learning curve for complex situations. | Small businesses with basic accounting needs, those needing strong reporting features. |

| QuickBooks Online | Wide range of features, well-established, user-friendly for many. | Can be expensive for basic needs, some users find it overwhelming. | Businesses with complex accounting needs or those familiar with QuickBooks Desktop. |

| Zoho Books | Affordable, good for basic accounting needs, integrates with other Zoho apps. | Fewer advanced features compared to Xero or QuickBooks, limited integrations. | Small businesses with limited accounting needs and those looking for a cost-effective solution. |

Market Analysis and Trends

The freelance virtual bookkeeping market is experiencing robust growth, driven by the increasing need for efficient and cost-effective financial management solutions for small businesses and entrepreneurs. This sector offers a unique blend of flexibility and specialization, catering to a diverse range of client needs.

The demand for freelance virtual bookkeepers is consistently high, particularly among small businesses lacking in-house accounting expertise or resources. This is fueled by the ongoing trend toward outsourcing non-core functions to optimize operational efficiency and reduce overhead costs.

Current Market Demand

The current market demand for freelance virtual bookkeepers is strong and shows no signs of slowing down. This is due to the increasing number of small businesses and entrepreneurs who prioritize outsourcing bookkeeping tasks to focus on core business operations. This trend is further amplified by the rising cost of hiring full-time accountants and the need for flexible financial management solutions.

Factors Driving Growth

Several factors are propelling the growth of the freelance virtual bookkeeping profession. These include the increasing adoption of cloud-based accounting software, the rising popularity of remote work, and the growing demand for specialized financial services. Additionally, the accessibility of online tools and platforms for managing client interactions and tasks has made it easier for freelance bookkeepers to expand their reach and manage their businesses effectively.

Typical Client Profile, Freelance virtual bookkeeper

The typical client profile for a freelance virtual bookkeeper comprises small businesses, startups, and freelancers with limited in-house accounting expertise. These clients often need assistance with various bookkeeping tasks, including accounts payable, accounts receivable, invoicing, bank reconciliation, and financial reporting. Furthermore, many entrepreneurs value the flexibility and scalability offered by virtual bookkeepers, especially during periods of rapid growth or transition.

Pricing Models

Common pricing models for freelance virtual bookkeepers include hourly rates, project-based fees, and retainer agreements. Hourly rates offer flexibility for tasks with varying time commitments, while project fees are suitable for specific, defined bookkeeping projects. Retainer agreements provide predictable monthly costs for ongoing bookkeeping services, which suits clients needing regular support.

Business Structures

Freelance virtual bookkeepers frequently operate under various business structures, including sole proprietorships, limited liability companies (LLCs), and partnerships. The chosen structure impacts legal and financial responsibilities, as well as the perceived professionalism of the business.

Pricing Structure

| Region | Hourly Rate Range | Project Fee Range | Factors Influencing Rates |

|---|---|---|---|

| Region A (e.g., USA – Northeast) | $50-$150 | $500-$5000 | Experience, specialization, software proficiency, client complexity, and market competition |

| Region B (e.g., USA – West Coast) | $40-$120 | $400-$3500 | Similar to Region A, but potentially influenced by a slightly lower cost of living |

| Region C (e.g., Europe – UK) | £30-£100 | £300-£3000 | Experience, specialization, software proficiency, client complexity, and market competition. Exchange rates also play a significant role. |

Note: These are estimated ranges and actual rates may vary significantly depending on the individual bookkeeper’s experience, specialization, and client requirements.

Marketing and Client Acquisition: Freelance Virtual Bookkeeper

Attracting clients is crucial for a successful freelance virtual bookkeeping service. Effective marketing strategies can significantly impact the volume of business and overall profitability. A well-defined approach that leverages online platforms and networking is vital for establishing a strong client base.

A comprehensive marketing plan should focus on creating a professional online presence, building relationships with potential clients, and showcasing expertise. This includes demonstrating a clear understanding of the target audience and tailoring marketing efforts accordingly. Consistent branding and a well-structured website are essential components of a successful marketing strategy.

Strategies for Marketing a Freelance Virtual Bookkeeping Service

A successful marketing approach often involves a multifaceted strategy, utilizing various platforms and techniques. Understanding the target audience is key to effective communication. Consider the types of businesses that need bookkeeping services, their size, and their specific needs. Tailoring marketing messages to address these needs is essential for reaching the right clients.

Methods for Attracting Clients

Several methods can effectively attract clients. Building a strong online presence is crucial, showcasing expertise through a professional website and social media profiles. Active engagement on relevant platforms and consistent posting of valuable content can generate interest. Networking through industry events, online communities, and professional organizations can introduce the service to potential clients. Providing valuable resources and demonstrating expertise through blog posts and articles can position the service as a valuable asset.

Online Platforms for Reaching Potential Clients

Numerous online platforms can be leveraged to reach potential clients. These include social media platforms, professional networking sites, and specialized bookkeeping directories. Each platform has a unique user base and characteristics, allowing for targeted marketing strategies. Consistent posting of engaging content and participation in relevant online conversations can increase visibility and attract potential clients.

Importance of Building a Strong Online Presence

A strong online presence is vital for attracting clients and building credibility. A well-designed website that clearly Artikels services and showcases expertise is critical. Regularly updated content, such as blog posts and articles, can position the service as a thought leader in the field. Consistent social media engagement can establish a strong brand identity and build trust with potential clients.

Role of Networking and Referrals in Acquiring Clients

Networking and referrals are important channels for acquiring clients. Attending industry events, joining online communities, and participating in relevant forums can provide opportunities to connect with potential clients and build relationships. Word-of-mouth referrals are powerful; happy clients are likely to recommend the service to their network. Building strong relationships with other professionals can also lead to valuable referrals.

Common Online Platforms and Marketing Strategies

| Platform | Description | Target Audience | Marketing Strategy |

|---|---|---|---|

| Professional networking platform | Small business owners, entrepreneurs, CFOs, and accounting professionals | Create a professional profile, participate in relevant groups, share industry insights, and engage with potential clients. | |

| X (formerly Twitter) | Social media platform for news and updates | Businesses, professionals, and individuals seeking quick information and updates | Share industry news, tips, and insights, engage in relevant conversations, and promote services concisely. |

| Social media platform for connecting with friends and family | Small business owners and individuals looking for business solutions | Create a business page, share valuable content, run targeted ads, and engage with potential clients through posts and groups. | |

| Visual social media platform | Businesses and individuals focused on visuals and aesthetics | Showcase the service visually, share success stories, highlight client testimonials, and create engaging content. | |

| Specialized Bookkeeping Directories | Online directories dedicated to bookkeeping services | Businesses requiring bookkeeping services | List the service on relevant directories, ensuring accurate and up-to-date information, and highlighting key expertise. |

End of Discussion

Source: virtuousbookkeeping.com

In conclusion, the freelance virtual bookkeeper role offers a rewarding path for those with accounting expertise and entrepreneurial spirit. By understanding the essential responsibilities, analyzing market trends, and implementing effective marketing strategies, you can establish a thriving bookkeeping practice. This guide provides the foundational knowledge to navigate the complexities of this exciting profession and achieve financial success.