DIY Bookkeeping Tips for Entrepreneurs A Practical Guide

DIY bookkeeping tips for entrepreneurs offer a practical approach to managing finances. This guide provides essential tools and techniques to streamline your bookkeeping processes, ensuring accuracy and efficiency. From choosing the right software to mastering effective record-keeping, you’ll discover actionable strategies to take control of your business finances.

This comprehensive resource covers essential bookkeeping tools and techniques, streamlining processes, and maintaining accurate records. We’ll explore various methods for tracking income and expenses, discuss automating tasks, and equip you with the knowledge to avoid common pitfalls. The guide also includes a step-by-step setup process, covering everything from initial setup to ongoing maintenance. This guide will empower you to handle your finances effectively and prepare for tax season with confidence.

Essential Bookkeeping Tools and Techniques for Entrepreneurs

Source: googleapis.com

Effective bookkeeping is crucial for any entrepreneur. It provides a clear picture of your financial health, enabling informed decision-making and ultimately contributing to your business’s success. Understanding your income and expenses allows you to forecast future needs, manage cash flow effectively, and identify areas for potential improvement. This section details essential tools and techniques to streamline your bookkeeping processes.

Essential Bookkeeping Software Options

Choosing the right bookkeeping software can significantly impact your efficiency. Different options cater to varying business needs and budgets. Consider these five popular choices:

- Xero: Known for its user-friendly interface and robust features, Xero is a popular choice for small businesses. Its strong reporting capabilities and integrations with other business tools are notable advantages. However, some features might require a subscription upgrade for advanced functionality.

- QuickBooks Online: QuickBooks Online offers comprehensive accounting tools, including invoicing, expense tracking, and financial reporting. Its extensive feature set and wide availability make it a reliable option. However, its steep learning curve might pose a challenge for new users.

- FreshBooks: FreshBooks excels in invoicing and client management. Its straightforward design and focus on client communication are beneficial for service-based businesses. While powerful for invoicing, it might lack the depth of financial reporting found in other options.

- Zoho Books: Zoho Books provides a versatile platform for various business needs. Its ease of use, robust reporting tools, and integration with other Zoho applications are attractive features. However, the interface might not be as intuitive for users unfamiliar with Zoho products.

- Wave Accounting: Wave Accounting is a free option that offers basic accounting tools for small businesses. Its simplicity and cost-effectiveness make it a viable option for startups or businesses with limited budgets. However, its limited features compared to paid alternatives may hinder growth and complex needs.

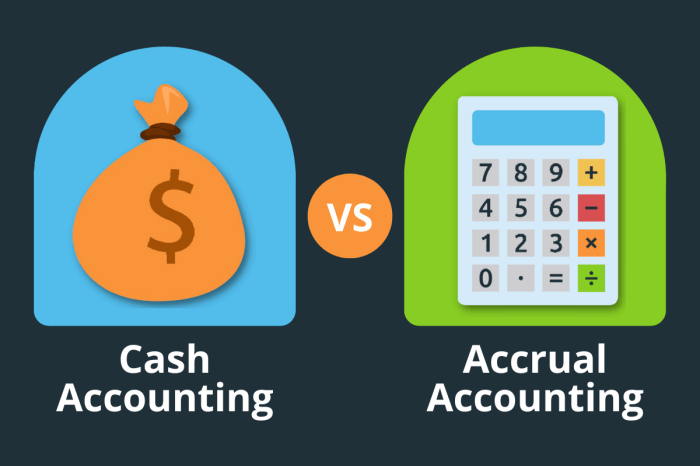

Income and Expense Tracking Methods

Different methods for tracking income and expenses cater to varying business structures and needs. Choose the one that best suits your specific business requirements.

- Categorized Tracking: This method involves meticulously categorizing each income and expense transaction. It provides detailed insights into revenue streams and expenditure patterns. This approach demands significant initial setup but offers highly detailed financial reporting. This method is ideal for businesses that want granular control over their finances, like retailers with diverse product lines.

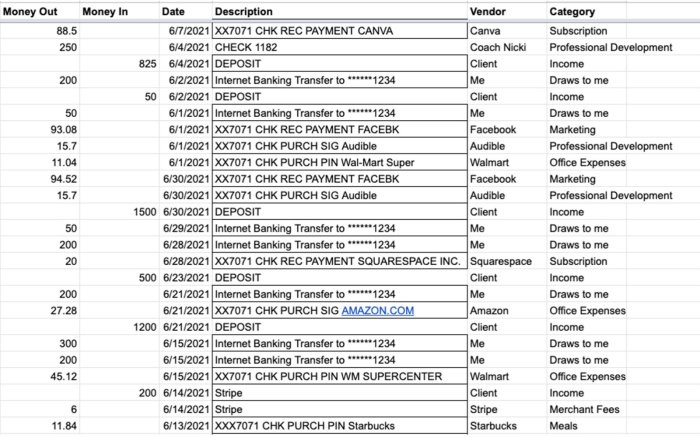

- Spreadsheet Tracking: Spreadsheets provide a flexible platform for tracking income and expenses. The adaptability of spreadsheets allows entrepreneurs to tailor the tracking method to their specific needs. However, maintaining data accuracy and consistency can be challenging as the business grows. This is a viable method for businesses with relatively straightforward financial operations.

- Accounting Software Tracking: Accounting software automatically categorizes transactions, allowing for efficient tracking. This automated approach reduces manual effort and potential errors. The software also offers various reporting features to help analyze financial performance. This method is particularly helpful for businesses dealing with a significant volume of transactions, such as those with high sales or many expenses.

Spreadsheet Bookkeeping Techniques

Spreadsheets can be a powerful tool for bookkeeping. They allow for customized tracking and analysis.

- Formulas: Utilize formulas like SUM, AVERAGE, and COUNT to quickly calculate totals, averages, and counts. For example, `=SUM(A1:A10)` sums the values in cells A1 through A10. `=AVERAGE(B2:B10)` calculates the average of values in cells B2 through B10.

- Functions: Employ functions like `IF` to create conditional statements. For instance, `=IF(A1>100,”High”,”Low”)` categorizes a value in cell A1 as “High” if it’s greater than 100 and “Low” otherwise.

- Data Organization: Organize data logically, using clear headers and consistent formatting. Use columns for different categories (date, description, income, expense). This clear organization will greatly improve readability and allow for easier analysis.

Daily/Weekly Bookkeeping Log Template

This template provides a structured approach to daily/weekly bookkeeping.

| Date | Description | Category | Income | Expense | Reference |

|---|---|---|---|---|---|

| 2024-08-28 | Sales from online store | Sales | $500 | Invoice #123 | |

| 2024-08-28 | Rent payment | Rent | $1500 | Receipt #456 |

Cloud-Based vs. Desktop Accounting Software

The table below compares cloud-based and traditional desktop accounting software.

| Feature | Cloud | Desktop |

|---|---|---|

| Accessibility | Available from anywhere with internet access | Limited to the computer where installed |

| Collaboration | Multiple users can access and edit data simultaneously | Usually limited to one user at a time |

| Security | Often with robust security measures and data backups | Security depends on the user’s computer security practices |

| Cost | Often subscription-based, with varying tiers | Typically a one-time purchase |

Streamlining Your Bookkeeping Processes

Source: docyt.com

Efficient bookkeeping is crucial for entrepreneurs to track finances accurately, make informed decisions, and ultimately, drive business success. A well-organized system saves time and reduces errors, allowing you to focus on growing your business. Streamlining your bookkeeping processes is a key aspect of this efficiency.

A streamlined bookkeeping system not only ensures accuracy but also improves the overall efficiency of your financial operations. By automating tasks, categorizing transactions, and maintaining accurate records, you can gain valuable insights into your financial performance, leading to better strategic planning and informed decision-making.

Time-Saving Strategies for Automating Bookkeeping Tasks

Automating bookkeeping tasks can significantly reduce the time spent on manual data entry and processing. This allows entrepreneurs to dedicate more time to strategic initiatives. Here are three effective strategies:

- Utilize accounting software:

- Employ expense tracking apps:

- Set up recurring transactions:

Accounting software packages like QuickBooks, Xero, or FreshBooks automate many bookkeeping functions, including invoice creation, expense tracking, and bank reconciliation. These platforms often integrate with other business tools, simplifying data flow and reducing manual entry.

Dedicated expense tracking apps allow for easy capture of receipts, automatic categorization of expenses, and simplified reporting. These apps often sync with your accounting software, minimizing data duplication and errors.

For consistent expenses like rent or subscriptions, set up recurring transactions in your accounting software. This ensures that these payments are automatically recorded and categorized, saving you significant time and effort each month.

Categorizing Transactions

Categorizing transactions properly is essential for insightful financial reporting. A well-defined categorization system allows for easy identification of expenses, revenue sources, and overall financial performance. This clarity is vital for budgeting and forecasting.

A robust categorization system should include specific categories for various expenses and income streams. For instance, you might have categories like “Rent,” “Salaries,” “Marketing,” “Advertising,” “Software Subscriptions,” “Sales Revenue,” “Consulting Fees,” etc. A detailed example of a transaction categorization system is shown below:

| Transaction | Category | Description |

|---|---|---|

| Payment to landlord | Rent | Monthly rent payment |

| Payment to employee | Salaries | Employee salary for the month |

| Payment for social media ads | Marketing | Cost of social media advertisements |

| Payment for website hosting | Software Subscriptions | Monthly website hosting fee |

| Sale of product | Sales Revenue | Revenue generated from product sales |

Creating and Maintaining Accurate Financial Records

Accurate financial records are the cornerstone of effective bookkeeping. These records provide a detailed history of your financial transactions, which is vital for tax preparation, financial reporting, and overall business decision-making.

Invoices and receipts are critical components of accurate financial records. Maintain a meticulous system for storing and organizing these documents, whether electronically or physically. Consider using a dedicated folder or file system, or a cloud-based storage solution for digital records.

Reconciling Bank Statements

Reconciling bank statements with your accounting records is a critical step in maintaining accurate bookkeeping. This process ensures that all transactions are recorded and that there are no discrepancies between your records and your bank statements. Discrepancies should be investigated and resolved promptly.

A step-by-step process for bank reconciliation is:

1. Download your bank statement.

2. Compare the statement to your accounting records.

3. Identify any differences.

4. Investigate the source of the differences.

5. Correct any errors in your accounting records or bank statements.

6. Update your records with any necessary adjustments.

Setting Up a Bookkeeping System, DIY bookkeeping tips for entrepreneurs

A well-structured bookkeeping system is essential for long-term success. Here’s a step-by-step guide for setting up your system:

- Choose bookkeeping software or methods:

- Set up your chart of accounts:

- Implement a transaction recording process:

- Establish a system for organizing invoices and receipts:

- Regularly reconcile bank statements:

- Back up your data:

Select a system that aligns with your business needs and budget.

Establish a comprehensive list of accounts to categorize your transactions.

Establish a system for recording all transactions, whether manually or through software.

Organize physical and digital records for easy retrieval.

Perform regular reconciliations to maintain accuracy.

Implement a robust data backup system to protect your records from loss.

Backing Up Bookkeeping Data

Data backups are crucial for preventing data loss due to unforeseen circumstances. Regular backups safeguard your financial records, ensuring business continuity and reducing the risk of losing valuable financial information.

Employ multiple backup strategies to ensure data redundancy. This could involve cloud-based storage, external hard drives, or a combination of both. Establish a schedule for regular backups to maintain a comprehensive and updated record.

Maintaining Accurate Records and Avoiding Common Pitfalls

Source: slidesharecdn.com

Accurate bookkeeping is the bedrock of sound financial management for any entrepreneur. It provides a clear picture of your business’s financial health, enabling informed decisions about pricing, investments, and growth strategies. Without meticulous records, it’s challenging to track progress, identify potential issues, and make strategic adjustments to stay ahead of the curve.

Thorough bookkeeping ensures a precise understanding of income, expenses, and cash flow, which is crucial for financial planning and forecasting. It allows you to anticipate future needs, optimize resource allocation, and make proactive decisions based on historical data. This, in turn, reduces the risk of unexpected financial challenges and allows for greater confidence in your business’s trajectory.

Significance of Accurate Bookkeeping

Accurate bookkeeping is paramount for informed financial planning and decision-making. It provides a historical record of transactions, allowing you to analyze trends, identify profitable areas, and pinpoint areas requiring improvement. This data-driven approach empowers you to make strategic adjustments to optimize your business’s financial performance.

Common Bookkeeping Errors and How to Avoid Them

Entrepreneurs frequently encounter certain bookkeeping errors. These errors, if left unaddressed, can lead to inaccurate financial statements and hinder your ability to make sound business decisions. Understanding these common pitfalls and implementing preventative measures is vital for maintaining a healthy financial picture.

- Incorrectly Categorizing Expenses: Ensure expenses are meticulously categorized to accurately reflect the nature of the business activity. This involves using a standardized chart of accounts and consistently applying categories to each transaction.

- Ignoring Small Transactions: Many entrepreneurs overlook small transactions, believing they are inconsequential. This can lead to significant inaccuracies in the overall financial picture. Implementing a system for recording even the smallest transactions will provide a comprehensive view of your business’s financial activities.

- Inconsistent Record-Keeping: Maintaining a consistent record-keeping system is essential for accurate financial reporting. Develop a standardized format for recording transactions and adhering to it consistently across all transactions. This aids in minimizing errors and ensures the integrity of your financial records.

- Failure to Reconcile Bank Statements: Regular reconciliation of bank statements with your bookkeeping records is crucial for catching discrepancies and errors promptly. This helps to identify and resolve any issues promptly.

Strategies for Staying Organized

Staying organized in bookkeeping is critical for entrepreneurs. It minimizes errors, facilitates efficient financial management, and allows for timely decision-making.

- Establish a Dedicated Workspace: A dedicated workspace, free from distractions, can significantly improve your focus and efficiency during bookkeeping tasks.

- Use Software and Tools: Leveraging bookkeeping software and tools can automate many tasks, improving accuracy and reducing manual effort. These tools can help manage transactions, categorize expenses, and generate financial reports.

- Develop a Routine: Creating a regular bookkeeping routine, including dedicated time slots for data entry and reconciliation, helps maintain a consistent workflow.

- Delegate Tasks (If Applicable): If your business grows, consider delegating bookkeeping tasks to a virtual assistant or a bookkeeper to maintain efficiency and accuracy.

- Regular Backups: Implementing a regular backup system for your financial data is crucial to protect against data loss. Regular backups safeguard your valuable information from unforeseen circumstances.

Inventory Tracking Methods

Different inventory tracking methods cater to various business needs and sizes. The chosen method should align with the specific requirements and characteristics of the business.

| Method | Description | Suitable for |

|---|---|---|

| First-In, First-Out (FIFO) | Assumes the first items purchased are the first ones sold. | Businesses with a high turnover rate of goods. |

| Last-In, First-Out (LIFO) | Assumes the last items purchased are the first ones sold. | Businesses with stable inventory or fluctuating prices. |

| Specific Identification | Tracks the cost of each individual item. | Businesses selling unique or high-value items. |

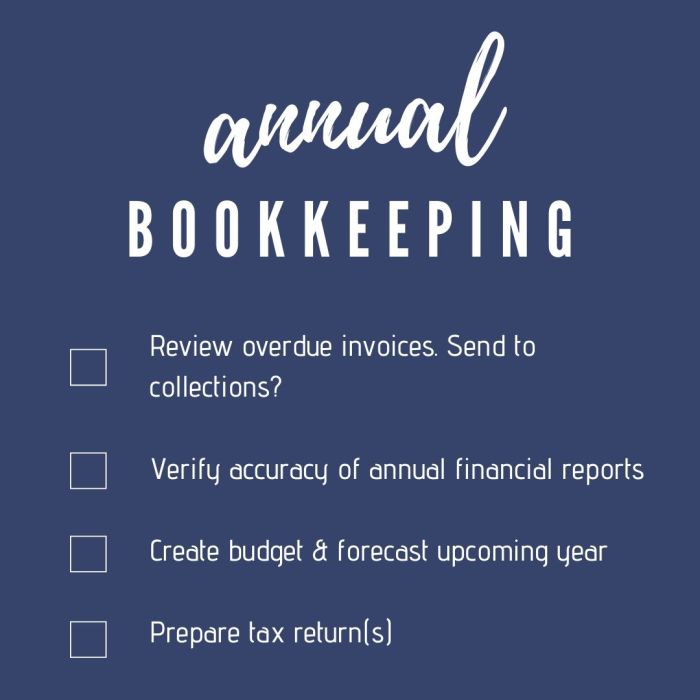

Regular Bookkeeping Tasks Checklist

A structured checklist ensures all essential bookkeeping tasks are completed promptly and accurately.

- Data Entry: Regularly input all transactions into the bookkeeping system.

- Reconciliation: Reconcile bank statements and credit card statements with the bookkeeping records.

- Reporting: Generate regular financial reports, including income statements, balance sheets, and cash flow statements.

- Record Keeping: Maintain detailed records of all transactions.

- File Management: Maintain a well-organized filing system for all financial documents.

Tax Season Preparation

Preparing for tax season involves organizing financial documents and records to ensure a smooth and accurate tax filing process.

- Document Collection: Gather all necessary financial documents, including receipts, invoices, and bank statements.

- Data Validation: Verify the accuracy of all financial data.

- Seek Professional Help: If needed, consult with a tax professional for guidance and support during the tax season.

Last Word: DIY Bookkeeping Tips For Entrepreneurs

In conclusion, mastering DIY bookkeeping is crucial for entrepreneurial success. By implementing the tips and strategies Artikeld in this guide, you can gain greater control over your finances, identify areas for improvement, and make informed business decisions. From selecting the right tools to maintaining accurate records, this comprehensive resource equips entrepreneurs with the knowledge and resources needed to thrive in today’s business environment. Remember, consistent effort and accurate record-keeping are key to achieving financial stability and success.