Cloud-Based Bookkeeping Apps A Comprehensive Guide

Cloud-based bookkeeping apps are revolutionizing how businesses manage their finances. These digital tools offer a streamlined, efficient alternative to traditional methods, simplifying record-keeping and freeing up valuable time. Key features include automated tasks, secure data storage, and seamless integration with other business software. This guide delves into the specifics, examining popular options like QuickBooks Online, Xero, and FreshBooks, their functionalities, pricing models, and user experiences. We’ll also explore the importance of integration, automation, security, and support in selecting the right app for your needs.

From intuitive interfaces to robust security measures, these apps provide a complete financial management solution. We’ll examine user experience, pricing structures, and the vital role of automation and integration in optimizing your workflow. The discussion also touches upon critical aspects such as data security and compliance, ensuring peace of mind and adherence to industry standards. Choosing the right cloud-based bookkeeping app is crucial for efficient and secure financial management. This guide will assist you in making informed decisions.

Introduction to Cloud-Based Bookkeeping Apps

Source: toptut.com

Cloud-based bookkeeping apps are software solutions that manage financial records and transactions through the internet. They offer a streamlined alternative to traditional bookkeeping methods, enabling users to access and update their financial data from anywhere with an internet connection. This accessibility and efficiency are key advantages for businesses and individuals alike.

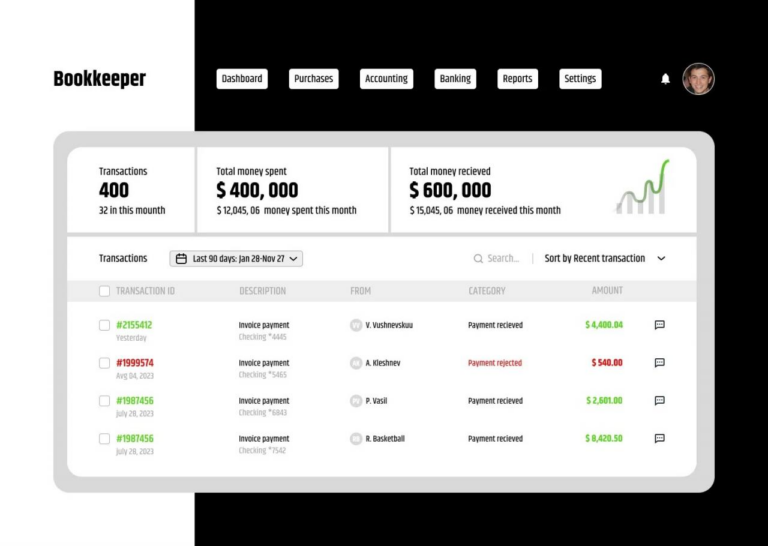

Key Features and Functionalities

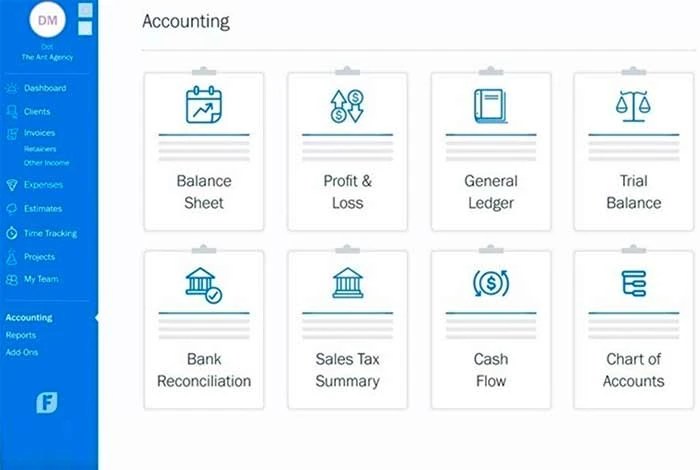

These apps typically offer a comprehensive suite of tools for managing various financial aspects. Core functionalities often include invoicing, expense tracking, bank reconciliation, and generating financial reports. Advanced features may include inventory management, project accounting, and customer relationship management (CRM) integration. These integrated tools significantly enhance efficiency and provide a holistic view of financial activity.

Benefits of Cloud-Based Bookkeeping Apps

Cloud-based bookkeeping apps provide numerous advantages over traditional methods. Increased accessibility is a major benefit, allowing users to work from anywhere with an internet connection. Real-time data updates and collaborative features enable multiple users to access and modify information simultaneously. Data security is enhanced through cloud-based systems, often exceeding the security measures available to individuals or small businesses using traditional methods. Furthermore, these apps typically come with automated backups and disaster recovery measures, safeguarding crucial financial data.

Examples of Popular Cloud-Based Bookkeeping Apps

Several popular cloud-based bookkeeping apps are readily available in the market. These include QuickBooks Online, Xero, FreshBooks, Zoho Books, and Wave Accounting, each offering specific features and pricing models. These options cater to a wide range of businesses and individuals, from small sole proprietors to larger enterprises.

Comparison of Popular Cloud-Based Bookkeeping Apps

| App | Pricing | Features | Customer Support |

|---|---|---|---|

| QuickBooks Online | Subscription-based, varying tiers based on features and user count. Basic plans are often affordable, while premium options come with more robust functionalities. | Robust invoicing, expense tracking, bank reconciliation, reporting, and integration with other QuickBooks products. Generally suitable for businesses needing comprehensive accounting tools. | 24/7 phone and email support, plus online resources and FAQs. The quality of support is generally regarded as high. |

| Xero | Subscription-based, offering tiered pricing options tailored to different business needs. The pricing often includes support for a set number of users. | Comprehensive invoicing, expense management, bank reconciliation, and reporting features. It is user-friendly and suitable for businesses that require good financial visibility. | 24/7 support channels, including phone, email, and online help resources. Customer feedback on support quality is generally positive. |

| FreshBooks | Subscription-based, offering various plans with varying features and user limits. Often suited for freelancers and small businesses with simpler accounting needs. | Focuses on invoicing and billing, with strong expense tracking and reporting features. Excellent for clients who need straightforward invoicing and tracking solutions. | Customer support includes phone and email assistance, as well as online resources. Support responsiveness and helpfulness are frequently highlighted by users. |

User Experience and Interface

A seamless user experience is paramount for cloud-based bookkeeping apps. A well-designed interface directly impacts user adoption, satisfaction, and ultimately, the app’s success. Intuitive navigation and clear presentation of information are key to encouraging users to utilize the app’s full potential for managing their financial records.

Effective bookkeeping apps go beyond simply recording transactions; they streamline the entire process. A user-friendly interface empowers users to easily input data, reconcile accounts, generate reports, and make informed financial decisions. This translates into greater efficiency and a reduced risk of errors, leading to a positive user experience.

Importance of a User-Friendly Interface

A user-friendly interface in cloud-based bookkeeping apps is crucial for several reasons. Firstly, it simplifies the often complex task of managing finances. Secondly, it reduces the learning curve, allowing users to quickly become proficient in using the application. Thirdly, it promotes accuracy and minimizes the potential for human error. Finally, a well-designed interface fosters a positive user experience, encouraging ongoing use and ultimately benefiting the user’s financial management.

Key Elements for a Positive User Experience

Several key elements contribute to a positive user experience. Clear visual hierarchy, intuitive navigation, and well-structured information presentation are crucial. The ability to easily search and filter transactions, along with customizable views and reporting options, enhances usability. Moreover, providing helpful prompts, tutorials, and error messages that guide users and reduce confusion significantly improve the overall experience.

Typical User Flow for Recording an Expense

This flow diagram illustrates the typical steps a user takes to record an expense in a cloud-based bookkeeping app.

[Placeholder for a diagram depicting a user flow from selecting an expense category, entering details like amount, date, description, and finally saving the expense.] The diagram should showcase the various steps, including data input fields, and visual cues for navigation, highlighting the intuitive flow.

Common Pain Points in User Experience

Common pain points in cloud-based bookkeeping apps include: complex navigation, unclear input fields, a lack of intuitive controls, insufficient error messages, and a confusing layout. These issues can lead to frustration and reduced user engagement. Another key pain point is the lack of visual aids and clear guidance on how to utilize the app’s features effectively.

Intuitive Design for Improved Engagement and Adoption, Cloud-based bookkeeping apps

Intuitive design is essential for improving user engagement and adoption. Clear labeling, consistent formatting, and recognizable icons contribute to a more user-friendly experience. Using a color palette that’s easy on the eyes and visually appealing also plays a significant role. Employing visual cues like tooltips and interactive elements can enhance the understanding and ease of use.

Comparison of Interface Designs

| Interface Design | Pros | Cons |

|---|---|---|

| Tab-based | Clear organization, easy access to different sections, logical grouping of functionalities | Can become cluttered if too many tabs are used, might not be suitable for complex tasks, can limit flexibility in presenting information |

| Card-based | Visually appealing, allows for flexible arrangement of information, easy to customize views | Can become overwhelming if not well-organized, might not be suitable for large datasets, potential for lack of structure |

| List-based | Simple and straightforward, easy to scan through large amounts of data, excellent for detailed financial reports | May not be visually appealing, can be difficult to navigate large lists of transactions, might require significant filtering options |

Integration and Automation

Cloud-based bookkeeping apps are designed to seamlessly integrate with other business tools, automating many repetitive tasks. This integration enhances efficiency and reduces manual errors, ultimately saving time and resources. The automation capabilities are crucial for modern businesses needing to streamline operations and maintain accurate financial records.

Modern bookkeeping software facilitates efficient workflows by automating tasks like data entry, report generation, and invoice processing. This allows businesses to focus on strategic initiatives rather than getting bogged down in administrative work. This interconnectedness also fosters a centralized view of financial data, enabling better decision-making.

Integration with Other Business Tools

Cloud-based bookkeeping apps often integrate with accounting software, CRM systems, and e-commerce platforms. This integration allows for a unified view of financial transactions and customer interactions, providing a comprehensive understanding of business operations. This seamless data flow between platforms eliminates data entry redundancies and ensures consistency across different business functions.

Automation Features

These apps offer various automation features. Automated invoice generation, bank reconciliation, and expense tracking are common examples. Automated data entry and reconciliation features can significantly reduce manual work. Furthermore, automatic categorization of transactions can significantly reduce the time required to maintain accurate records.

Examples of Workflow Streamlining

Automated invoice processing allows businesses to quickly generate invoices, track payments, and manage outstanding balances. Automated bank reconciliation can reduce errors and discrepancies, improving the accuracy of financial reports. Automated expense tracking can help businesses manage costs and maintain financial controls. These automated features collectively enhance business efficiency by streamlining workflows.

Data Security and Backup in Integrated Systems

Data security and backup are paramount when integrating bookkeeping apps with other business tools. Robust security measures, such as encryption and access controls, are essential to protect sensitive financial data. Regular backups of integrated data ensure business continuity in case of data loss or system failure. Backup systems also offer an extra layer of security in case of unauthorized access attempts.

Common Integrations Offered by Popular Bookkeeping Apps

- Accounting Software: Many bookkeeping apps seamlessly integrate with popular accounting software packages like QuickBooks, Xero, and Sage, enabling real-time data exchange.

- CRM Systems: Integration with CRM systems allows businesses to track customer interactions and link them directly to sales and financial transactions, improving customer relationship management.

- E-commerce Platforms: Integration with platforms like Shopify and WooCommerce automatically synchronizes sales data with the bookkeeping app, ensuring accurate financial records.

- Payment Gateways: Integration with payment gateways like Stripe and PayPal automatically processes payments and updates the bookkeeping records, streamlining payment management.

- Payroll Services: Integration with payroll services automatically updates payroll information into the bookkeeping app, ensuring accurate record-keeping of payroll data.

Benefits of Using Automation Tools

Automation tools in bookkeeping apps provide numerous benefits. They reduce manual data entry, minimizing errors and saving time. Improved accuracy in financial records leads to better financial reporting and decision-making. Automation fosters a centralized view of financial data, leading to more efficient management of resources and streamlined workflows. This, in turn, can lead to cost savings and improved business performance.

Pricing and Subscription Models: Cloud-based Bookkeeping Apps

Cloud-based bookkeeping apps offer diverse pricing models to cater to various business needs and budgets. Understanding these models is crucial for making informed decisions when selecting a suitable solution. Different tiers often include varying levels of features, impacting the overall cost-effectiveness of each option.

Cloud-based bookkeeping apps employ diverse pricing strategies, from simple flat fees to tiered subscriptions based on usage or features. This allows businesses of all sizes to find a solution that fits their budget and requirements.

Pricing Structures

Various pricing structures are employed by cloud-based bookkeeping apps. These often involve tiered pricing models, where different levels of features are offered at different price points. Businesses can choose a tier that aligns with their needs and budget. Furthermore, some apps offer a free tier with limited functionality, which can be beneficial for startups or small businesses exploring the software. Other apps may offer custom pricing based on unique requirements.

Cost-Effectiveness Comparison

Comparing the cost-effectiveness of different pricing tiers requires evaluating the features included in each tier. A Basic tier may offer essential features, but lack advanced functionalities, while a Premium tier might provide extensive features, but also command a higher price. Businesses should meticulously assess the features they need and compare the value proposition of each tier. A cost-benefit analysis is critical to ensuring the chosen tier aligns with the business’s long-term needs.

Pricing Tier Breakdown (Example App)

| Pricing Tier | Features | Price |

|---|---|---|

| Basic | Basic accounting functions, limited customer support, 1 user, limited reports | $19/month |

| Premium | Advanced accounting functions, unlimited customer support, multiple users, comprehensive reporting, inventory management | $49/month |

| Enterprise | All Premium features plus custom integrations, dedicated account manager, advanced analytics, advanced security protocols | $99/month and up |

This table provides a simplified example. Real-world pricing and features vary considerably depending on the specific bookkeeping app.

Subscription Options

Different subscription options are available, from monthly to annual plans. Annual plans often provide a discount compared to monthly payments. Some apps may also offer payment options based on a project or usage-based model. Understanding these options can lead to significant cost savings.

Factors to Consider When Choosing a Pricing Model

Businesses should consider various factors when choosing a pricing model. Factors like the number of users, required features, and projected usage should be carefully weighed. Budget constraints, anticipated growth, and long-term needs should also play a role in the decision. Furthermore, a clear understanding of the customer support and maintenance policies associated with each tier is crucial. Evaluating the vendor’s reputation and financial stability is also a significant consideration.

Security and Compliance

Source: completecontroller.com

Cloud-based bookkeeping apps have become increasingly popular due to their accessibility and efficiency. However, safeguarding sensitive financial data is paramount. Robust security measures and adherence to compliance standards are critical for user trust and maintaining the integrity of financial information. This section delves into the importance of security, the measures taken by leading bookkeeping apps, and the steps users can take to protect their data.

Importance of Data Security

Data security in cloud-based bookkeeping apps is paramount. Compromised financial data can lead to significant financial losses, reputational damage, and legal repercussions. Data breaches can expose sensitive information such as account numbers, transaction details, and personal identification data. Preventing unauthorized access and ensuring data integrity is essential to maintain user confidence and uphold the reliability of the platform.

Security Measures Employed by Popular Bookkeeping Apps

Leading bookkeeping apps employ a multi-layered approach to data security. This involves implementing various technologies and procedures to safeguard user data. These security measures often include robust encryption protocols, multi-factor authentication (MFA), and regular security audits. Access controls are meticulously managed, restricting access to authorized personnel only.

Compliance Standards Adhered to by Bookkeeping Apps

Many bookkeeping apps adhere to international standards, such as the Payment Card Industry Data Security Standard (PCI DSS), ensuring secure handling of credit card information. Compliance with relevant financial regulations is also critical, and adherence to industry best practices for data security is a priority. Compliance standards help to protect user data and uphold the credibility of the bookkeeping app.

Data Encryption Levels

Different levels of data encryption are employed to protect sensitive financial data. Data at rest (stored data) is often encrypted using strong algorithms. Data in transit (data being transmitted) is also encrypted using industry-standard protocols. This multi-layered approach ensures that unauthorized access to data is significantly hindered. For example, Advanced Encryption Standard (AES) 256-bit encryption is a common method used by reputable bookkeeping apps.

Steps to Protect Sensitive Financial Data

Users can take several steps to protect their sensitive financial data. Strong passwords, combined with MFA, are crucial. Regularly updating software and apps to patch security vulnerabilities is also essential. Users should avoid using public Wi-Fi networks when accessing sensitive financial accounts. Furthermore, being cautious of phishing scams and suspicious emails is vital.

Data Privacy Policy Example (Hypothetical App – “CloudBookkeeping”)

CloudBookkeeping’s data privacy policy Artikels its commitment to safeguarding user data. The policy details the types of data collected, the purposes for which it is used, and the measures taken to protect it. It explicitly states how user data is stored, transferred, and secured. For example, CloudBookkeeping uses AES 256-bit encryption for data at rest and HTTPS for data in transit. The policy also clarifies user rights regarding their data, such as the right to access, correct, or delete their information.

“At CloudBookkeeping, we prioritize the security and privacy of your financial data. We employ industry-leading security measures to protect your information from unauthorized access and maintain the confidentiality of your transactions.”

Support and Training

Cloud-based bookkeeping apps strive to provide seamless user experiences. Comprehensive support and training are crucial elements in achieving this goal, ensuring users can effectively utilize the software and resolve any issues that may arise. Thorough documentation and readily available support channels are vital for a positive user experience.

Effective support systems not only resolve immediate problems but also empower users to confidently navigate the software, leading to improved efficiency and ultimately, better financial management.

Types of Support Offered

Cloud-based bookkeeping apps typically offer various support options, ranging from self-service resources to dedicated customer service representatives. These support options cater to diverse user needs and preferences, aiming to provide the best possible assistance.

Support Channels

A wide array of support channels are accessible to users, allowing them to reach out for help in a manner that best suits their needs. This accessibility is key to user satisfaction and successful adoption of the software.

- Online Help Centers: Many apps provide extensive online documentation, FAQs, and tutorials. These resources cover a broad range of topics, from basic account setup to advanced features. Comprehensive knowledge bases are invaluable to users, offering solutions to frequently asked questions and common problems.

- Customer Support Teams: Dedicated customer support teams offer assistance via phone, email, or live chat. These teams are typically staffed with knowledgeable representatives capable of resolving complex issues and providing personalized guidance.

- Community Forums: Some apps foster online communities where users can interact with each other, share experiences, and seek solutions to problems. This peer-to-peer support can be invaluable for resolving specific issues or gaining insight from other users facing similar challenges.

Importance of Training Resources

Thorough training materials are crucial for maximizing the benefits of cloud-based bookkeeping apps. Well-structured training resources equip users with the knowledge and skills necessary to leverage the software’s capabilities effectively, streamlining financial processes and boosting efficiency. Detailed documentation and readily accessible tutorials empower users to become proficient and confident in using the software.

Examples of Training Materials

Various cloud-based bookkeeping apps offer different types of training materials to suit various learning styles.

- Xero: Xero provides a comprehensive help center with articles, videos, and step-by-step guides. Their resources cover a broad spectrum of topics, from setting up accounts to managing invoices.

- QuickBooks Online: QuickBooks Online offers tutorials, webinars, and a robust knowledge base. This allows users to find solutions to specific issues and learn about the app’s features in an accessible format.

- Zoho Books: Zoho Books provides comprehensive documentation, including detailed guides, video tutorials, and FAQs. Their training materials focus on practical application and offer insights into efficient workflows.

Troubleshooting Common Issues

Common bookkeeping issues, such as data entry errors or syncing problems, can be effectively addressed with appropriate troubleshooting steps. Understanding common problems and their solutions allows users to resolve these issues quickly and independently, reducing reliance on external support.

- Data Entry Errors: Double-checking entries and using built-in verification tools can help prevent errors. Following the app’s guidelines for data formatting can also minimize issues.

- Syncing Problems: Ensuring a stable internet connection is critical for syncing data. Reviewing the app’s troubleshooting guide for syncing problems can provide solutions.

- Password Issues: Strong passwords and secure login practices are essential for protecting sensitive financial data. Using a password manager can assist in managing multiple logins and maintaining security.

Comparing Support Options

Different cloud-based bookkeeping apps offer varied support options. A comparative analysis can aid users in choosing the best app based on their specific support needs.

| App | Support Channels | Training Materials |

|---|---|---|

| Xero | Online help center, phone support, email | Articles, videos, step-by-step guides |

| QuickBooks Online | Online help center, phone support, live chat | Tutorials, webinars, knowledge base |

| Zoho Books | Online help center, email support | Guides, video tutorials, FAQs |

Ending Remarks

Source: onestopaccounting.com

In conclusion, cloud-based bookkeeping apps offer a significant advancement in financial management, providing a powerful alternative to traditional methods. This comprehensive guide has highlighted the key features, user experiences, pricing structures, and security considerations associated with these applications. By carefully evaluating your needs and considering the available options, businesses can leverage these tools to enhance their financial processes, gain valuable insights, and achieve greater efficiency.