Cash vs Accrual Accounting Method A Comprehensive Guide

Cash vs accrual accounting method are fundamental concepts in bookkeeping, impacting how businesses record and report financial transactions. Understanding the nuances of each approach is crucial for accurate financial reporting and strategic decision-making. This guide will delve into the intricacies of both methods, examining their procedures, advantages, disadvantages, and applications across various business types. We’ll also analyze their impact on financial statements, regulations, and practical considerations.

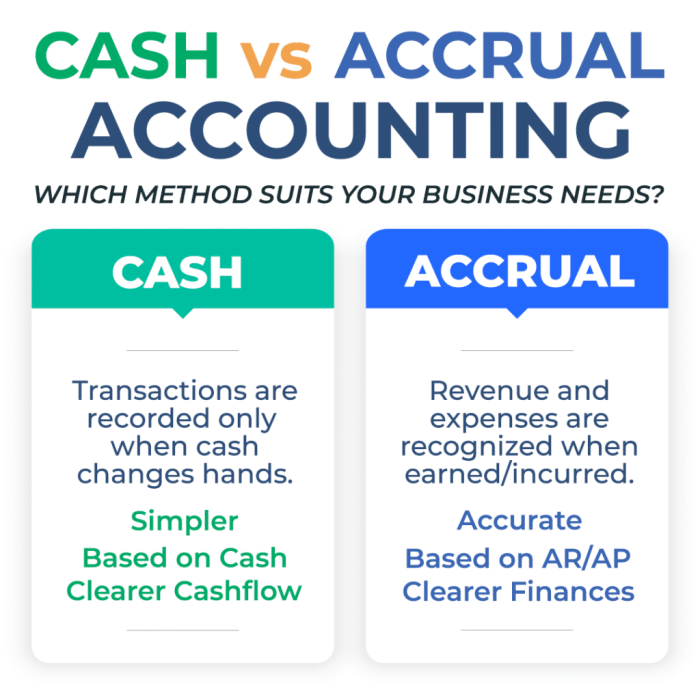

The choice between cash and accrual accounting significantly affects how a business tracks revenue and expenses. Cash accounting recognizes transactions when cash changes hands, while accrual accounting records transactions when they occur, regardless of when cash is exchanged. This distinction leads to different financial statements and implications for tax reporting and overall business strategy.

Cash Accounting Method

The cash accounting method is a straightforward way to track income and expenses. It records transactions only when cash changes hands, either coming into or going out of the business. This method is simpler than accrual accounting, but it may not provide a complete picture of a company’s financial position.

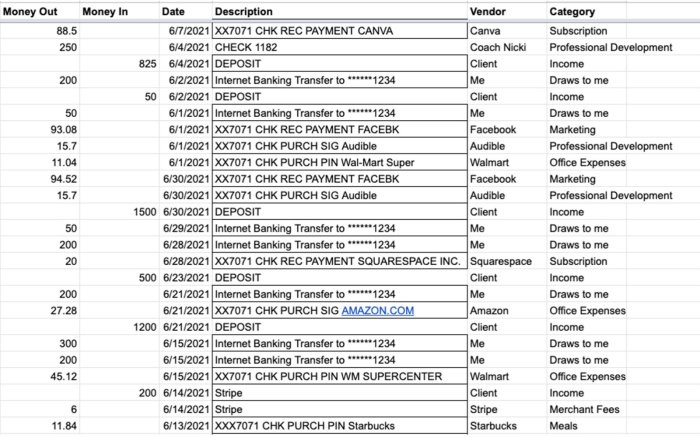

Procedure for Recording Transactions

The cash method prioritizes the actual receipt or disbursement of cash. When a business receives cash from a customer for goods or services, that transaction is recorded as revenue. Similarly, when a business pays cash for expenses, like rent or salaries, that is recorded as an expense. No adjustments are made for anticipated future cash flows.

Timing of Revenue and Expense Recognition, Cash vs accrual accounting method

Revenue is recognized when cash is received, not when the service is performed or the product is delivered. Expenses are recognized when cash is paid, not when the obligation is incurred. This contrasts with accrual accounting, where revenue and expenses are recognized when they are earned or incurred, regardless of when cash is exchanged. For instance, if a company provides services in December but receives payment in January, the revenue would be recognized in January under cash accounting.

Advantages of Using Cash Accounting

Cash accounting offers several benefits. It’s relatively simple to understand and implement, minimizing the complexities associated with tracking accounts receivables and payables. The simplicity of the method reduces administrative overhead and allows for a quicker calculation of profit and loss. This is especially helpful for small businesses with limited accounting resources. Additionally, cash accounting can be advantageous for businesses that experience significant fluctuations in cash flow.

Potential Disadvantages of Using Cash Accounting

While simple, cash accounting has drawbacks. It may not reflect the true financial picture of a business, especially if the company has significant accounts receivable or accounts payable. For example, a company might appear profitable in a given period if it collects a significant amount of cash from customers, even if it hasn’t yet paid all its suppliers. This can lead to an inaccurate assessment of a company’s overall financial health. It also might not comply with the requirements of certain regulatory bodies.

Sample Cash Accounting Transaction

| Date | Description | Cash Inflow/Outflow | Account Affected |

|---|---|---|---|

| 2024-10-26 | Received cash from customer for services rendered | $500 | Revenue |

| 2024-10-27 | Paid rent for the month | -$200 | Rent Expense |

| 2024-10-28 | Paid employee salaries | -$150 | Salaries Expense |

Accrual Accounting Method

The accrual accounting method provides a more comprehensive picture of a company’s financial performance than the cash method. It recognizes revenue and expenses when they are earned or incurred, regardless of when cash changes hands. This approach offers a more accurate reflection of a company’s profitability and financial position over a specific period.

Procedure for Recording Transactions

Accrual accounting meticulously records transactions based on the matching principle. This principle dictates that revenues and expenses should be recognized in the same period in which they are earned or incurred, not necessarily when cash is received or paid. This approach provides a more accurate picture of a company’s financial health. The process involves identifying the economic event, determining the accounts affected, and recording the appropriate journal entry.

Timing of Revenue and Expense Recognition, Cash vs accrual accounting method

The timing of revenue and expense recognition is crucial in accrual accounting. Revenue is recognized when it is earned, meaning when a company has performed the service or delivered the product, and the customer is obligated to pay. Expenses are recognized when they are incurred, reflecting the consumption of resources in generating revenue. For instance, if a company provides services in January but receives payment in February, the revenue is recognized in January, when the service is performed. Similarly, if a company pays rent in advance, the rent expense is recognized over the period for which the rent covers.

Advantages of Using Accrual Accounting

Accrual accounting offers several benefits. Firstly, it provides a more accurate reflection of a company’s financial performance, avoiding distortions caused by timing differences between cash inflows and outflows. Secondly, it enables better long-term planning and forecasting, as it offers a clearer picture of a company’s profitability trend. Thirdly, it facilitates better decision-making by providing a more realistic view of a company’s financial position.

Disadvantages of Using Accrual Accounting

While accrual accounting offers advantages, it also has potential drawbacks. Firstly, it can be more complex to implement compared to cash accounting, requiring a deeper understanding of accounting principles. Secondly, accrual accounting relies on estimates and judgments, which can introduce some level of subjectivity. Thirdly, it may not be suitable for all businesses, especially those with very simple transactions.

Sample Accrual Accounting Transaction

| Date | Description | Account Affected | Journal Entry |

|---|---|---|---|

| 2024-01-15 | Provided services to a customer on credit | Accounts Receivable, Service Revenue | Debit Accounts Receivable, Credit Service Revenue |

| 2024-02-15 | Received cash from the customer for the services provided | Cash, Accounts Receivable | Debit Cash, Credit Accounts Receivable |

| 2024-01-20 | Incurred utility expense | Utilities Expense, Accounts Payable | Debit Utilities Expense, Credit Accounts Payable |

| 2024-02-20 | Paid utility expense | Accounts Payable, Cash | Debit Accounts Payable, Credit Cash |

Key Differences and Similarities

Understanding the nuances between cash and accrual accounting methods is crucial for accurate financial reporting. Both methods track revenue and expenses, but they differ significantly in timing. This distinction impacts the overall picture of a company’s financial health and performance.

Comparison of Cash and Accrual Accounting

Cash and accrual accounting methods provide different perspectives on a company’s financial position. Cash accounting recognizes revenue and expenses when cash changes hands, while accrual accounting recognizes them when the transaction occurs, regardless of when cash is exchanged. This fundamental difference leads to distinct financial statements and impacts how a business views its profitability and liquidity.

Key Differences

The core difference between cash and accrual accounting lies in the timing of revenue and expense recognition. This difference can significantly affect the reported financial performance.

- Revenue Recognition: Cash accounting recognizes revenue when cash is received. Accrual accounting recognizes revenue when it is earned, regardless of when cash is received. For example, if a company sells goods on credit, cash accounting would not record the revenue until payment is received, while accrual accounting would record the revenue when the sale is made.

- Expense Recognition: Cash accounting recognizes expenses when cash is paid. Accrual accounting recognizes expenses when they are incurred, even if cash hasn’t been paid yet. Imagine a company ordering supplies on credit. Cash accounting would record the expense when payment is made, while accrual accounting would record it when the supplies are ordered or used.

- Matching Principle: Accrual accounting adheres to the matching principle, which requires expenses to be matched with the revenues they generate. Cash accounting does not adhere to this principle; expenses are recognized when cash leaves the company, which may not correlate with the revenue they support.

Key Similarities

Despite their differences, cash and accrual accounting share some common ground. Both methods are essential for tracking business transactions and ultimately contributing to financial reporting.

- Transaction Recording: Both methods meticulously record every business transaction. The methods may differ in the timing of recording, but the fundamental process of recording transactions remains the same.

- Financial Reporting: Both systems ultimately provide financial information, which is essential for decision-making, analysis, and reporting to stakeholders. Both methods lead to a snapshot of a business’s financial status.

Summary Table

| Difference/Similarity | Cash Accounting | Accrual Accounting | Explanation |

|---|---|---|---|

| Revenue Recognition | When cash is received | When revenue is earned | Cash accounting records revenue only when cash is received, while accrual accounting records revenue when the sale is made. |

| Expense Recognition | When cash is paid | When expenses are incurred | Cash accounting records expenses only when cash is paid, while accrual accounting records expenses when they are used or incurred. |

| Matching Principle | Not applicable | Applicable | Accrual accounting adheres to the matching principle, aligning expenses with related revenues. Cash accounting does not. |

| Similarities | Records transactions | Records transactions | Both methods meticulously record business transactions. |

| Similarities | Provides financial information | Provides financial information | Both systems offer crucial financial data for reporting and decision-making. |

Application and Examples: Cash Vs Accrual Accounting Method

Choosing between cash and accrual accounting significantly impacts a business’s financial reporting. Understanding which method best suits a business’s needs is crucial for accurate financial picture and informed decision-making. The appropriate method depends on factors like the business type, size, and complexity of transactions.

Businesses often select the accounting method that best reflects their specific financial realities and operational practices. Cash accounting provides a simpler view of immediate cash flow, while accrual accounting offers a more comprehensive picture of overall profitability.

Businesses Commonly Using Cash Accounting

Cash accounting is often preferred by small businesses with relatively simple transactions. Its simplicity makes it easier to manage for businesses with limited resources. Examples include sole proprietorships, freelancers, and small retail shops with a high volume of cash transactions. These businesses frequently find the straightforward nature of cash accounting aligns well with their operations.

- Sole proprietorships: These businesses, often run by a single individual, typically have fewer complex transactions and rely heavily on cash inflows and outflows for day-to-day operations.

- Freelancers: Independent contractors often work on projects and receive payment when the job is completed. This makes cash accounting a natural fit as income is recognized when cash is received.

- Small retail shops with high cash volume: Businesses like small grocery stores or corner shops often receive and spend a large amount of cash. Cash accounting reflects this high volume of immediate transactions effectively.

Businesses Commonly Using Accrual Accounting

Accrual accounting is usually more suitable for businesses with more complex operations and a larger volume of transactions. Larger businesses and companies often find that accrual accounting offers a more accurate reflection of their financial position and profitability.

- Large corporations: Companies with numerous transactions, intricate supply chains, and significant credit sales generally benefit from accrual accounting’s detailed view of profitability.

- Businesses with significant credit sales: Companies that sell goods or services on credit, recognizing revenue when earned rather than when cash is received, often use accrual accounting.

- Service-based businesses with long-term contracts: Companies providing services over extended periods, with revenue recognition over time, will find accrual accounting more appropriate.

Suitability for Various Business Types and Sizes

The choice between cash and accrual accounting is often dictated by the specific characteristics of the business. Factors such as the frequency and volume of transactions, the presence of credit sales, and the complexity of operations influence the optimal choice.

- Small businesses with limited transactions may find cash accounting easier to manage. It provides a straightforward view of cash flow, aligning well with their needs.

- Larger businesses or those with complex operations often benefit from the more comprehensive view of profitability offered by accrual accounting. This allows for better financial planning and decision-making.

Scenario-Based Comparison of Cash vs. Accrual Accounting

| Business Type | Common Scenario | Accounting Method | Explanation |

|---|---|---|---|

| Small retail store | Selling merchandise primarily for cash | Cash | Reflects immediate cash flow, suitable for simple transactions. |

| Software development firm | Providing services on contract basis with payment terms | Accrual | Accurate representation of revenue recognition over the project’s lifecycle, essential for financial reporting. |

| Construction company | Building houses with long-term projects and payments | Accrual | Recognizes revenue and expenses as they are earned or incurred, essential for accurate financial reporting of a long-term project. |

| Freelancer | Performing tasks for clients and receiving payments upon completion | Cash | Simple recognition of income and expenses as cash is received or paid. |

Impact on Financial Statements

The choice between cash and accrual accounting significantly influences the presentation of financial statements. Understanding these differences is crucial for investors, creditors, and internal stakeholders alike, as the methods provide varying perspectives on a company’s financial health and performance. Different stakeholders will require different methods depending on their needs.

Impact on Income Statements

The key distinction between cash and accrual accounting lies in when revenue and expenses are recognized. Cash accounting recognizes revenue and expenses when cash is received or paid, respectively. Accrual accounting, on the other hand, recognizes revenue when earned and expenses when incurred, regardless of cash flow. This difference directly impacts the income statement.

- Under cash accounting, income is reported only when cash is received. This can result in income fluctuations if cash receipts are inconsistent with revenue generation. Conversely, expenses are recorded when cash is paid out, leading to a similar inconsistent pattern. This method provides a snapshot of the company’s immediate cash flow but may not accurately reflect the overall financial performance.

- Accrual accounting provides a more comprehensive view of a company’s profitability. Revenue is recognized when earned, regardless of when cash is received. Expenses are recorded when incurred, regardless of when cash is paid. This results in a more stable representation of the company’s ongoing profitability.

Impact on Balance Sheets

The balance sheet reflects a company’s assets, liabilities, and equity at a specific point in time. Both accounting methods affect this presentation.

- Cash accounting primarily reflects the company’s cash on hand and accounts receivable or payable directly related to cash transactions. The accounts receivable and payable balances are significantly impacted by cash flows.

- Accrual accounting provides a broader picture of the company’s assets and liabilities. It includes accounts receivable and payable for transactions not yet settled in cash. This leads to a more complete representation of the company’s financial position.

Impact on Cash Flow Statements

The cash flow statement tracks the movement of cash into and out of a company. Both accounting methods affect the presentation of this statement.

- Cash accounting directly reflects cash inflows and outflows. The statement is straightforward, as it only includes transactions involving cash.

- Accrual accounting provides a more detailed view of cash flows, including the effects of transactions that do not involve immediate cash exchange. It separates cash from non-cash transactions, offering a more comprehensive view of the company’s cash flow activities.

Example: Sales on Credit

Consider a scenario where a company sells goods on credit.

| Transaction | Cash Accounting Income Statement | Accrual Accounting Income Statement | Cash Flow Statement (Cash) | Cash Flow Statement (Accrual) |

|---|---|---|---|---|

| Sale of goods worth $10,000 on credit | No impact | $10,000 revenue | No impact | No impact |

| Collection of $10,000 from customer | $10,000 revenue | $10,000 revenue | $10,000 cash inflow | $10,000 cash inflow |

Cash accounting recognizes revenue only when cash is received. Accrual accounting recognizes revenue when the sale is made, regardless of when the cash is collected. The cash flow statement reflects the actual cash inflows and outflows under both methods.

Accounting Standards and Regulations

Source: ledgergurus.com

The choice between cash and accrual accounting methods isn’t arbitrary; it’s governed by a framework of accounting standards and regulations. These frameworks ensure consistency and comparability in financial reporting across businesses and jurisdictions. Understanding these standards is crucial for businesses to comply with legal requirements and present accurate financial pictures.

The application of these accounting methods is significantly influenced by the regulatory environment. Different countries and regions have varying accounting standards, which can impact the selection and implementation of the method suitable for a specific business.

Accounting Standards Governing Each Method

Various accounting standards, such as Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS), dictate how businesses should account for transactions. These standards often mandate the accrual method for most situations, recognizing revenue and expenses when they are earned or incurred, rather than when cash changes hands.

Regulations Impacting the Choice of Accounting Method

Regulations can impact the choice of accounting method in several ways. Tax regulations, for instance, often influence the accounting method used for tax purposes. Specific industries may also have unique regulatory requirements that affect the application of cash or accrual accounting. Legal requirements for financial reporting often specify the method businesses must use for external reporting, ensuring transparency and accountability.

Comparison of Regulations Across Jurisdictions

Different jurisdictions have different regulatory frameworks regarding accounting methods. The United States, for instance, generally prefers the accrual method, while some other countries might allow or even require the cash method for certain circumstances, particularly for small businesses. The complexity of the regulatory landscape often necessitates a thorough understanding of the specific requirements within each jurisdiction.

Summary of Relevant Accounting Standards and Regulations

| Standard | Description | Application |

|---|---|---|

| GAAP (US) | Generally Accepted Accounting Principles are a set of accounting standards that are generally followed by companies in the United States for financial reporting purposes. | Accrual accounting is typically required for most financial reporting under GAAP. |

| IFRS (International) | International Financial Reporting Standards are a set of accounting standards that are used globally by many companies for financial reporting purposes. | Accrual accounting is typically required for most financial reporting under IFRS. |

| Tax Regulations (Specific Country) | Tax regulations in a given country dictate the accounting method acceptable for tax purposes. | These regulations may differ significantly from accounting standards and allow for the use of cash accounting in some circumstances. |

| Industry-Specific Regulations | Certain industries may have unique regulatory requirements that affect the accounting method used. | Examples include regulations in financial services or healthcare that may specify the accounting method. |

This table provides a high-level overview of the accounting standards and regulations governing cash and accrual accounting. The specific application and nuances can vary greatly based on the jurisdiction, industry, and individual circumstances.

Practical Considerations

Source: advancedtax.ca

Choosing between cash and accrual accounting methods has significant implications for businesses, impacting their tax liabilities, financial reporting, and overall strategic decision-making. Understanding these practical considerations is crucial for making an informed choice that aligns with a company’s specific needs and goals.

A careful analysis of the potential advantages and disadvantages of each method is essential. This includes evaluating the impact on financial statements, the tax implications, and the challenges and benefits associated with implementing each approach in different operational contexts.

Tax Implications

The tax implications of each method are a primary concern for businesses. Cash accounting recognizes revenue when cash is received and expenses when cash is paid. This straightforward approach often leads to immediate tax deductions, resulting in potentially lower immediate tax burdens. However, it can also lead to deferral of taxes if revenue is recognized later than expenses. Accrual accounting, on the other hand, recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This method, while potentially resulting in higher tax liabilities in certain periods, provides a more accurate picture of the company’s financial performance and position over time. It often results in a more even distribution of tax obligations across the financial year.

Impact on Financial Reporting and Analysis

The chosen accounting method significantly affects the accuracy and clarity of financial reporting and analysis. Cash accounting presents a snapshot of the company’s immediate financial situation, while accrual accounting offers a more comprehensive view of its overall financial health and performance. Analyzing financial statements prepared under different methods can reveal potential misinterpretations and inaccuracies. Accrual accounting, by reflecting the timing of revenue recognition and expense accrual, provides a more accurate measure of profitability and operating performance over a period, offering a more robust basis for financial analysis.

Examples of Challenges and Benefits in Different Contexts

The optimal accounting method varies significantly depending on the business context. A small, rapidly growing startup might find cash accounting more manageable initially, allowing for easier tracking of immediate cash flows. However, as the company matures and its revenue stream becomes more complex, the accrual method may become necessary for accurate financial reporting and informed decision-making. Established businesses in industries with longer sales cycles, such as construction or manufacturing, often benefit significantly from accrual accounting to provide a more accurate reflection of long-term profitability and obligations. Conversely, a company with highly fluctuating cash inflows and outflows might find cash accounting more suitable for immediate cash flow management.

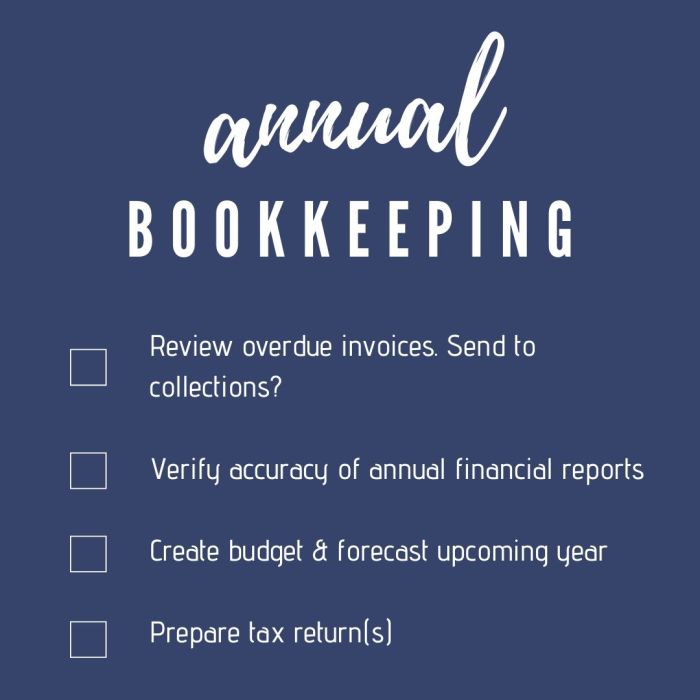

Considerations in Choosing an Accounting Method

Selecting the appropriate accounting method is a crucial decision with long-term implications. Several factors should be carefully evaluated before making a choice. The factors are not mutually exclusive and must be weighed in conjunction to arrive at the most appropriate decision.

- Business Size and Complexity: Smaller businesses with simpler operations might find cash accounting easier to implement and manage. Larger businesses with complex transactions and long-term contracts will likely benefit from the greater detail and accuracy provided by accrual accounting. Companies with seasonal revenue or significant inventory management might need accrual accounting to accurately represent the revenue and expense flow throughout the year.

- Industry Standards and Regulations: Certain industries are required to use specific accounting methods. Publicly traded companies, for instance, are almost universally required to use accrual accounting to meet regulatory requirements. Businesses operating in industries with specific reporting requirements, like healthcare or finance, might also be bound by industry standards requiring accrual accounting.

- Financial Reporting Needs: The needs of stakeholders (investors, lenders, and management) should be considered. Accrual accounting often provides a more comprehensive picture of financial performance and allows for a more nuanced financial analysis. The type of information desired by stakeholders should influence the accounting method selected.

- Tax Implications and Strategies: The potential tax implications associated with each method should be carefully weighed. A business might choose the method that minimizes immediate tax liabilities, but it should be aware of the long-term tax consequences. Understanding tax laws and regulations is essential for effective financial planning.

End of Discussion

In conclusion, understanding the differences between cash and accrual accounting methods is essential for informed business decisions. While cash accounting offers simplicity and a direct reflection of cash flow, accrual accounting provides a more comprehensive view of profitability and long-term financial health. The choice depends on the specific needs and characteristics of the business, as well as the applicable accounting standards and regulations. Ultimately, selecting the appropriate method ensures accurate financial reporting and supports sound business practices.