Bookkeeping Process Step by Step A Practical Guide

Bookkeeping process step by step guides you through the essential steps for organizing and managing your financial records. From initial setup to creating reports, this comprehensive guide provides practical advice and clear instructions for anyone looking to improve their bookkeeping skills.

This guide covers the fundamental aspects of setting up a bookkeeping system, including choosing software, creating a chart of accounts, and recording various transactions. It emphasizes the importance of accurate record-keeping and provides practical examples for different types of businesses. Furthermore, it details how to maintain accurate records, identify common errors, and generate financial statements.

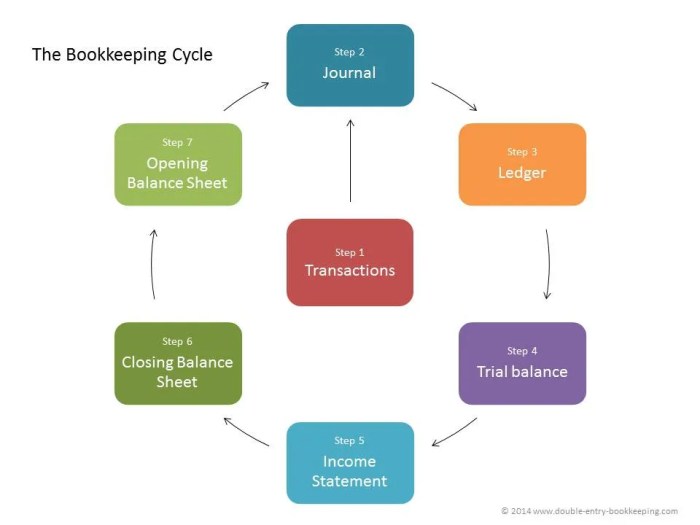

Initial Setup and Chart of Accounts

Source: double-entry-bookkeeping.com

A robust bookkeeping system begins with a meticulous initial setup. This phase establishes the foundation for accurate and organized financial records, ensuring clarity and traceability of transactions throughout the business lifecycle. A well-structured chart of accounts is crucial for categorizing transactions, facilitating financial reporting, and enabling informed decision-making.

A carefully crafted initial setup streamlines the entire bookkeeping process. By implementing a clear and consistent system from the outset, you pave the way for efficient data management, enabling easier reconciliation and financial analysis. This meticulous preparation minimizes errors and ensures that financial records are always reliable.

Choosing a Bookkeeping Software Program

Selecting the right software is paramount for efficient bookkeeping. Consider factors such as ease of use, features (e.g., invoicing, expense tracking, reporting), scalability to accommodate future growth, and integration with other business tools. Research different software options and their pricing models to find the best fit for your specific needs and budget.

Creating a Chart of Accounts, Bookkeeping process step by step

A chart of accounts is a structured list of accounts used to categorize and track transactions. A well-defined chart of accounts provides a clear framework for organizing financial data, enabling the creation of accurate financial statements and reports.

Developing a Chart of Account Categories and Subcategories

A detailed chart of accounts, meticulously categorized, offers significant advantages. This structured approach enhances the clarity and organization of financial records, facilitating efficient data analysis and management. The structure should be adaptable to the specific needs of the business.

| Category | Subcategories | Description |

|---|---|---|

| Assets | Cash, Accounts Receivable, Inventory, Prepaid Expenses, Property, Plant, and Equipment | Represents resources owned by the business. |

| Liabilities | Accounts Payable, Salaries Payable, Notes Payable, Loans Payable | Represents obligations of the business to others. |

| Equity | Owner’s Equity, Retained Earnings | Represents the residual interest in the assets of the business after deducting liabilities. |

| Revenue | Sales Revenue, Service Revenue, Interest Revenue | Represents the income generated from the primary business activities. |

| Expenses | Cost of Goods Sold, Salaries Expense, Rent Expense, Utilities Expense, Marketing Expense | Represents the costs incurred in running the business. |

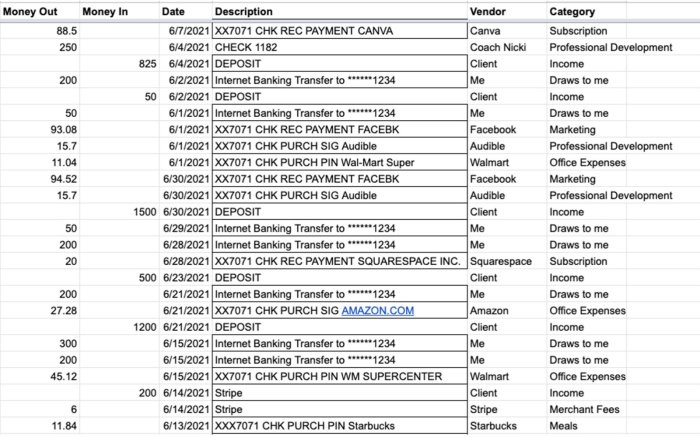

Recording Transactions

Source: workful.com

Recording transactions accurately and consistently is fundamental to sound bookkeeping. This process involves meticulously documenting all financial activities, ensuring a clear audit trail and facilitating accurate financial reporting. Properly recording transactions allows for the calculation of profit or loss, the tracking of assets and liabilities, and the identification of areas for potential improvement.

A well-structured transaction recording system is crucial for any business. This system should be designed to capture all relevant details, enabling swift and accurate analysis of financial performance. It should facilitate the identification of trends, patterns, and potential risks, thereby enabling proactive decision-making.

Different Types of Transactions

Various financial activities constitute transactions. These include sales, purchases, expenses, and payments. Each transaction type requires careful documentation to ensure that the bookkeeping process is accurate and comprehensive. For example, a sale transaction records revenue generated by a business, while a purchase transaction records the cost of goods acquired. Expenses reflect the costs incurred in running the business, and payments represent funds disbursed.

Transaction Documentation and Source Documents

Accurate transaction recording hinges on proper documentation. Source documents serve as the primary evidence for each transaction. These documents include invoices, receipts, bank statements, and purchase orders. These source documents provide verifiable evidence of the transaction’s details, enabling auditors to validate the recorded entries. For instance, an invoice from a supplier details the goods or services purchased, the quantity, the price, and other crucial information.

Methods for Recording Transactions

Various methods exist for recording transactions. One common method is double-entry bookkeeping. This method involves recording each transaction in at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) remains balanced. This method ensures that every transaction affects at least two accounts, maintaining the balance sheet’s accuracy.

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Double-Entry Bookkeeping | Each transaction affects at least two accounts. | Maintains the accounting equation balance, enhancing accuracy. | Can be more complex for beginners, requiring more knowledge. |

| Single-Entry Bookkeeping | Transactions are recorded in a single account. | Simpler to implement for small businesses with limited transactions. | Less accurate and prone to errors, making it unsuitable for complex businesses. |

Handling Cash Transactions

Cash transactions are handled differently from transactions involving bank accounts. Detailed records of all cash receipts and payments are essential. This includes recording the date, amount, and description of each transaction. This meticulous documentation allows for a precise accounting of cash inflows and outflows.

Bank Reconciliations

Regular bank reconciliations are vital to maintain the accuracy of the books. This process involves comparing the company’s records of cash transactions with the bank’s records. Discrepancies, if any, must be investigated and resolved. Reconciliations are crucial for identifying errors or fraudulent activities, ensuring the accuracy of financial statements. For instance, a bank statement might show a deposit that isn’t reflected in the company’s records, which needs investigation.

Maintaining Records and Reporting

Maintaining accurate records and generating insightful reports are crucial aspects of successful bookkeeping. These processes provide a clear picture of a business’s financial health, enabling informed decision-making. Thorough record-keeping allows for easy identification of trends, potential issues, and areas for improvement.

Accurate records are essential for preparing reliable financial statements, which are vital for investors, creditors, and internal stakeholders. These statements provide a snapshot of a company’s financial performance over a specific period. Well-maintained records also facilitate tax compliance and ensure that financial reporting meets regulatory requirements.

Maintaining Accurate Records

Thorough record-keeping is critical for the reliability of financial data. This involves meticulous documentation of all transactions, ensuring all entries are properly categorized and validated. Regularly backing up data is equally important to prevent data loss due to unforeseen circumstances.

- Data Backup Strategies: Implementing a robust data backup strategy is paramount. This includes regularly backing up data to an external hard drive, cloud storage, or a combination of both. Automated backups are highly recommended for continuous protection. Establish a schedule for backups, ensuring they are performed at least weekly. Test the restoration process periodically to ensure data integrity.

- Record Retention: Adhering to the necessary record retention policies is critical. These policies are influenced by industry regulations and local laws. It’s vital to understand and follow the specific retention requirements for your business.

Preventing Bookkeeping Errors

Recognizing and mitigating common bookkeeping errors is crucial for maintaining accurate financial records. Carelessness in data entry, incorrect categorization of transactions, and overlooking crucial details can lead to inaccurate reports and financial statements.

- Data Entry Errors: Double-checking data entry is essential to prevent errors. Using a spreadsheet software with built-in validation features or employing data entry checks can significantly reduce mistakes. Implementing data entry controls, such as having two people independently verify transactions, can further mitigate errors.

- Transaction Categorization Errors: Thorough understanding of accounting principles and careful categorization of transactions are vital for accurate reporting. Utilizing accounting software with predefined transaction categories or creating a detailed chart of accounts will assist in proper categorization.

- Ignoring Crucial Details: Paying close attention to all aspects of a transaction is vital. This includes dates, amounts, descriptions, and supporting documents. Neglecting any of these elements can lead to inaccuracies in the financial records.

Preparing Financial Statements

Financial statements, including the income statement, balance sheet, and cash flow statement, are essential for evaluating a company’s financial performance and position.

- Income Statement: The income statement reports a company’s revenues and expenses over a specific period, typically a month, quarter, or year. It reveals the company’s profitability and operating performance. A common formula for net income is: Revenue – Expenses = Net Income.

- Balance Sheet: The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

- Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of a company over a period. It’s crucial for evaluating a company’s liquidity and ability to meet its short-term obligations.

Using Bookkeeping Records for Decision-Making

Bookkeeping records provide valuable insights for informed business decisions. Analyzing trends, identifying areas for improvement, and forecasting future performance are facilitated by thorough bookkeeping.

- Trend Analysis: Analyzing historical data to identify trends in revenue, expenses, and profitability is crucial. This enables proactive adjustments to strategies and helps anticipate future performance.

- Identifying Areas for Improvement: Analyzing financial statements can pinpoint areas where costs can be reduced or revenue can be increased. This allows for targeted improvements and strategic planning.

- Forecasting: Using historical data and current trends to forecast future performance allows for proactive planning and resource allocation.

Financial Reports and Their Purposes

A table illustrating various financial reports and their purposes follows.

| Report | Purpose |

|---|---|

| Income Statement | Summarizes revenues and expenses over a period to determine profitability. |

| Balance Sheet | Provides a snapshot of assets, liabilities, and equity at a specific point in time. |

| Cash Flow Statement | Tracks cash inflows and outflows over a period, assessing liquidity and solvency. |

| Profit and Loss Statement | Alternative term for Income Statement. |

| Statement of Retained Earnings | Details changes in retained earnings over a period. |

Last Recap: Bookkeeping Process Step By Step

In conclusion, mastering the bookkeeping process step by step empowers businesses to make informed decisions, track financial performance, and ensure accurate financial reporting. By understanding and implementing the Artikeld procedures, you can gain a deeper understanding of your financial position and make strategic moves towards achieving your financial goals. The practical examples and tables provided offer a clear pathway to success for any business owner.