Bookkeeping Checklist for Small Business A Comprehensive Guide

Bookkeeping checklist for small business is crucial for maintaining financial health and avoiding potential pitfalls. This guide provides a structured approach to organizing your financial records, ensuring accurate tracking of income and expenses, and enabling informed decision-making. Whether you’re a service-based business, a retail store, or a freelancer, this checklist will equip you with the tools to streamline your bookkeeping processes.

This comprehensive checklist covers essential elements like daily tasks, transaction categorization, and record keeping. It also delves into specific needs for various business types, from service-based ventures to retail operations, outlining tailored checklists for each. Furthermore, it highlights best practices for implementing and maintaining a robust bookkeeping system, including integration with accounting software and strategies for regular review and updates. Finally, it emphasizes the importance of backup and archiving procedures and how the checklist can help proactively identify potential financial issues.

Essential Elements of a Bookkeeping Checklist: Bookkeeping Checklist For Small Business

Source: pattonaccounting.net

A well-structured bookkeeping checklist is crucial for small businesses to maintain accurate financial records. It ensures timely recording of transactions, facilitates efficient tax preparation, and provides valuable insights into the company’s financial health. This checklist Artikels essential elements, from daily tasks to crucial reconciliation procedures, to help streamline your bookkeeping process.

Effective bookkeeping is more than just recording transactions; it’s about organizing them in a way that allows for analysis, trend identification, and strategic decision-making. A comprehensive checklist ensures consistency and minimizes errors, ultimately leading to more accurate financial reporting.

Essential Tasks for a Bookkeeping Checklist

A robust bookkeeping checklist should include critical tasks to ensure all financial activities are documented accurately and completely. This includes tracking income, expenses, and all transactions, facilitating efficient tax reporting. These tasks are essential for a healthy financial record.

-

- Record all income and expenses:

This encompasses documenting every transaction, including cash sales, credit card payments, and invoices. Accurate recording ensures a complete picture of financial activity.

-

- Categorize transactions:

Categorization is key for analysis. Classifying transactions into specific expense or income categories allows for better understanding of financial flows and trends.

-

- Maintain accurate records of receipts and invoices:

Properly storing and organizing receipts and invoices ensures compliance and helps verify transactions. It is essential to preserve receipts and invoices as evidence of transactions for both internal and external audits.

-

- Reconcile bank statements regularly:

Comparing bank statements with internal records is crucial for identifying discrepancies. Early reconciliation helps prevent financial errors.

-

- Track inventory, if applicable:

If applicable, maintain a clear record of inventory levels and costs. This is crucial for calculating COGS (Cost of Goods Sold).

-

- Record payroll information:

Accurate payroll recording is essential for compliance and financial reporting. This includes calculating salaries, taxes, and deductions.

-

- Generate reports:

Regularly generating reports like profit and loss statements, balance sheets, and cash flow statements is crucial for evaluating business performance.

-

- Pay bills on time:

Timely payment of bills ensures smooth operations and avoids late fees. This is essential for maintaining good vendor relationships.

-

- File required tax documents:

Keeping track of tax-related documents and ensuring timely filing prevents penalties. This includes receipts, invoices, and expense reports.

-

- Maintain confidentiality of financial data:

Protect sensitive financial data to avoid unauthorized access and maintain compliance with regulations. This includes passwords and access control measures.

Daily Bookkeeping Checklist Template

A daily checklist ensures consistent record-keeping. This template provides a structured approach for handling daily bookkeeping tasks.

| Task | Estimated Time (minutes) |

|---|---|

| Record daily transactions | 15-30 |

| Categorize transactions | 10-20 |

| Update accounting software | 10-15 |

| Review bank statements | 5-10 |

| Pay bills | 15-20 |

| Record expenses | 5-10 |

| File receipts | 5 |

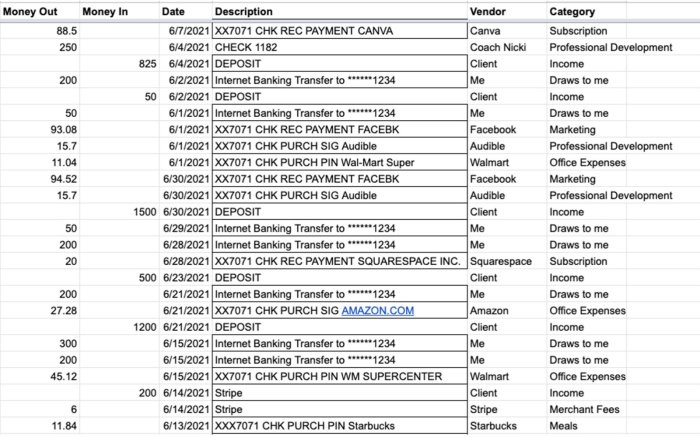

Categorizing Transactions

Categorizing transactions allows for detailed analysis. This is vital for tracking specific revenue streams and expenses, enabling a clear understanding of financial performance.

By categorizing transactions, you can identify areas of high expenditure or revenue, enabling data-driven decisions to optimize business operations. This is a fundamental aspect of bookkeeping for small businesses, enabling effective financial management and informed decision-making.

Recording Receipts, Invoices, and Expenses

A clear system for recording receipts, invoices, and expenses is crucial for accuracy and compliance.

- Receipts: Store in a secure location and ensure accurate descriptions of the goods or services.

- Invoices: Maintain a separate folder for invoices received and those sent. Double-check the accuracy of the amounts and descriptions.

- Expenses: Categorize expenses for efficient reporting and tax purposes.

Reconciling Bank Statements

Reconciling bank statements is a crucial step in bookkeeping.

- Compare: Compare bank statements with your internal records.

- Identify discrepancies: Identify any discrepancies between the two sets of records.

- Investigate: Investigate the source of any discrepancies and make necessary corrections to your records.

Specific Bookkeeping Tasks for Different Business Types

Source: finaccountants.com

A crucial aspect of running a successful small business is maintaining accurate and up-to-date bookkeeping records. This ensures financial transparency, facilitates informed decision-making, and simplifies tax preparation. Different business structures have unique bookkeeping needs, and tailoring a checklist to each type is essential for efficiency and compliance.

Effective bookkeeping systems are not just about recording transactions; they are about organizing financial information to provide a clear picture of the business’s financial health. This enables business owners to track performance, identify areas for improvement, and make sound financial projections.

Service-Based Small Business Bookkeeping Checklist

This checklist focuses on the specific bookkeeping tasks for a service-based small business. These businesses primarily sell services rather than products.

- Track time spent on each project: Accurate time tracking is essential for calculating billable hours and accurately determining project costs. This data is vital for invoicing and profitability analysis.

- Manage client invoices and payments: Prompt invoicing and timely collection of payments are key for maintaining cash flow. This involves sending invoices, following up on outstanding payments, and recording payments received.

- Record expenses related to services: This includes tracking marketing expenses, supplies, and any other costs directly associated with providing services.

- Monitor and track income from clients: Keep detailed records of all income generated, including fees and payments received.

- Prepare regular financial statements: Reviewing income statements, balance sheets, and cash flow statements is crucial for assessing financial performance and identifying potential issues.

Retail Business Bookkeeping Checklist (Including Inventory Management)

For retail businesses, inventory management is a critical aspect of bookkeeping. This section outlines Artikels essential tasks.

- Track inventory levels: Using a perpetual inventory system, consistently monitor the quantity of goods on hand. This ensures that you don’t run out of stock and can accurately value inventory.

- Record purchases of inventory: Maintain a detailed record of all inventory purchases, including costs, quantities, and supplier information.

- Record sales of inventory: Accurately track all sales transactions, including the quantity and price of items sold. This information is essential for calculating sales revenue and cost of goods sold.

- Calculate cost of goods sold (COGS): Use inventory data to calculate COGS, a crucial component of the income statement.

- Manage returns and exchanges: Properly account for returns and exchanges, updating inventory levels and adjusting sales records accordingly.

Bookkeeping Checklist for Freelance Businesses vs. Small Companies

Freelance businesses and small companies with employees differ significantly in their bookkeeping requirements.

- Freelancers: Typically handle their own finances and record transactions directly. Their checklist primarily focuses on tracking income, expenses, and invoicing.

- Small Companies: Involve multiple employees, necessitating a more comprehensive bookkeeping system to manage payroll, employee deductions, and other company-related expenses. This requires a more structured accounting system and potentially specialized software.

Tracking Sales Tax Obligations

Sales tax obligations vary based on the business type and location. This checklist provides a general framework.

- Determine applicable sales tax rates: Research and understand the sales tax rates applicable to your business location and the products or services you offer.

- Collect sales tax from customers: Implement a system to collect sales tax on all applicable transactions.

- Track sales tax collected: Maintain accurate records of sales tax collected from customers.

- File sales tax returns: Prepare and file sales tax returns regularly, usually monthly or quarterly, depending on the requirements of the tax jurisdiction.

Handling Payroll and Employee Deductions

Payroll and employee deductions are essential for small businesses with employees. This checklist provides guidance.

- Calculate employee wages: Accurately calculate employee wages based on hours worked and pay rates.

- Track employee deductions: Record all applicable deductions, such as federal and state income tax, Social Security, Medicare, and health insurance premiums.

- Prepare and distribute paychecks: Prepare and distribute paychecks to employees on a regular schedule.

- File payroll taxes: File payroll tax returns and make payments to the relevant tax authorities on time.

Implementing and Maintaining a Bookkeeping Checklist

A robust bookkeeping checklist is only effective when consistently implemented and maintained. This process ensures accuracy, efficiency, and facilitates the early identification of potential financial issues. Proper integration with accounting software and a system for regular review and updates are crucial elements.

Effective bookkeeping is not a one-time task; it’s an ongoing process requiring consistent attention to detail and adaptation to evolving business needs. A well-maintained checklist allows businesses to stay on top of their financial records, making informed decisions and avoiding costly errors.

Integrating the Checklist into Accounting Software

Implementing a bookkeeping checklist within existing accounting software streamlines the process and reduces manual data entry. This integration enhances accuracy and consistency. Several methods exist, including custom fields within the software to flag tasks, or linking checklist items to specific transactions. For example, tagging invoices as “paid” or “pending” directly within the accounting system automates the checklist process and reduces the risk of errors.

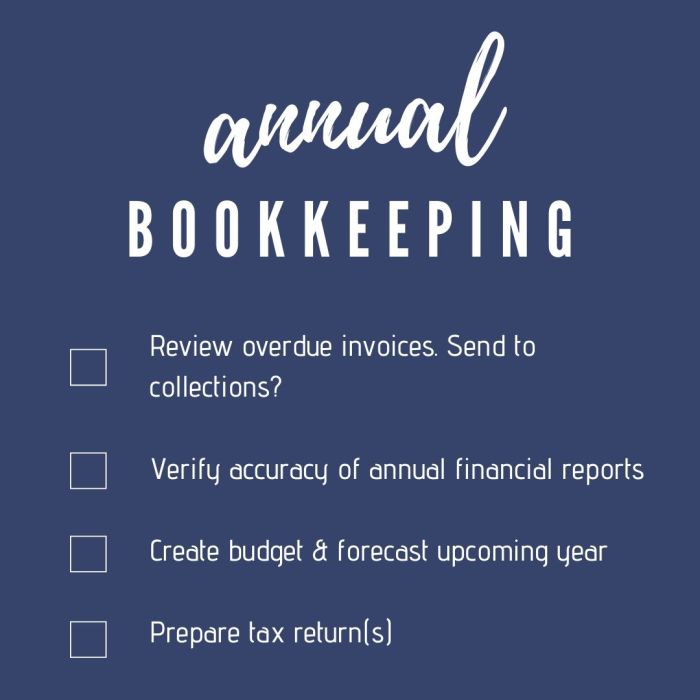

Regularly Reviewing and Updating the Checklist

Regularly reviewing and updating the checklist is essential for maintaining its relevance. Businesses should assess the checklist’s effectiveness at least quarterly. This review should consider changes in business operations, industry best practices, and new accounting regulations. Updating the checklist ensures that it remains aligned with current business needs. For example, a growing retail business might need to add new tasks related to inventory management.

Maintaining Accuracy and Organization, Bookkeeping checklist for small business

Maintaining the accuracy and organization of the bookkeeping checklist is critical. A clear system for documenting updates and revisions is essential. Use a version control system, similar to those used for software development, to track changes. This approach allows for easy identification of past issues and facilitates the return to previous versions if needed. Using a dedicated spreadsheet for checklist management, with clear labeling and formatting, can enhance organization.

Checklist for Backing Up and Archiving Bookkeeping Records

A robust backup and archiving strategy is vital for preserving financial records. A checklist ensures compliance with regulations and prevents data loss. This checklist should include steps for regular backups, the frequency of backups (e.g., daily, weekly), and the storage location for backups. The checklist should also detail the procedure for archiving older records, setting a timeline for archiving, and specifying the storage medium. For example, storing backups in an off-site location, like a cloud storage service, adds an extra layer of protection.

Using the Checklist to Identify Potential Financial Issues

The bookkeeping checklist can serve as a proactive tool for identifying potential financial issues early. Regular review of the checklist can highlight inconsistencies or delays in completing tasks, such as late invoice payments or slow cash flow. This early detection allows for timely intervention and prevents more significant problems. For example, if the checklist consistently shows delays in recording sales, it might signal a problem with the sales team’s efficiency or the sales process itself. Analyzing these trends helps to make proactive adjustments and maintain financial health.

Last Point

In conclusion, this bookkeeping checklist for smallbusinessess provides a robust framework for managing your finances effectively. By implementing the strategies and checklists in this guide, you can gain a clearer understanding of your financial position, making informed decisions, and ultimately contributing to the growth and success of your small business. Remember, consistent use and adaptation to your specific business needs are key to maximizing the benefits of this comprehensive resource.