Bookkeeping App for iOS and Android A Comprehensive Guide

Bookkeeping app for iOS and Android has become increasingly important for individuals and small businesses alike. This guide explores the diverse landscape of these apps, examining their functionalities, user experiences, and crucial factors like security and pricing. We’ll delve into the essential features of top bookkeeping apps, comparing free and paid options, and analyzing user interfaces across different platforms.

From personal finance management to sophisticated small business accounting, this guide provides a comprehensive overview of available apps. We’ll also explore how these apps integrate with other financial tools, ensuring a seamless workflow. Furthermore, we’ll address security, pricing, and customer support to help you choose the best bookkeeping app for your needs.

Introduction to Bookkeeping Apps

Bookkeeping apps have become indispensable tools for individuals and small businesses, streamlining the record-keeping process and simplifying financial management. These apps offer a wide range of features to cater to diverse needs, from personal budgeting to complex business accounting. Their user-friendly interfaces and automated functionalities make them a valuable asset for efficient financial administration.

Overview of Bookkeeping Apps

Bookkeeping apps for iOS and Android devices provide a comprehensive suite of tools for managing financial transactions. These apps cover a broad spectrum of functionalities, including recording income and expenses, generating reports, and tracking budgets. Their accessibility and ease of use make them attractive options for users of all technical levels.

Core Functionalities of Bookkeeping Apps

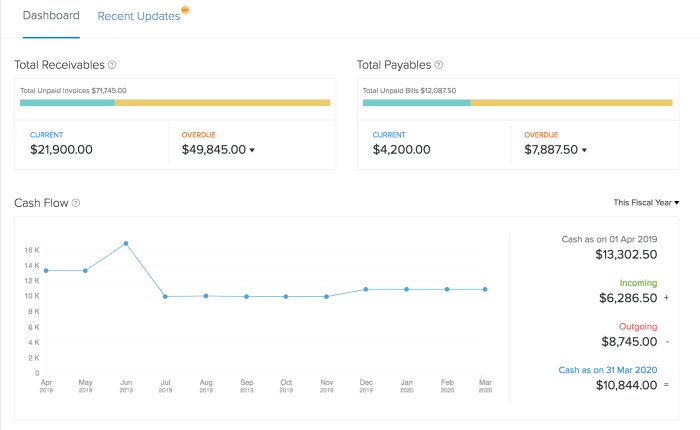

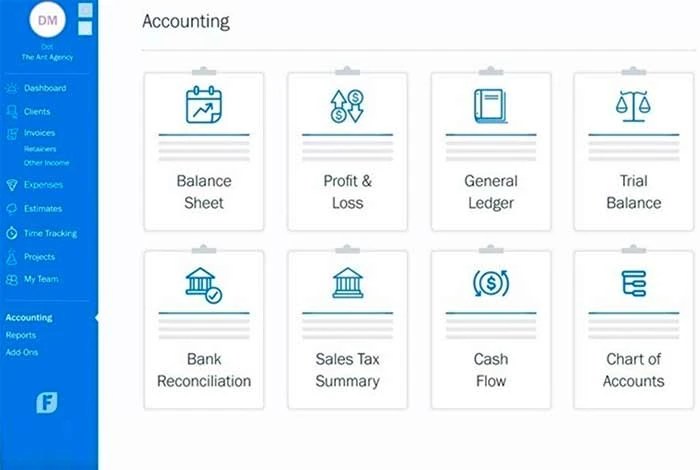

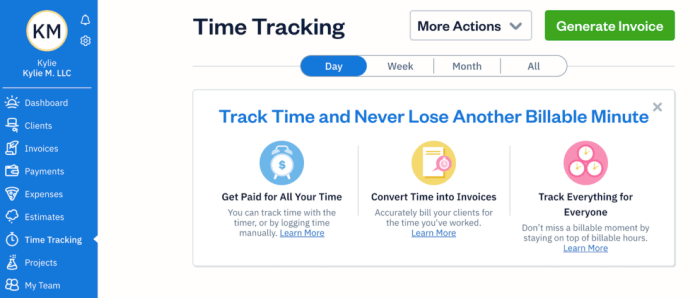

These apps typically offer core functionalities such as inputting transactions, categorizing expenses, generating financial statements (like income statements and balance sheets), tracking budgets, and creating customized reports. Integration with bank accounts often streamlines the process of importing transactions.

Types of Bookkeeping Apps

Bookkeeping apps cater to a variety of users, ranging from personal finance management to small business accounting. Personal apps focus on budgeting, expense tracking, and bill paying, while small business apps offer more robust features for inventory management, invoicing, and financial reporting. Some apps cater to specific industries, providing tailored solutions.

Comparison of Bookkeeping Apps

| App Name | Category | Key Features | Platform |

|---|---|---|---|

| Mint | Personal Finance | Budgeting, expense tracking, bill payment, band ank account integration | iOS, Android |

| QuickBooks Self-Employed | Small Business | Invoicing, expense tracking, financial reporting, and inventory management | iOS, Android |

| Wave | Small Business | Invoicing, expense tracking, accounting, and customer management | iOS, Android |

| Personal Capital | Personal Finance | Investment tracking, portfolio management, and financial planning | iOS, Android |

| Xero | Small Business | Accounting, invoicing, expense tracking, financial reporting, and inventory management | iOS, Android |

This table provides a concise overview of different categories of bookkeeping apps. Note that specific features may vary between different app versions and subscription tiers.

Features and Functionality

A good bookkeeping app should streamline financial management, making record-keeping efficient and accessible. This section explores the core features of effective bookkeeping apps, contrasting free and paid options, and analyzing user interfaces. We will also examine the processes involved in setting up and maintaining accounts within these applications.

Essential features of a robust bookkeeping app include the ability to categorize transactions, track income and expenses, generate reports, and integrate with other financial tools. These functionalities empower users to gain a comprehensive understanding of their financial health.

Essential Features of Bookkeeping Apps

A well-designed bookkeeping app should offer a range of features to cater to diverse user needs. Key functionalities include transaction recording, categorization, and reporting. Effective apps also allow users to customize views, set budgets, and export data for analysis.

- Transaction Recording: The app should allow users to easily input transaction details, including date, description, amount, and category. This data forms the foundation for financial analysis and reporting.

- Categorization: Accurate categorization of transactions is critical for generating meaningful reports and understanding spending patterns. The app should provide pre-defined categories or allow users to create custom ones.

- Reporting: Generating various financial reports, such as income statements, expense summaries, and balance sheets, is essential for monitoring financial performance. A good app will provide customizable report options.

- Budgeting: Budgeting tools enable users to set financial goals and track progress towards them. This feature often includes the ability to set spending limits and receive alerts when budgets are exceeded.

- Customization: The ability to personalize views and data presentation is crucial for the user experience. This can involve choosing preferred formats for displaying information and adjusting settings for specific needs.

- Data Export: The ability to export data to other applications or formats, such as spreadsheets, is beneficial for analysis and integration with other financial tools.

Free vs. Paid Bookkeeping Apps

Free bookkeeping apps often come with limited features and functionality compared to paid options. Paid apps usually offer more comprehensive features, advanced reporting tools, and greater customization options.

- Free Apps: Free apps typically offer basic transaction recording, limited reporting, and basic budgeting capabilities. They often have ads and limited data storage.

- Paid Apps: Paid apps usually offer a wider range of features, including advanced reporting, customizable dashboards, and robust data storage. They often integrate with other financial services and provide better customer support.

User Interface Comparison

User interface design significantly impacts the user experience. Intuitive interfaces are crucial for ease of use and navigation.

- App A: App A has a clean, modern design with clear categorization and reporting features. Navigation is straightforward.

- App B: App B boasts a simple, easy-to-understand interface. However, its reporting features are somewhat limited compared to App A.

- App C: App C’s interface is visually appealing but might be slightly more complex to navigate for beginners. It offers extensive customization options.

Popular App Feature Comparison

This table illustrates the availability of popular features in different bookkeeping apps.

| Feature | App A | App B | App C |

|---|---|---|---|

| Transaction Recording | Excellent | Good | Very Good |

| Categorization | Excellent | Good | Excellent |

| Reporting | Advanced | Basic | Comprehensive |

| Budgeting | Yes | Yes | Yes |

| Data Export | Yes | Yes | Yes |

Creating and Managing Accounts

The process of creating and managing accounts varies depending on the app. Most apps involve entering account details, linking bank accounts, and categorizing transactions.

- Account Creation: Users typically provide account information, such as name, type (e.g., checking, savings), and relevant details.

- Bank Account Linking: Many apps allow users to link their bank accounts for automatic transaction import. This process ensures accuracy and efficiency.

- Transaction Categorization: This step involves assigning transactions to specific categories to facilitate analysis and reporting. Some apps offer intelligent categorization features.

User Experience and Interface

A strong user experience (UX) is paramount for bookkeeping apps. Intuitive design significantly impacts user adoption and satisfaction. Users should easily navigate the app, input data accurately, and access reports quickly and effortlessly. Poor UX can lead to frustration and abandonment, ultimately impacting the app’s effectiveness.

Importance of Intuitive Design

Intuitive design in bookkeeping apps is crucial for user adoption and satisfaction. A well-designed interface streamlines the process of recording transactions, managing accounts, and generating reports. Users should feel confident and empowered when interacting with the app, not overwhelmed or confused. This reduces the learning curve and encourages consistent use.

User Experience Aspects of Different Apps

Many bookkeeping apps prioritize different aspects of the user experience. Some apps emphasize ease of data entry, while others focus on sophisticated reporting features. Some may excel in their visual design and layout, while others prioritize functional efficiency. A good bookkeeping app strikes a balance between these aspects, providing a seamless and intuitive experience. A user-friendly interface translates into increased productivity and accuracy in managing finances.

Examples of Excellent and Poor User Interface Design

Excellent examples of bookkeeping app design include intuitive dashboards for a quick overview, clearly labeled fields for data entry, and visually appealing reports with customisable layouts. Conversely, poorly designed apps often have cluttered interfaces, confusing navigation, or overly complex data entry forms, leading to user frustration and errors. Poorly designed reports may also lack key information or use difficult-to-understand charts.

Comparison of User Interface Elements

| App | Navigation | Data Entry | Reporting |

|---|---|---|---|

| App A | Clear menu structure, easily accessible options, contextual help | Simple, intuitive forms with auto-fill options; error prevention | Customizable reports, clear visualizations, and drill-down capabilities |

| App B | Unclear menu structure, hidden options, no immediate help | Complex forms with numerous fields, potential for errors | Basic reports, limited customization, no interactive elements |

| App C | Modern design, intuitive layout, quick access to key features | Clean design, smart input fields, real-time validation | Interactive charts, advanced filtering, and comprehensive summaries |

This table compares three hypothetical bookkeeping apps. The table highlights variations in navigation, data entry, and reporting features.

Common Usability Issues in iOS and Android Bookkeeping Apps

Common usability issues in bookkeeping apps include:

- Inconsistent design elements: Different apps use varying styles and layouts, leading to a confusing user experience. This inconsistency can make it difficult for users to navigate and find specific features across different apps.

- Complex data entry forms: Users may find it challenging to input data correctly into complex and poorly designed forms. This leads to errors, frustration, and reduced accuracy.

- Lack of intuitive navigation: Difficult-to-understand menus and navigation make it harder to access key features. This problem can significantly hinder the user’s ability to perform bookkeeping tasks efficiently.

- Poor reporting capabilities: Some apps may offer basic reports with limited customization options. This hinders the user’s ability to analyze their financial data effectively. Effective reporting capabilities are vital for informed decision-making.

These usability issues can impact user satisfaction and ultimately affect the overall efficiency of the bookkeeping process.

Integration and Connectivity

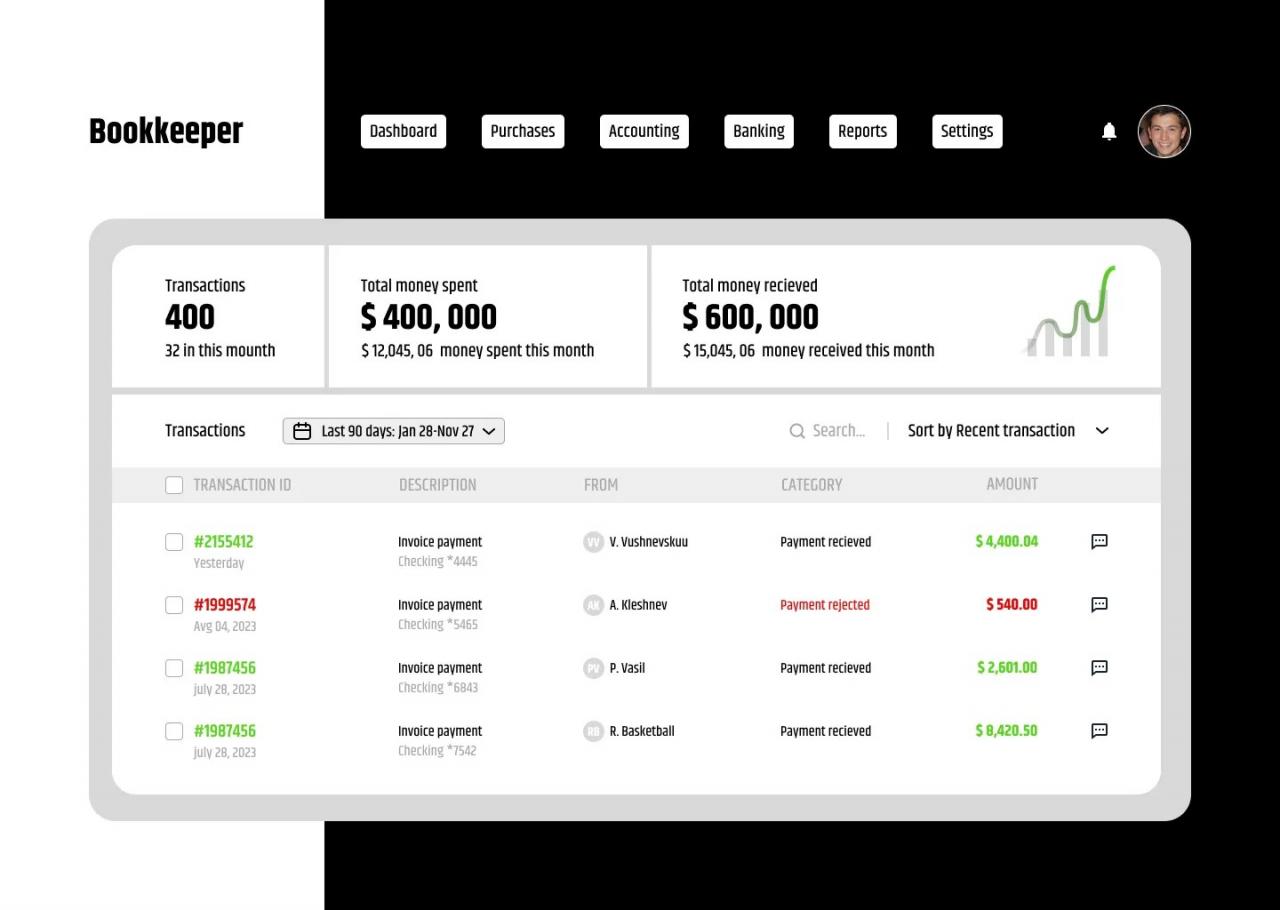

Source: dribbble.com

Bookkeeping apps are increasingly vital tools for managing personal and business finances. A key aspect of their utility lies in their ability to seamlessly integrate with other financial platforms, providing a holistic view of financial data. This integration streamlines the bookkeeping process and enhances the overall user experience.

The connectivity features of these apps extend beyond basic data entry. They offer a powerful mechanism for automated updates and real-time information, minimizing manual effort and ensuring accuracy. This interoperability is crucial for maintaining a complete and up-to-date financial record.

Integration with Financial Institutions

Modern bookkeeping apps offer robust integration with various financial institutions. This allows users to directly connect their bank accounts and credit cards, automatically importing transaction data. This automated process saves significant time and effort compared to manually inputting data.

- Bank Account Integration: Many apps support direct bank account integration through secure APIs. This process involves providing the app with read-only access to account data, enabling the app to automatically download transaction information.

- Credit Card Integration: Similar to bank account integration, apps can link credit cards. This allows for the automatic import of transaction details, enabling users to track spending and manage their finances efficiently. This automation minimizes the risk of human error and ensures the integrity of financial records.

Data Security Considerations

Data security is paramount when dealing with sensitive financial information. Bookkeeping apps employ various security measures to protect user data. These measures include encryption, secure storage, and multi-factor authentication. These precautions ensure the confidentiality and integrity of financial records.

- Encryption: Sensitive data, such as account numbers and transaction details, is encrypted both in transit and at rest, safeguarding against unauthorized access.

- Secure Storage: Data is stored in secure databases, often adhering to industry-standard security protocols, minimizing the risk of breaches and unauthorized access.

- Multi-factor Authentication (MFA): Robust security protocols often include MFA, requiring users to provide multiple forms of verification before accessing their accounts. This adds an extra layer of protection against unauthorized access.

Data Synchronization

A critical aspect of bookkeeping apps is their ability to synchronize data across multiple devices. This ensures that users have access to their financial information regardless of the device they are using. Different apps have varying synchronization capabilities, impacting their usefulness for users with multiple devices.

- Synchronization Across Devices: A core function of bookkeeping apps is data synchronization across various devices. This functionality ensures that financial records are accessible on a smartphone, tablet, or computer.

- Data Consistency: Effective synchronization mechanisms maintain consistency in data across all devices. Changes made on one device are reflected seamlessly on others, ensuring data integrity and preventing discrepancies.

Synchronization Process Detail

The synchronization process typically involves the app regularly downloading and uploading data to a central server. The app then mirrors the changes on the other devices. This is a background process, so users are unaware of its operation.

- Real-time Updates (optional): Some apps offer real-time updates, allowing users to see changes as they happen, enhancing responsiveness. This real-time functionality enhances the immediacy and usefulness of the data.

- Offline Access (optional): Some apps offer offline access to data. This enables users to view and manage their records even without an internet connection. This is particularly valuable in areas with limited or intermittent internet access.

Security and Privacy: Bookkeeping App For IOS And Android

Bookkeeping apps handle sensitive financial data, making robust security measures crucial. Users need assurance that their transactions and personal information are protected from unauthorized access and misuse. This section explores the security protocols employed by bookkeeping apps, emphasizing the importance of data encryption and protection, and examining real-world examples of breaches. It also articulates the privacy policies of popular apps and highlights best practices for account and data security.

Protecting financial data is paramount in the digital age. A strong security posture safeguards user trust and prevents financial losses due to data breaches. Many bookkeeping apps prioritize security through a combination of technical safeguards and user-centric practices.

Security Measures in Bookkeeping Apps

Various security measures are employed by bookkeeping apps to safeguard user data. These include robust encryption techniques, multi-factor authentication, and regular security audits. Data encryption, for instance, transforms sensitive data into an unreadable format, making it inaccessible to unauthorized individuals.

Importance of Data Encryption and Protection

Data encryption plays a vital role in safeguarding financial information. It converts data into an unreadable format, making it extremely difficult for unauthorized parties to access or manipulate it. Without robust encryption, sensitive data is vulnerable to theft or corruption. Strong encryption protocols are critical in preventing data breaches and maintaining user trust.

Examples of Data Breaches in Bookkeeping Apps

While detailed information on specific bookkeeping app breaches is often limited, publicly reported data breaches in financial services demonstrate the potential risks. For example, breaches in banking and financial institutions have highlighted the importance of robust security measures in safeguarding sensitive financial data. These incidents underscore the necessity for continuous security updates and rigorous security protocols in the development and maintenance of bookkeeping apps.

Privacy Policies of Popular Bookkeeping Apps

Popular bookkeeping apps generally include privacy policies outlining their data handling practices. These policies describe how personal data is collected, used, and protected. Users should carefully review these policies to understand the app’s commitment to data security. They should pay close attention to provisions related to data sharing, storage, and retention. Users should also understand how the app handles data breaches and notifies users of security incidents.

Best Practices for Securing Accounts and Data

Users can take proactive steps to enhance their account security in bookkeeping apps. These practices include choosing strong passwords, enabling multi-factor authentication (MFA), and regularly updating app software. Using unique and complex passwords for each account is crucial. MFA adds an extra layer of security by requiring a second verification method (e.g., a code sent to a phone). Keeping the app software up-to-date ensures that security vulnerabilities are patched.

Pricing and Plans

Bookkeeping apps offer varying pricing models to cater to diverse user needs and budgets. Understanding these models is crucial for selecting the most suitable app. This section details the different pricing strategies employed by various bookkeeping applications, enabling informed decisions.

Pricing models for bookkeeping apps typically fall into free and paid tiers, each offering distinct feature sets. Free versions often serve as a trial period or a limited-functionality option. Paid versions unlock more features and support, aligning with the user’s evolving needs. Paid tiers can vary significantly in terms of the breadth and depth of features offered.

Free Version Features

Free versions often provide a glimpse into the app’s functionality and user interface. They typically include basic accounting tools, such as transaction recording, categorized expense tracking, and simple reporting. The availability of advanced features like financial forecasting, automated reports, and collaboration tools may be limited or absent. The extent of these limitations depends heavily on the specific bookkeeping app.

Paid Version Features

Paid versions offer a wider range of features, enhancing the user experience and streamlining accounting processes. Features often include advanced reporting tools, comprehensive financial analysis, integration with other financial platforms, and enhanced security measures. Paid plans frequently offer more storage capacity and more features for advanced bookkeeping functions.

Comparison of Pricing Models

The following table compares the pricing models of three popular bookkeeping apps, highlighting the features available in their respective free and paid versions:

| App | Free Version Features | Paid Version Features | Cost |

|---|---|---|---|

| App A | Basic transaction recording, simple expense categorization, and limited reporting | Advanced reporting tools, financial analysis, integration with banks, unlimited storage | $9.99/month |

| App B | Transaction recording, basic budgeting tools, and limited customer support | Advanced analytics, custom dashboards, API access, priority customer support | $19.99/month |

| App C | Transaction recording, limited chart of accounts, basic reporting | Advanced chart of accounts, automated reconciliation, multi-user access, unlimited storage | $24.99/month |

Subscription Guide

This step-by-step guide details the process of subscribing to a premium plan for a bookkeeping app:

- Open the app on your device.

- Navigate to the “Pricing” or “Plans” section within the app’s menu.

- Select the desired premium plan.

- Enter your payment details, ensuring the correct billing information is provided.

- Review the plan details and confirm the subscription.

- The app will then process your payment and activate the premium features.

Customer Support and Help

Bookkeeping apps vary significantly in their support offerings, impacting user experience and satisfaction. Effective support ensures users can easily resolve issues, troubleshoot problems, and maximize the app’s benefits. This section explores the diverse approaches to customer support within popular bookkeeping apps.

Customer Support Methods

Different bookkeeping apps employ various support methods to assist users. Some apps prioritize email support, while others offer phone assistance or live chat. A combination of channels is often the most comprehensive approach. In-app help documentation plays a crucial role in addressing common queries. The availability and effectiveness of these channels vary considerably across different apps.

Quality of Customer Support

The quality of customer support is a key differentiator between bookkeeping apps. Apps with responsive and knowledgeable support teams are likely to receive higher user ratings and testimonials. Thorough documentation and well-structured FAQs are essential for self-service support. A quick response time and the ability to resolve issues efficiently are key aspects of high-quality support. Many apps provide tutorials and video guides to aid users in navigating the app and performing various tasks.

Channels for User Assistance

Users can seek assistance through multiple channels. Email support is a common method, allowing users to submit detailed inquiries. Phone support provides direct interaction with a support representative, which can be beneficial for complex problems. Live chat support offers real-time interaction, allowing for immediate clarification. In-app help features often include FAQs, tutorials, and guides to help users independently resolve common issues. The most effective apps combine multiple support channels to provide a comprehensive support experience.

Effectiveness of Support Mechanisms, Bookkeeping app for iOS and Android

The effectiveness of support mechanisms varies considerably between apps. Apps with comprehensive documentation and readily available FAQs tend to offer better self-service support. A fast response time and resolution of user issues are key indicators of effective support. The availability of multiple channels (e.g., email, phone, chat) allows users to choose the method that best suits their needs and preferences. The responsiveness and knowledge of the support staff significantly impact user satisfaction.

Support Channel Comparison

| App | Phone | Chat | In-App Help | |

|---|---|---|---|---|

| App A | Within 24 hours | Available during business hours | Within 30 minutes | Extensive FAQs, tutorials |

| App B | Within 48 hours | Limited hours | Variable response time | Basic FAQs, some guides |

| App C | Within 12 hours | Available 24/7 | Within 15 minutes | Comprehensive FAQs, interactive tutorials |

The table above provides a simplified comparison. Actual response times and support quality may vary based on the specific issue and the volume of support requests. Users should research and review customer feedback for specific apps before choosing.

Advantages and Disadvantages

Choosing the right bookkeeping app can significantly impact your financial management. Understanding the strengths and weaknesses of various options is crucial for making an informed decision. This section details the pros and cons of different bookkeeping apps, focusing on iOS and Android platforms, cloud-based solutions, and mobile apps versus desktop software.

Advantages of iOS and Android Bookkeeping Apps

Mobile bookkeeping apps offer unparalleled convenience and accessibility. They allow users to manage their finances on the go, whether at home, in the office, or out on the road. This flexibility is a key advantage.

- Accessibility and Portability: Users can access their financial data from virtually anywhere with an internet connection, greatly improving the speed and ease of record-keeping.

- Real-time Updates: Many apps offer real-time data synchronization, enabling immediate visibility of financial transactions.

- Convenience and Speed: Performing tasks like entering transactions, generating reports, and viewing balances is often faster and more efficient on mobile devices compared to traditional desktop methods.

- Cost-effectiveness: Mobile apps can be more cost-effective than dedicated desktop bookkeeping software, especially for small businesses with limited budgets.

Disadvantages of iOS and Android Bookkeeping Apps

Despite the advantages, mobile bookkeeping apps do have limitations. Connectivity issues, data security concerns, and a potential lack of advanced features can impact user experience.

- Dependence on Internet Connectivity: Cloud-based apps require a stable internet connection for access and synchronization. Interruptions can lead to data loss or inaccessibility.

- Limited Features Compared to Desktop Software: Some advanced features and functionalities available in desktop software might not be replicated in mobile versions. Complex reporting or customized dashboards might be less intuitive on smaller screens.

- Security Concerns: While many apps prioritize security, the risk of data breaches or unauthorized access remains a potential concern, especially with weak passwords or outdated security protocols.

- Potential for Data Entry Errors: Data entry errors can occur more easily on mobile devices due to smaller keyboards and less precise input methods. Double-checking is critical.

Advantages of Cloud-Based Bookkeeping Apps

Cloud-based bookkeeping apps provide significant advantages in terms of accessibility and collaboration.

- Accessibility from Anywhere: Cloud apps allow users to access and manage their finances from any location with an internet connection, boosting flexibility and remote work capabilities.

- Automatic Data Backups: Cloud storage automatically backs up data, minimizing the risk of data loss due to device failure or accidental deletion.

- Real-Time Collaboration: Many cloud-based apps allow multiple users to access and edit financial data simultaneously, facilitating collaboration among team members.

- Scalability: Cloud-based solutions can easily scale to accommodate growing business needs and can be upgraded without requiring substantial upfront investment in hardware or software.

Disadvantages of Cloud-Based Bookkeeping Apps

However, cloud-based apps are not without their drawbacks.

- Internet Dependency: The need for a constant and stable internet connection can be a significant disadvantage for users in areas with unreliable connectivity.

- Security Risks: While cloud providers invest in security, data breaches or unauthorized access are always possible, particularly if proper security protocols aren’t followed.

- Potential for Data Loss: While cloud storage generally has robust backup systems, data loss is still a possibility, though less likely than with locally stored data.

- Vendor Lock-in: Switching to a different cloud provider can be challenging and time-consuming, as data migration and integration may be complex.

Comparison of Different Bookkeeping Apps

Comparing different bookkeeping apps involves evaluating their features, pricing, and customer support.

- Feature Sets: Different apps offer varying levels of functionality, from basic accounting tools to advanced reporting and analytical capabilities. Consider your specific needs when selecting an app.

- User Interface: The app’s user interface (UI) plays a crucial role in usability. A well-designed UI makes navigating and using the app intuitive.

- Pricing and Plans: Pricing models and available plans vary considerably. Choose a plan that aligns with your budget and usage needs.

Mobile Bookkeeping Apps vs. Desktop Software

Mobile apps offer a different experience compared to desktop bookkeeping software.

- Portability and Accessibility: Mobile apps offer unparalleled portability and accessibility, allowing for on-the-go financial management.

- Ease of Use: Mobile apps are generally easier to learn and use compared to complex desktop software, especially for basic bookkeeping tasks.

- Cost: Mobile apps often have lower upfront costs compared to desktop software, which may require purchasing both software and hardware.

- Features: Desktop software often boasts more advanced features, complex reporting options, and customization options not always available in mobile versions.

Trends and Future of Bookkeeping Apps

Bookkeeping apps are constantly evolving, driven by technological advancements and user needs. This evolution reflects a shift towards increased automation, greater accessibility, and a focus on user-friendly interfaces. The future of bookkeeping apps promises to be deeply integrated into broader financial management systems, simplifying tasks and offering more comprehensive insights.

The current landscape of bookkeeping apps demonstrates a significant trend toward integration with other financial tools and platforms. This integration is designed to streamline the entire financial management process, eliminating the need for manual data transfer and reducing errors. Moreover, the focus on user experience is paramount, emphasizing intuitive interfaces and simplified workflows to cater to a broader user base.

Current Trends in Bookkeeping App Development

Bookkeeping apps are increasingly adopting cloud-based architectures, offering greater scalability, accessibility, and data security. This shift allows users to access their financial data from any device with an internet connection. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) is transforming bookkeeping apps by automating tasks like invoice processing, expense categorization, and bank reconciliation. These advancements free up valuable time for users to focus on strategic financial planning and decision-making.

Future Direction of Bookkeeping Apps in the Context of AI and Automation

AI-powered bookkeeping apps will play an increasingly important role in automating routine tasks, such as data entry, report generation, and financial analysis. For example, AI algorithms can automatically categorize transactions, identify potential errors, and provide predictive insights into future financial performance. This level of automation will significantly reduce the time and effort required for bookkeeping, enabling users to spend more time on high-value activities.

Predictions on the Evolution of Bookkeeping Apps

Bookkeeping apps will likely become more integrated with other financial management tools, such as budgeting apps, investment platforms, and tax preparation software. This integration will create a unified financial ecosystem, offering a holistic view of a user’s financial situation. Furthermore, apps will anticipate user needs by offering personalized financial advice and recommendations based on their financial history and goals.

How Emerging Technologies are Changing the Bookkeeping Landscape

Emerging technologies like blockchain and biometric authentication are poised to revolutionize the security and transparency of financial data. Blockchain technology can enhance the security and immutability of financial records, while biometric authentication can add an extra layer of security to user accounts. This ensures that financial data is secure and accessible only to authorized users.

Impact of Mobile-First Approaches on Bookkeeping Software

Mobile-first approaches are driving the development of more intuitive and user-friendly bookkeeping software. The design prioritizes ease of use on smartphones and tablets, allowing users to manage their finances on the go. This accessibility fosters a more proactive approach to financial management, enabling users to address financial matters immediately and efficiently.

Final Thoughts

Source: medium.com

In conclusion, the bookkeeping app for the iOS and Android markets offers a wide range of options to suit various needs and budgets. We’ve examined key features, user experiences, and essential considerations like security and pricing. By carefully evaluating these aspects, you can confidently choose the best app to streamline your financial management. The future of bookkeeping apps looks promising, with ongoing advancements in AI and automation.