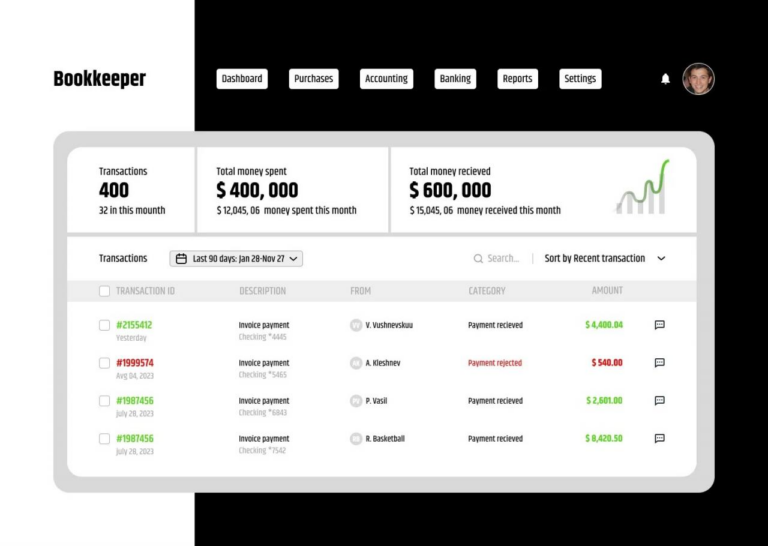

Best Bookkeeping Software for Small Business A Comprehensive Guide

Best bookkeeping software for small business is crucial for managing finances effectively. Choosing the right software can streamline your accounting processes, from invoicing and expense tracking to bank reconciliation and reporting. This guide explores various options, considering key features, pricing models, and customer reviews to help you find the perfect fit for your small business needs.

We’ll delve into the different types of bookkeeping software available, including cloud-based and desktop solutions, highlighting their respective advantages and disadvantages. We’ll also examine essential features like invoicing, expense tracking, and reporting, and discuss their significance for different business types. The comparison tables will illustrate the key differences in features and pricing, enabling you to make an informed decision.

Key Features to Consider in Bookkeeping Software

Choosing the right bookkeeping software is crucial for small businesses to maintain accurate financial records and streamline operations. A robust system should handle essential tasks efficiently, allowing business owners to focus on core activities rather than getting bogged down in tedious accounting procedures. Effective bookkeeping software empowers businesses to make informed decisions based on readily available data.

Modern bookkeeping software solutions provide a comprehensive suite of tools, moving beyond simple record-keeping to encompass essential functions like invoicing, expense tracking, and reporting. These features, when integrated effectively, significantly improve the efficiency and accuracy of accounting processes. This allows businesses to track their financial health and make better strategic decisions.

Invoicing

Accurate and timely invoicing is paramount for businesses of all sizes, particularly for those operating in retail and e-commerce. The ability to create professional invoices, send them electronically, and track payments is vital for efficient cash flow management. Well-designed invoicing features automate this process, reducing errors and ensuring timely collection. A robust invoicing system allows businesses to tailor invoices to specific customer needs, including customized discounts and payment terms.

Expense Tracking

Effective expense tracking is essential for managing costs and maximizing profitability. A dedicated expense tracking module allows businesses to categorize, record, and report expenses efficiently. This is crucial for compliance, budget management, and understanding spending patterns. Modern software often integrates with bank accounts, automatically importing transactions and facilitating quick categorization, reducing manual data entry and the risk of errors.

Bank Reconciliation

Regular bank reconciliation is a vital step in maintaining accurate financial records. Software that seamlessly reconciles bank statements with accounting records helps identify discrepancies promptly. Automated reconciliation tools minimize the risk of errors and ensure financial statements accurately reflect the company’s true financial position. This feature saves time and effort, freeing up resources for more strategic tasks.

Reporting, Best bookkeeping software for small business

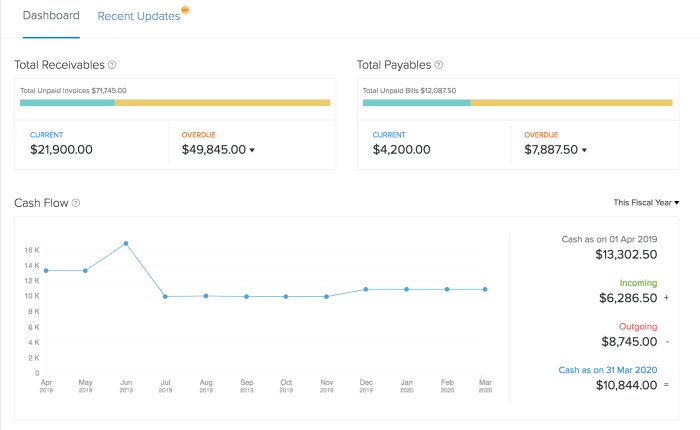

Generating insightful reports is a critical aspect of bookkeeping software. The ability to generate various reports, including profit and loss statements, balance sheets, and cash flow statements, empowers businesses to monitor their financial performance. Customizable reporting options allow businesses to tailor reports to specific needs and analyze key metrics. Detailed reporting fosters data-driven decision-making, allowing businesses to adapt strategies effectively.

Importance of Features by Business Type

| Feature | Importance of Retail | Importance for Service-Based Businesses | Importance of E-commerce |

|---|---|---|---|

| Invoicing | High – Managing sales transactions, customer invoices, and payment processing are critical. | Highly Accurate invoicing for services rendered is essential for billing and revenue recognition. | Very High – E-commerce relies heavily on efficient invoicing for order fulfillment and payment collection. |

| Expense Tracking | High – Tracking inventory costs, employee expenses, and operational costs is vital. | High – Tracking client-related expenses, travel costs, and professional fees is essential. | Medium – While important, expense tracking may be less critical compared to invoicing in e-commerce. |

| Bank Reconciliation | High – Ensuring accuracy in financial records and detecting errors. | High – Critical for maintaining a clear picture of cash flow and financial health. | High – Essential for managing online transactions and ensuring accurate financial reporting. |

| Reporting | High – Analyzing sales trends, inventory levels, and profitability. | High – Understanding service revenue, client profitability, and operational costs. | High – Monitoring sales performance, customer behavior, and financial metrics. |

Top Bookkeeping Software Options

Choosing the right bookkeeping software is crucial for small businesses. It streamlines financial processes, allowing for more accurate reporting and informed decision-making. A well-selected system can significantly impact efficiency and profitability.

Popular Bookkeeping Software Options

Various software options cater to different business needs and budgets. Consider factors like the size of your business, the complexity of your transactions, and your technical expertise when making a selection. Here are some popular choices:

- Xero: Xero is a cloud-based accounting software known for its user-friendly interface and comprehensive features. Its intuitive design makes it easy to navigate and manage finances, from invoicing and expense tracking to bank reconciliation and reporting. Xero excels in its integration capabilities, connecting with various other business tools. However, some users find its reporting features less detailed than competitors. A key strength is its excellent mobile app support.

- QuickBooks Online: QuickBooks Online, a well-established name in the accounting software market, offers a robust set of features for small and medium-sized businesses. Its strengths include a wide range of functionalities, such as invoicing, expense management, and financial reporting. A notable advantage is its extensive support network. However, it might have a steeper learning curve compared to some simpler alternatives. Its user interface is generally considered clear and functional.

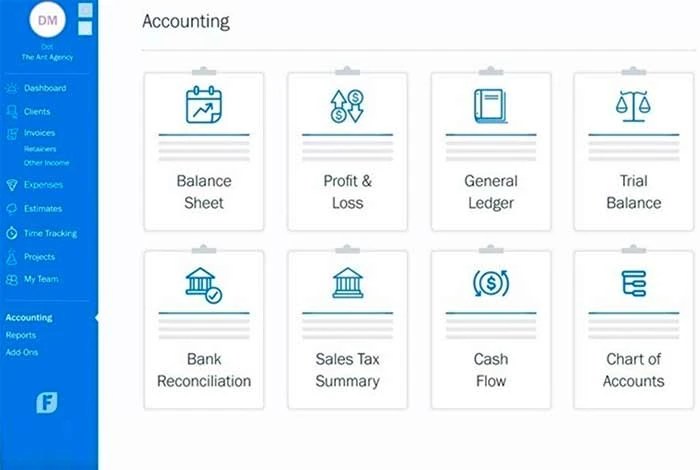

- FreshBooks: FreshBooks is specifically designed for freelancers and small businesses, focusing on invoicing and expense tracking. It’s particularly user-friendly, with a straightforward interface. This makes it an excellent choice for those new to bookkeeping. Its strength lies in its simplicity and affordability. However, its features might be limited compared to more comprehensive solutions for larger businesses with intricate financial needs. It’s particularly well-suited for those primarily focused on invoicing and client management.

- Wave Accounting: Wave Accounting is a free online accounting software with a focus on simplicity. Its strength lies in its straightforward approach to basic bookkeeping tasks. It’s a perfect solution for very small businesses or freelancers on a tight budget. Its simplicity, however, translates to a reduced feature set compared to other options. This can be a disadvantage for businesses with more complex financial requirements.

Comparing Software Functionalities

The table below provides a comparative overview of the discussed software options, highlighting their strengths, weaknesses, and target audiences.

| Software | Strengths | Weaknesses | Target Audience |

|---|---|---|---|

| Xero | User-friendly interface, robust features, strong integration capabilities, excellent mobile app support | Reporting features could be more detailed for some users | Small to medium-sized businesses seeking a comprehensive and easy-to-use solution. |

| QuickBooks Online | Extensive functionalities, including invoicing, expense management, and financial reporting, extensive support network. | Steeper learning curve compared to some simpler alternatives | Small and medium-sized businesses require a wide range of accounting tools. |

| FreshBooks | User-friendly, straightforward interface, excellent for invoicing and expense tracking, affordable | Limited features compared to more comprehensive solutions, not ideal for businesses with complex needs | Freelancers and small businesses prioritize invoicing and client management. |

| Wave Accounting | Free, simple approach to basic bookkeeping, perfect for very small businesses or freelancers on a tight budget | Reduced feature set compared to other options, not suitable for complex financial requirements | Very small businesses or freelancers need a simple and cost-effective solution. |

Choosing the Right Software for Your Small Business

Selecting the appropriate bookkeeping software is crucial for a small business’s financial health and operational efficiency. The right software streamlines processes, improves accuracy, and frees up valuable time for core business activities. This selection process involves careful consideration of various factors, from budget constraints to specific business needs.

Careful evaluation of bookkeeping software options is paramount. A poorly chosen solution can lead to inefficiencies, increased errors, and ultimately, a negative impact on the bottom line. Understanding the factors influencing your choice is key to making an informed decision.

Factors to Consider When Selecting Bookkeeping Software

Choosing the right bookkeeping software requires a thoughtful assessment of your business’s specific needs. This includes considering factors like budget, size, and the particular accounting requirements your business demands. Ignoring these factors can result in costly mistakes and suboptimal performance.

- Budget: Software costs vary significantly. Free options often come with limitations, while premium features usually entail higher subscription fees. Consider the long-term value proposition and align software costs with your budget constraints. A detailed budget analysis is essential to determine the optimal balance between cost and functionality.

- Business Size and Structure: The complexity of your accounting needs depends on your business’s size and structure. Small businesses with straightforward operations might benefit from a basic, user-friendly package. Larger businesses or those with complex financial transactions may need more advanced features and support.

- Specific Needs: Different businesses have unique accounting requirements. If you specialize in a specific industry, software tailored to your sector may offer advantages. For instance, a retail business may need specific features for inventory management, while a service-based company might prioritize client invoicing. Analyze the specific functions required for your business’s day-to-day operations and match them with software functionalities.

Evaluating Different Software Options

A systematic approach to evaluating different bookkeeping software options is critical. This involves a structured process of comparing features, pricing, and user reviews. A thorough evaluation helps you choose the software that best aligns with your business’s needs and financial goals.

- Feature Comparison: Carefully examine the features offered by each software package. Look for functionality related to accounts payable, accounts receivable, inventory management, reporting, and tax preparation. Consider which features are essential and which are secondary for your business’s needs.

- Pricing Models: Understand the different pricing models available, such as subscription fees or one-time purchases. Analyze the costs associated with different tiers of service or functionalities, and consider the potential long-term expenses.

- User Reviews and Testimonials: Seek feedback from other users to understand the software’s strengths and weaknesses. Look for software with positive reviews related to ease of use, customer support, and overall performance. This will help in making an informed choice based on real-world experiences.

Testing Software Before Purchase

Testing different software options before committing to a purchase is crucial. This allows you to experience the software’s functionality firsthand and assess its suitability for your business’s specific needs.

- Free Trials or Demo Accounts: Most bookkeeping software providers offer free trials or demo accounts. Utilize these opportunities to test the software’s features, user interface, and ease of use. This trial period provides valuable insights into how the software will integrate with your existing workflow and address your business’s specific requirements.

- Import Existing Data: Import a sample of your existing financial data into the software to assess its data import capabilities and the accuracy of the import process. This step is critical for ensuring seamless data migration and a smooth transition to the new system.

- Workflow Simulation: Simulate your daily accounting tasks within the software to understand how it will affect your workflow. This involves testing different transactions, reports, and functionalities to gain a realistic understanding of the software’s impact on your operational efficiency.

Integration and Automation with Other Tools: Best Bookkeeping Software For Small Business

Source: cloudfront.net

Choosing the right bookkeeping software goes beyond basic accounting functions. Modern businesses rely on interconnected systems, and a robust bookkeeping solution should seamlessly integrate with other critical tools like customer relationship management (CRM) systems and point-of-sale (POS) systems. This integration streamlines workflows, improves data accuracy, and ultimately boosts overall business efficiency.

Integration capabilities are a key differentiator between bookkeeping software solutions. The ability to connect with other business applications directly impacts the efficiency and accuracy of your financial data. By connecting your bookkeeping software to your CRM and POS systems, you can automate tasks and eliminate manual data entry, reducing the potential for errors.

Integration Capabilities with CRM Systems

Effective integration with CRM systems allows for a synchronized flow of customer data. This means that sales information, customer interactions, and other crucial CRM data can be automatically transferred to the bookkeeping software. This automation reduces the need for manual data entry, minimizing the chance of errors and ensuring data consistency. For instance, a sale recorded in your POS system can automatically update your CRM and accounting software to reflect the transaction. This real-time data synchronization allows for quicker and more accurate reporting, which in turn enables informed business decisions.

Integration Capabilities with POS Systems

Point-of-sale (POS) systems are essential for tracking sales transactions. Integrating a bookkeeping solution with your POS system allows for seamless transfer of sales data. This eliminates the need for manual data entry from receipts, invoices, or other sales documents. Automatic transfer ensures a streamlined workflow and prevents errors often associated with manual data entry. For example, when a sale is processed through the POS system, the corresponding transaction details are automatically transferred to the bookkeeping software, updating inventory levels and financial records simultaneously.

Benefits of Integration for Streamlining Workflows

Integration with other business tools streamlines workflows by automating data exchange. This automation eliminates manual processes, reducing the time and resources needed to manage financial data. Tasks like updating inventory levels, recording sales, and reconciling transactions are significantly accelerated. This automation allows employees to focus on higher-level tasks, improving overall productivity.

Examples of Integration with Popular Tools

Many bookkeeping software options integrate with popular tools like Xero, QuickBooks, and others. For instance, Xero integrates with various CRM platforms, allowing businesses to synchronize customer data and streamline sales processes. QuickBooks offers integration with popular POS systems, automating the transfer of sales data and improving financial record-keeping. This seamless integration helps businesses save time, minimize errors, and improve overall operational efficiency.

Improved Data Accuracy and Efficiency

Accurate data is essential for sound financial decision-making. Integration minimizes manual data entry, significantly reducing the risk of human error. Automated data transfer ensures consistency and accuracy, leading to reliable financial reports. This, in turn, allows businesses to make more informed decisions based on precise data.

Best Practices for Using Bookkeeping Software

Maximizing the benefits of bookkeeping software requires a strategic approach beyond simple setup. This involves understanding best practices for efficient data management, security, and workflow optimization. These techniques ensure accurate financial reporting, reduce errors, and ultimately contribute to informed business decisions.

Effective bookkeeping software implementation transcends mere installation. It necessitates a commitment to consistent use, meticulous record-keeping, and proactive security measures. By adopting these best practices, small businesses can leverage the software’s capabilities to streamline their financial operations and gain valuable insights.

Data Backup and Security Best Practices

Robust data backup and security protocols are crucial for any business using bookkeeping software. Loss of data can severely impact operations and profitability. Regular backups safeguard against accidental deletion, hardware failure, or cyberattacks.

- Regular Backups: Implement a scheduled backup system. This could be daily, weekly, or monthly, depending on the frequency of transactions and the business’s risk tolerance. Consider an off-site backup solution to protect against local disasters.

- Strong Passwords and Access Controls: Use strong, unique passwords for all accounts associated with the software. Restrict access to sensitive financial data to authorized personnel only. Employ multi-factor authentication whenever possible to enhance security.

- Data Encryption: Explore encryption options offered by the software to protect sensitive financial information during transmission and storage. This ensures data remains confidential even if a data breach occurs.

- Regular Security Audits: Periodically review and update security protocols. Stay informed about emerging threats and implement necessary updates to maintain the integrity of the system.

Organizing Financial Records

Effective organization of financial records within the bookkeeping software is paramount for efficient retrieval and analysis. Clear categorization and naming conventions enhance searchability and reduce the time spent on data retrieval.

- Clear Categorization: Develop a consistent system for categorizing transactions. Use predefined categories or create custom ones to ensure accurate classification of income and expenses. This improves reporting and analysis.

- Descriptive Naming Conventions: Use detailed and specific names for transactions, accounts, and other records. For example, instead of “Rent,” use “Rent – Main Office.” This enhances record clarity and traceability.

- Reconciliation: Regularly reconcile bank statements with the software records to identify discrepancies promptly. This proactive approach minimizes errors and maintains data accuracy.

- Detailed Transaction Descriptions: Include sufficient detail in transaction descriptions. For example, rather than “Supplies,” use “Office Supplies – Purchase from Acme Inc.” This provides context and enhances record analysis.

Efficient Workflows Using the Software

Streamlining workflows through the bookkeeping software optimizes efficiency and reduces manual effort. A well-defined workflow reduces errors and speeds up reporting.

- Automated Processes: Identify and automate repetitive tasks such as invoice generation, payment processing, and expense reporting. This frees up time for other crucial business activities.

- Integration with Other Tools: Integrate the bookkeeping software with other business tools like CRM or accounting platforms to ensure seamless data flow and avoid manual data entry.

- Reporting and Analysis: Leverage the software’s reporting features to generate insightful financial reports. Use these reports to track key performance indicators (KPIs) and make informed business decisions.

- Clear Roles and Responsibilities: Define clear roles and responsibilities for different tasks related to the software, and maintain detailed documentation for these procedures. This ensures accountability and minimizes errors.

Customer Reviews and Comparisons

Choosing the right bookkeeping software can significantly impact your small business’s efficiency and profitability. Understanding user experiences through reviews and comparisons can be invaluable in making an informed decision. This section delves into real user feedback, highlighting both positive and negative aspects of various popular options.

Review Excerpts

Customer reviews provide invaluable insights into the strengths and weaknesses of different bookkeeping software. Here are a few representative excerpts:

- Software A: “I love how intuitive this software is. Setting up accounts was a breeze, and the reporting features are amazing. Worth the investment.”

- Software B: “While the software has some great features, the customer support is slow to respond. It’s frustrating to have problems unresolved for several days.”

- Software C: “This software is perfect for my small business’s needs. The pricing is affordable, and the automated invoicing feature saves me so much time. I highly recommend it.”

- Software D: “The interface is a bit cluttered, and I found it challenging to navigate initially. However, once I got used to it, the software is very powerful.”

User Experience Comparisons

Examining the overall user experience across various bookkeeping software options is crucial. Factors like ease of use, intuitiveness of the interface, and the availability of helpful resources play a key role.

- Software A tends to receive high marks for its user-friendly interface and straightforward navigation. Users often praise the comprehensive documentation and readily available tutorials.

- Software B often receives mixed reviews. While some users find the advanced features powerful, others criticize the complexity of the software and the lack of clear documentation.

- Software C often scores well in terms of affordability and ease of use, particularly for smaller businesses. Many appreciate the straightforward interface and the wide range of templates.

- Software D, on the other hand, frequently receives praise for its powerful features, but users may find the learning curve steep initially. This is often balanced by the extensive support options available to users.

Summary Table

The table below summarizes the pros and cons of each software based on customer feedback. This concise format helps users quickly compare the strengths and weaknesses of each option.

| Software | Positive Reviews | Negative Reviews | Overall Score |

|---|---|---|---|

| Software A | Intuitive interface, excellent reporting features, easy setup | Limited customization options, occasional bugs | 4.5/5 |

| Software B | Powerful features, robust data analysis | Slow customer support, complex interface | 3.8/5 |

| Software C | Affordable pricing, automated invoicing, and user-friendly | Limited advanced features, basic reporting | 4.2/5 |

| Software D | Comprehensive features, powerful analytics, and excellent support options | Steep learning curve, cluttered interface | 4.0/5 |

Last Word

Source: seekahost.com

In conclusion, selecting the best bookkeeping software for your small business involves careful consideration of your specific needs and budget. This guide has provided a comprehensive overview of available options, key features, and essential factors to consider. Remember to evaluate different software solutions thoroughly, test them before committing, and ensure seamless integration with other business tools. By following these recommendations, you can choose the perfect software to enhance your accounting processes and drive your business forward.