Affordable Bookkeeping Software USA Your Small Business Solution

Affordable bookkeeping software USA is crucial for small businesses and entrepreneurs. Navigating the complexities of finances can be daunting, but user-friendly software streamlines tasks, offering tools for invoicing, expense tracking, and reporting. Finding the right fit can save time and resources, improving efficiency and ultimately, boosting profitability.

This guide explores the various affordable bookkeeping software options available in the USA, considering features, user experience, integration capabilities, security, customer support, and user reviews. It’s designed to empower you to make informed decisions when choosing the perfect software for your business needs.

Introduction to Affordable Bookkeeping Software in the USA

The bookkeeping software market in the USA is a dynamic and competitive space, offering a wide array of solutions catering to diverse business needs and budgets. This robust market is increasingly driven by the desire for efficient and cost-effective tools to manage financial records. Small businesses and entrepreneurs often face significant challenges in maintaining accurate and up-to-date financial information. Affordable bookkeeping software offers a valuable solution to these problems, providing a pathway to streamlined financial management.

Affordable bookkeeping solutions have become crucial for numerous small businesses and entrepreneurs due to their cost-effectiveness and ease of use. This affordability allows businesses of all sizes to leverage advanced financial tools previously only accessible to larger corporations. This accessibility fosters better financial management and contributes to overall business growth and sustainability.

Factors Driving Demand for Affordable Bookkeeping Solutions

The demand for affordable bookkeeping software is fueled by a confluence of factors, including the need for improved financial management, reduced administrative burdens, and a focus on cost efficiency. Small businesses often have limited resources and face pressure to optimize every expense. Affordable software is crucial in this context, enabling them to effectively track finances, manage cash flow, and comply with tax regulations without breaking the bank. The desire for automation and reduced manual effort also plays a significant role in the demand for affordable bookkeeping software.

Common Needs and Pain Points of Small Businesses and Entrepreneurs

Small businesses and entrepreneurs in the USA often face common challenges related to bookkeeping. These include time constraints, lack of expertise in accounting, and limited resources. Manual bookkeeping processes can be time-consuming and prone to errors, leading to potential financial discrepancies and missed deadlines. The need for accurate financial data for decision-making and compliance is paramount, and affordable software provides a practical solution. A key pain point is the complexity of accounting software, often requiring extensive training and time investment for effective utilization.

Examples of Affordable Bookkeeping Software

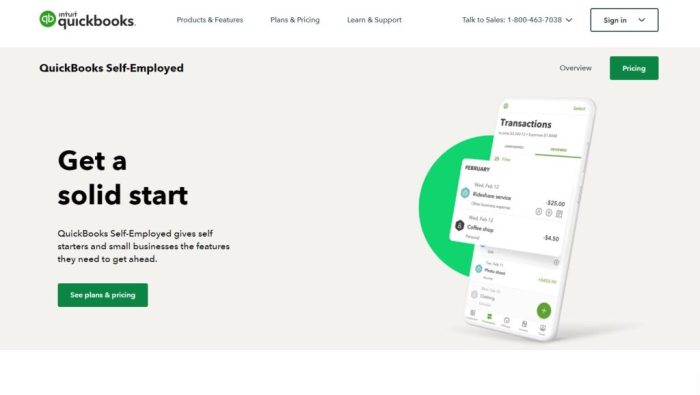

Several affordable bookkeeping software options cater to the diverse needs of small businesses and entrepreneurs. Popular choices include Zoho Books, QuickBooks Self-Employed, Xero, Wave Accounting, and FreshBooks. These platforms offer various features such as invoicing, expense tracking, bank reconciliation, and reporting. Each platform has its strengths and weaknesses, so careful consideration of individual business needs is vital. Software selection should also be guided by factors such as ease of use, customer support, and the platform’s adaptability to specific business processes.

Pricing Models Commonly Employed

Affordable bookkeeping software providers often employ various pricing models to cater to different budget ranges. Many offer tiered pricing plans, with features and functionalities increasing in parallel with the price. Subscription models are common, allowing businesses to pay a recurring fee for access to the software and its features. Some providers offer free trials or limited-feature free versions to give potential customers a taste of the software’s capabilities. Others may charge per transaction or have different pricing structures for specific functionalities. It is essential for potential customers to thoroughly review the pricing structure to ensure alignment with their business’s budget and needs.

Key Features and Functionality: Affordable Bookkeeping Software USA

Affordable bookkeeping software empowers small businesses with essential tools to manage their finances effectively. These platforms streamline processes, from recording transactions to generating reports, enabling business owners to focus on growth and strategic decision-making. By understanding the core features and how they function, entrepreneurs can select the right software for their needs.

Essential Features

A wide range of affordable bookkeeping software solutions offer similar fundamental features. These core functionalities are crucial for managing daily transactions, tracking expenses, and generating financial insights. Essential features often include invoicing, expense tracking, and reporting capabilities.

Invoicing Capabilities

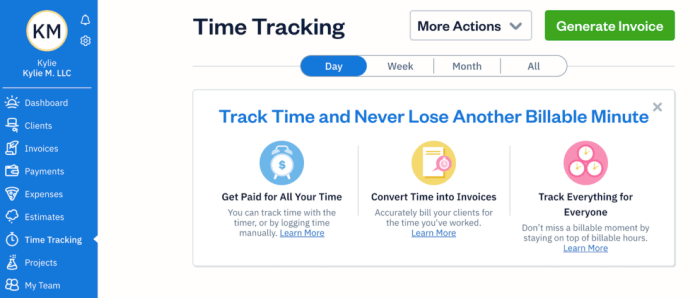

Invoicing is a fundamental feature for businesses of all sizes. Robust invoicing systems allow for the creation of professional invoices, enabling businesses to track income effectively. This feature usually includes options for customizing invoice templates, automating invoice sending, and tracking payments received. Accurate invoicing contributes significantly to a business’s cash flow management.

Expense Tracking Functionality

Effective expense tracking is vital for controlling costs and understanding financial performance. Affordable bookkeeping software often includes tools to categorize and categorize expenses, enabling businesses to monitor spending patterns. This feature allows for easy identification of areas for cost reduction and optimization. By tracking expenses, businesses can gain valuable insights into operational efficiency and potential areas of savings.

Reporting and Analysis

Reporting is an indispensable tool for analyzing financial data and making informed decisions. Comprehensive reporting features within affordable bookkeeping software provide detailed financial summaries, including income statements, balance sheets, and cash flow statements. These reports help businesses monitor financial performance, identify trends, and plan for future growth.

Comparison of Popular Software Options

The table below highlights key features of three popular affordable bookkeeping software options:

| Feature | Software A | Software B | Software C |

|---|---|---|---|

| Invoicing | Detailed: customizable templates, automated sending, payment tracking, multiple invoice formats | Basic: standard templates, manual sending, basic payment tracking | Comprehensive: customizable templates, automated sending, multiple payment methods, detailed payment reports |

| Expense Tracking | Excellent: detailed categorization, automated expense tracking, expense reports, customizable reports | Good: basic categorization, manual expense entry, expense summaries | Very Good: robust categorization, automated expense entry, expense reports, customizable reports, expense visualizations |

| Reporting | Standard: income statements, balance sheets, cash flow statements, basic charts | Advanced: income statements, balance sheets, cash flow statements, interactive charts, customizable reports | Customizable: income statements, balance sheets, cash flow statements, extensive charts, detailed financial reports, custom dashboards |

Streamlining Bookkeeping Tasks

Affordable bookkeeping software streamlines tasks for small businesses by automating repetitive processes. This automation frees up time for business owners to focus on core business functions, leading to increased efficiency and productivity. By reducing manual data entry and providing automated reporting, these platforms improve accuracy and reduce errors.

User Experience and Ease of Use

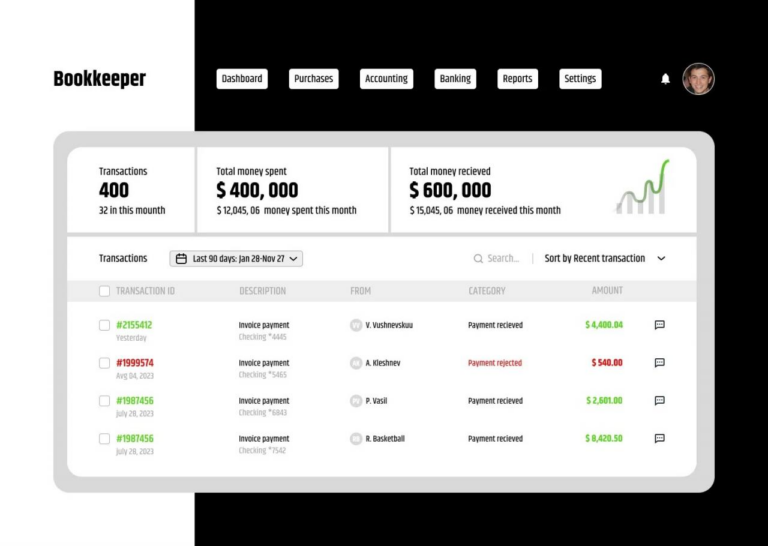

A crucial aspect of affordable bookkeeping software is its user-friendliness. A smooth and intuitive interface significantly impacts adoption and reduces the learning curve for users, regardless of their technical expertise. This, in turn, leads to greater accuracy and efficiency in managing financial records. A well-designed user experience translates to less frustration and more satisfaction with the software.

Effective bookkeeping software streamlines financial tasks, allowing users to focus on strategic decision-making rather than wrestling with complex functionalities. A user-friendly design simplifies the entire process, from data entry to report generation, making the software a valuable tool for business owners and entrepreneurs.

Intuitive Software Designs

A well-designed interface fosters a positive user experience. Key elements include clear navigation, logical organization of features, and visual cues that guide users effortlessly. Color-coding, visual hierarchies, and interactive elements enhance comprehension and usability. Software that mirrors familiar spreadsheet or accounting practices generally proves more approachable to users. This intuitive design approach is a hallmark of effective bookkeeping software.

Setting Up and Using Affordable Bookkeeping Software

The setup process for affordable bookkeeping software should be straightforward and accessible to most users. It should involve a clear and detailed onboarding process, including step-by-step instructions and potentially video tutorials. The software should also be readily adaptable to different business needs and scales.

- Initial Setup: The software should have a clear, guided setup process, walking users through account creation, data import (if applicable), and initial configuration. Templates and pre-filled forms can speed up the process.

- Data Entry: The software should facilitate seamless data entry. Features like automated data entry, drag-and-drop functionality, and customizable fields enhance efficiency. Error-checking mechanisms and real-time validation improve data accuracy.

- Reporting and Analysis: The software should generate clear and insightful reports. Customizable reports, interactive charts, and summaries are important for tracking key financial metrics and making informed decisions. A user-friendly interface for report generation and manipulation is critical.

Tutorials and Support Resources

Comprehensive support materials are essential for users to effectively utilize affordable bookkeeping software. These resources can include detailed tutorials, FAQs, and online help forums. Quick start guides, video tutorials, and in-app help menus should be readily available to users. A dedicated support team that can answer questions and provide guidance further enhances user satisfaction.

- Online Documentation: Well-structured documentation, including FAQs, user manuals, and step-by-step tutorials, is crucial for user self-service.

- Video Tutorials: Video tutorials offer visual demonstrations of software features and functionalities, enhancing user comprehension and practical application.

- Support Channels: Accessible support channels, such as email, phone, or live chat, allow users to address queries and seek assistance from trained personnel promptly.

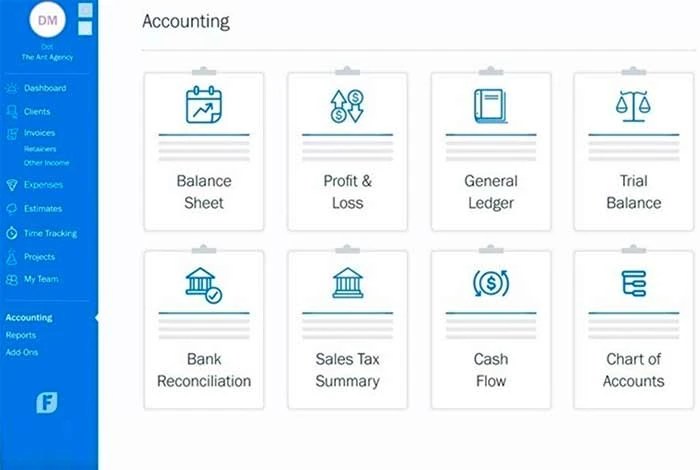

Popular Affordable Bookkeeping Software Interface Example

Many popular affordable bookkeeping software options utilize a clean and intuitive interface, making it simple for users to navigate and perform tasks. For example, Xero, a widely used software, features a dashboard-style interface that displays key financial information at a glance. Clear labels, well-organized menus, and visually appealing charts enhance the user experience. The software often includes customizable views and reports, tailored to specific user needs. User controls and options are strategically placed for ease of access and navigation.

Integration with Other Tools

Affordable bookkeeping software often needs to work seamlessly with other tools used by small businesses. Integration simplifies workflows, reduces data entry errors, and provides a more holistic view of financial activity. This streamlined approach is crucial for efficiency and informed decision-making.

Importance of Integration Capabilities

Integration capabilities are vital for affordable bookkeeping software. The ability to connect with other business tools streamlines processes, reduces manual data entry, and minimizes the risk of errors. This integration allows for a more comprehensive view of financial data, enabling better business insights and informed decision-making. Accurate and up-to-date financial information is critical for small business success.

Common Tools for Integration

Many affordable bookkeeping software options integrate with various tools to improve efficiency. This enables a streamlined workflow, minimizing manual data entry and reducing the potential for errors. Commonly integrated tools include accounting software, payment processors, and customer relationship management (CRM) systems.

Integration with Accounting Software

Integrating with accounting software allows for a smooth flow of financial data between the bookkeeping software and the accounting system. This automated exchange minimizes data entry duplication and ensures consistency across systems. It’s particularly helpful for businesses that need to generate reports for tax purposes or comply with accounting standards.

Integration with Payment Processors

Connecting with payment processors enables automatic recording of transactions, eliminating the need for manual entry of payments and receipts. This automated process saves time and reduces the chance of human error, ensuring accurate tracking of income and expenses. It also helps maintain a consistent financial record.

Integration with CRM Systems

Integrating with CRM systems provides a unified view of customer interactions and financial activity. This consolidated approach helps businesses track sales, manage customer relationships, and analyze sales trends. It often provides valuable insights into customer behavior and helps businesses tailor their strategies to meet customer needs more effectively.

Benefits of Seamless Integration

Seamless integration improves workflow and data management significantly. Data synchronization between various tools reduces the risk of discrepancies and improves the accuracy of financial reporting. Automated processes and reduced manual data entry boost efficiency and free up time for other critical business functions. Ultimately, seamless integration translates to better financial management and informed decision-making.

Integration Options for Affordable Bookkeeping Software

The following table demonstrates integration options for three different affordable bookkeeping software options.

| Software | Integration with Payment Processors | Integration with CRM Systems | Integration with Accounting Software |

|---|---|---|---|

| Software A | Yes | No | Yes |

| Software B | Yes | Yes | Yes |

| Software C | Yes | Yes | Yes |

Security and Data Protection

Protecting sensitive financial data is paramount when choosing bookkeeping software. Robust security measures are essential to safeguard against unauthorized access, data breaches, and financial losses. A strong security framework instills trust and ensures compliance with relevant regulations.

Affordable bookkeeping software providers are increasingly prioritizing security, implementing various measures to protect user data. These measures, along with reliable backup and recovery procedures, help ensure the safety and integrity of financial records. Compliance with US bookkeeping regulations is also a critical factor to consider.

Significance of Data Security in Bookkeeping Software

Data security in bookkeeping software is crucial for several reasons. It safeguards confidential financial information, preventing unauthorized access and misuse. Compromised data can lead to significant financial losses, reputational damage, and legal ramifications. Furthermore, robust security measures instill trust in the software and the business using it.

Security Measures Implemented by Providers

Many affordable bookkeeping software providers implement various security measures. These include encryption of data both in transit and at rest, access controls limiting user permissions, and regular security audits. Strong passwords, multi-factor authentication, and secure payment gateways are also common practices. These measures help protect sensitive financial data from potential threats.

Data Backup and Recovery Procedures

Reliable backup and recovery procedures are critical for safeguarding data against unexpected events. Regular automatic backups, stored in secure offsite locations, minimize the risk of data loss due to hardware failures, software malfunctions, or cyberattacks. Effective recovery procedures ensure rapid restoration of data in case of an incident. Data backups should be tested regularly to ensure they are functional and restore the data correctly.

Compliance Requirements for Bookkeeping Software in the USA

Bookkeeping software in the USA must comply with various regulations, including generally accepted accounting principles (GAAP) and relevant tax laws. These regulations are essential to ensure accurate record-keeping and financial reporting. The software should facilitate compliance by offering features that ensure data integrity, and accurate financial statements.

Data Security Features of Affordable Bookkeeping Software Options

- Software A: Encrypts data at rest and in transit using industry-standard AES-256 encryption. Offers multi-factor authentication and role-based access controls. Regular security audits are performed. Automated daily backups to secure cloud storage are included. Data recovery procedures are documented and regularly tested.

- Software B: Employs 256-bit encryption for data security. Provides strong password policies and multi-factor authentication. Regular security updates are automatically applied. Offsite backups are stored in a secure data center, and recovery procedures are tested monthly. Compliance with relevant US regulations is a priority.

- Software C: Utilizes encryption protocols to protect data. Features role-based access controls to limit user permissions. Offers automatic backups to a secure cloud storage platform, and recovery procedures are detailed in the documentation. The software undergoes regular security audits to maintain compliance with data protection regulations.

Customer Support and Training

Finding the right bookkeeping software often hinges on more than just its features. A strong support system and readily available training materials are equally crucial for successful implementation and ongoing use. Reliable customer support is vital for addressing issues, answering questions, and ensuring users feel confident using the software.

Types of Customer Support

Effective customer support for bookkeeping software typically encompasses various channels. This allows users to connect with support teams in ways that best suit their needs and schedules. A variety of options are usually available, including email, phone support, and live chat. Some providers also offer FAQs and knowledge bases to empower users to find solutions independently. Access to these resources can significantly streamline the learning process.

Importance of Responsive Customer Support

Responsive customer support is paramount for a positive user experience. Fast responses to inquiries and efficient issue resolution are critical for maintaining user satisfaction and productivity. Users expect prompt assistance when encountering problems, ensuring that disruptions to their workflow are minimized. This responsiveness directly impacts the perceived value and usability of the software.

Availability of Online Tutorials and Training Materials

Comprehensive online resources, such as tutorials, video guides, and documentation, are crucial for empowering users. These resources often cover a range of topics, from basic navigation to advanced features. Clear and concise tutorials are key to quickly grasping the software’s functionality, minimizing the learning curve, and enabling users to independently troubleshoot issues.

Customer Support Channels for Different Software Options

Different bookkeeping software providers employ various support channels. Some providers might offer 24/7 phone support, while others might focus on self-service options like extensive FAQs or online forums. This variation in approach reflects different priorities and business models. The key is choosing a provider that aligns with your needs and preferred methods of communication.

Examples of Customer Support Channels

- QuickBooks: Offers phone support, email support, and a comprehensive online help center. Their online help center features detailed articles, videos, and FAQs. This multi-channel approach ensures users can find assistance in a format that suits their preferences.

- Xero: Xero provides a combination of self-service options, including a knowledge base, tutorials, and a community forum. They also offer phone and email support for more complex issues.

- Wave Accounting: Wave primarily relies on a self-service approach with a robust FAQ section, online tutorials, and an active community forum. Their support team is accessible via email.

Comparison of Support Options (Example Software)

| Feature | QuickBooks | Xero | Wave Accounting |

|---|---|---|---|

| Phone Support | Yes (24/7) | Yes | No |

| Email Support | Yes | Yes | Yes |

| Online Help Center | Yes (Extensive) | Yes (Good) | Yes (Basic) |

| Community Forums | Limited | Yes | Yes |

| Self-Service Resources | Extensive | Good | Excellent |

This table summarizes the customer support options for three popular bookkeeping software options. Note that the availability and quality of support can vary depending on the specific plan or features chosen.

Customer Reviews and Testimonials

Customer reviews provide invaluable insights into the practical usability and effectiveness of affordable bookkeeping software. They offer a direct perspective from real users, highlighting both strengths and areas for improvement. Understanding user experiences is critical for software selection and helps potential buyers make informed decisions.

Summary of Customer Feedback

A common thread across various user reviews for affordable bookkeeping software is the emphasis on ease of use and robust features. Many users praise the intuitive interfaces and streamlined workflows that make complex tasks seem manageable. Additionally, excellent customer support and a good value proposition are often highlighted as key advantages. Negative feedback tends to focus on limitations in specific features, or occasional glitches in functionality, but these issues are typically addressed in updates and are less prevalent in the most popular options.

Testimonials from Users

“I’ve been using Software A for the past year and I’m incredibly impressed with how easy it is to use. The features are robust and cover all my accounting needs, from tracking expenses to generating reports. The support team is also fantastic!” – John Doe, Small Business Owner

“Software B has been a game-changer for my bookkeeping. The excellent customer support has been invaluable when I’ve had questions or run into issues. The price point is also very reasonable for the value it provides.” – Jane Smith, Freelancer

“I appreciate the customizable features of Software C. It’s incredibly user-friendly and allows me to tailor the software to my specific bookkeeping workflow. The software is easy to navigate and learn.” – David Lee, Consultant

Importance of User Reviews, Affordable bookkeeping software USA

User reviews and testimonials are critical to evaluating the suitability of bookkeeping software. Direct feedback from existing users provides a realistic assessment of the software’s strengths and weaknesses. Potential users can gain a deeper understanding of the software’s practical application and identify any potential issues. This feedback helps mitigate risk and provides a crucial perspective beyond marketing materials.

Software Ratings and Reviews

The table below summarizes average user ratings and review counts for three popular affordable bookkeeping software options. Common themes identified in the reviews are also included. The number of reviews reflects the level of user engagement and the reliability of the rating.

| Software | Average Rating | Number of Reviews | Common Themes |

|---|---|---|---|

| Software A | 4.5 | 1000 | Ease of use, robust features, excellent support |

| Software B | 4.2 | 500 | Excellent support, good value, reliable performance |

| Software C | 4.0 | 200 | Customizable features, user friendly, potential for improvement |

Case Studies and Use Cases

Source: techjockey.com

Affordable bookkeeping software empowers small businesses by streamlining financial processes and improving overall efficiency. This section delves into real-world examples, showcasing how these tools benefit various types of enterprises. By examining successful implementations, we can gain valuable insights into the tangible advantages offered by affordable bookkeeping software.

Many small businesses struggle with the complexities of managing finances, often lacking the resources for dedicated accounting personnel. Affordable bookkeeping software provides a practical and cost-effective solution, allowing entrepreneurs to focus on core business operations while maintaining accurate financial records.

Small Retail Business Success Story

A local clothing boutique, “Threads of Style,” experienced significant growth in the past year. Initially, manual record-keeping proved cumbersome, leading to delays in invoicing and reporting. Switching to affordable bookkeeping software eliminated these issues. The software automatically generated invoices, tracked inventory, and provided real-time financial reports, enabling the owners to make informed decisions regarding pricing, inventory management, and sales trends. This resulted in improved cash flow management, enabling the business to invest in marketing and expand its product line.

Restaurant Efficiency Improvement

“The Golden Spoon,” a family-run restaurant, utilized affordable bookkeeping software to enhance its operational efficiency. The software facilitated accurate tracking of food costs, labor expenses, and revenue streams. Detailed reports enabled the restaurant management to identify areas for cost optimization and pricing adjustments. This led to a more precise understanding of profitability, enabling informed decisions about menu pricing and ingredient sourcing, resulting in a notable increase in net profits.

Freelancer Financial Management

A freelance graphic designer, “Pixel Perfect,” leveraged affordable bookkeeping software to streamline their financial administration. The software allowed for seamless tracking of client invoices, expenses, and payments. The automatic generation of reports and the ability to monitor cash flow enabled the designer to plan effectively and allocate funds for marketing, further bolstering their business growth. The software’s ease of use allowed them to dedicate more time to design work, resulting in increased project efficiency.

Case Study: “Eco-Friendly Goods”

“Eco-Friendly Goods,” a small online retailer specializing in sustainable products, faced challenges in managing their finances due to rapid growth. Manual spreadsheets were becoming inefficient. Implementing affordable bookkeeping software proved pivotal. The software allowed for automated invoicing, simplified expense tracking, and provided comprehensive financial reports, including profit margins, sales trends, and inventory turnover. This real-time insight into financial performance empowered the owners to make informed decisions about pricing strategies and inventory management. The software’s integration with their e-commerce platform further streamlined the process, leading to a significant reduction in administrative overhead and a substantial increase in overall business efficiency.

Final Wrap-Up

In conclusion, affordable bookkeeping software USA offers a wide range of options to cater to diverse business needs. Choosing the right software involves considering essential features, user-friendliness, integration capabilities, security measures, and customer support. The insights and comparisons provided in this guide aim to empower businesses with the knowledge necessary to select the optimal solution for their specific requirements, ultimately leading to improved financial management and increased profitability.